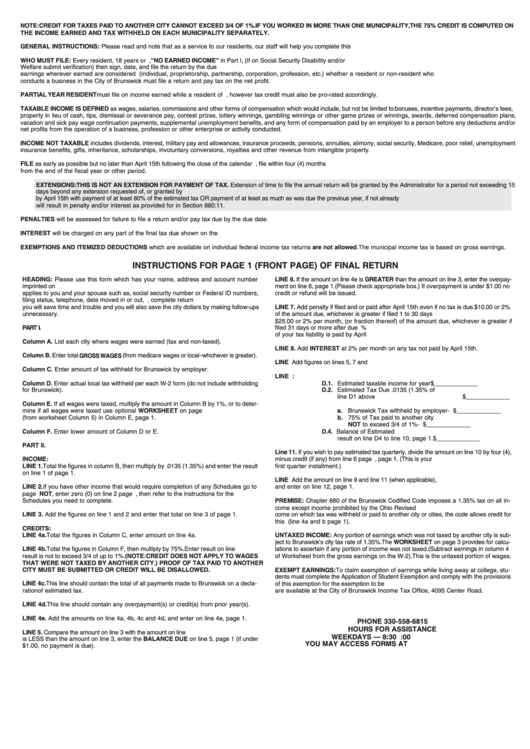

Form 1120 Instructions 2022

Form 1120 Instructions 2022 - Corporation income and replacement tax return. See faq #17 for a link to the instructions. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. If you do not follow these instructions, your election will be considered invalid and we will not apply your credit as you requested.if you submit a valid request, we will apply your credit as you requested and notify you. Web your fein, the tax year of the return creating the overpayment, and the tax year you wish to have the credit apply. Corporation income tax return, including recent updates, related forms and instructions on how to file. We will compute any penalty or interest dueand notify you. However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year. Web for tax year 2022, please see the 2022 instructions. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information.

However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year. See faq #17 for a link to the instructions. Web information about form 1120, u.s. Web for tax year 2022, please see the 2022 instructions. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web your fein, the tax year of the return creating the overpayment, and the tax year you wish to have the credit apply. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Corporation income and replacement tax return. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. We will compute any penalty or interest dueand notify you.

If you do not follow these instructions, your election will be considered invalid and we will not apply your credit as you requested.if you submit a valid request, we will apply your credit as you requested and notify you. Web your fein, the tax year of the return creating the overpayment, and the tax year you wish to have the credit apply. See faq #17 for a link to the instructions. Web for tax year 2022, please see the 2022 instructions. However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year. Corporation income and replacement tax return. Web information about form 1120, u.s. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. We will compute any penalty or interest dueand notify you. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.

form 1120 f instructions 2022 JWord サーチ

We will compute any penalty or interest dueand notify you. Corporation income tax return, including recent updates, related forms and instructions on how to file. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Web your fein, the tax year of the return creating.

2020 Form IRS 1120 Fill Online, Printable, Fillable, Blank pdfFiller

See faq #17 for a link to the instructions. Web your fein, the tax year of the return creating the overpayment, and the tax year you wish to have the credit apply. We will compute any penalty or interest dueand notify you. Web information about form 1120, u.s. If you do not follow these instructions, your election will be considered.

Instructions For Form 1120 Final Tax Return printable pdf download

Web information about form 1120, u.s. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web your fein, the tax year of the return creating the overpayment, and the tax year you wish to have the credit apply. Use this form to report the income, gains, losses, deductions, credits, and to figure the income.

1120s instructions 2023 PDF Fill online, Printable, Fillable Blank

See faq #17 for a link to the instructions. We will compute any penalty or interest dueand notify you. Web your fein, the tax year of the return creating the overpayment, and the tax year you wish to have the credit apply. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to.

1120 Tax Form Blank Sample to Fill out Online in PDF

However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year. Corporation income tax return, including recent updates, related forms and instructions on how to file. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to.

Form 1120 instructions 2016

Web your fein, the tax year of the return creating the overpayment, and the tax year you wish to have the credit apply. Web for tax year 2022, please see the 2022 instructions. However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year..

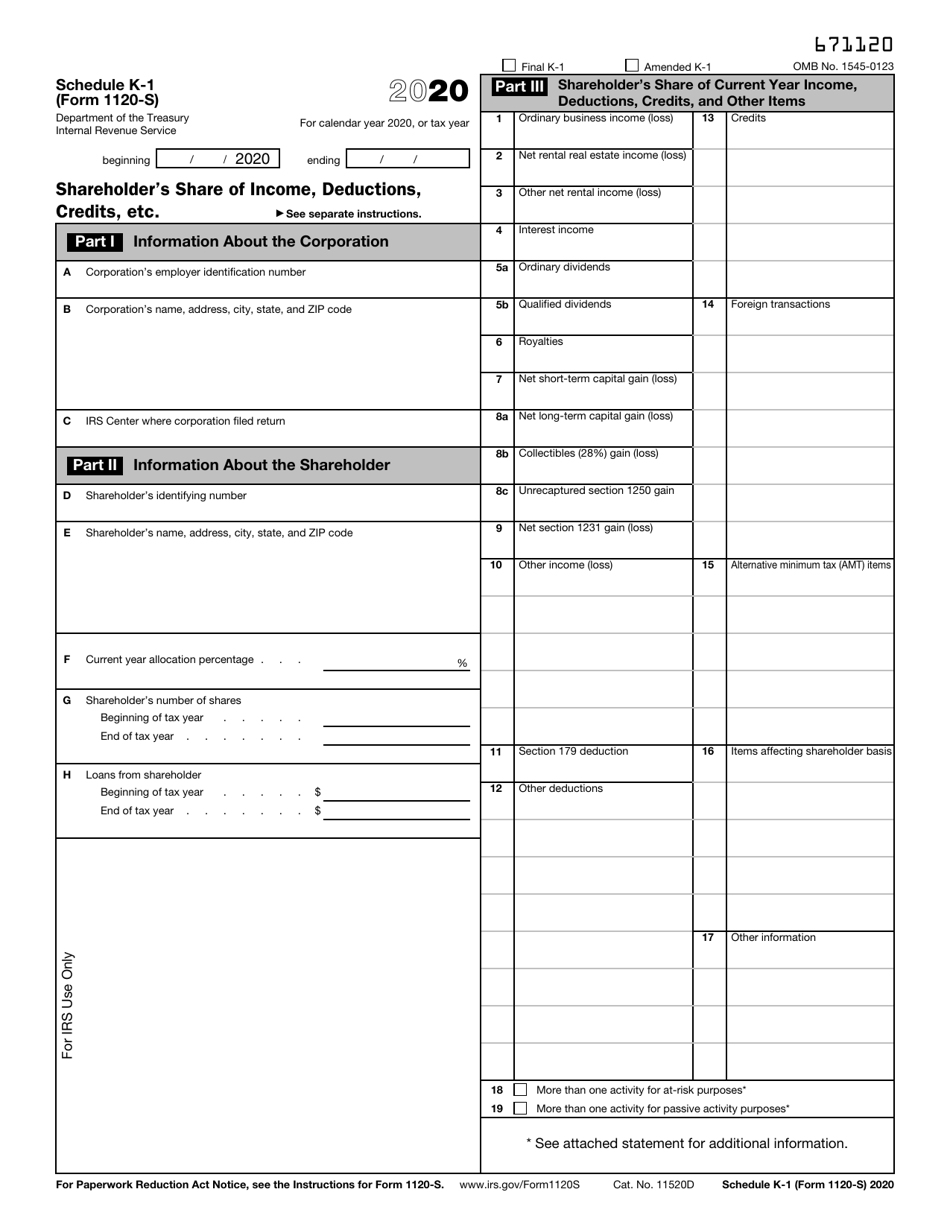

IRS Form 1120S Schedule K1 Download Fillable PDF or Fill Online

However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web for tax year 2022, please see the 2022 instructions. Web information about form 1120, u.s. Corporation income.

form 1120f instructions 2020 Fill Online, Printable, Fillable Blank

Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. See faq #17 for a link to the instructions. Web your fein, the tax year of the return creating the overpayment, and the tax year you wish to have the credit apply. We will compute any penalty or interest.

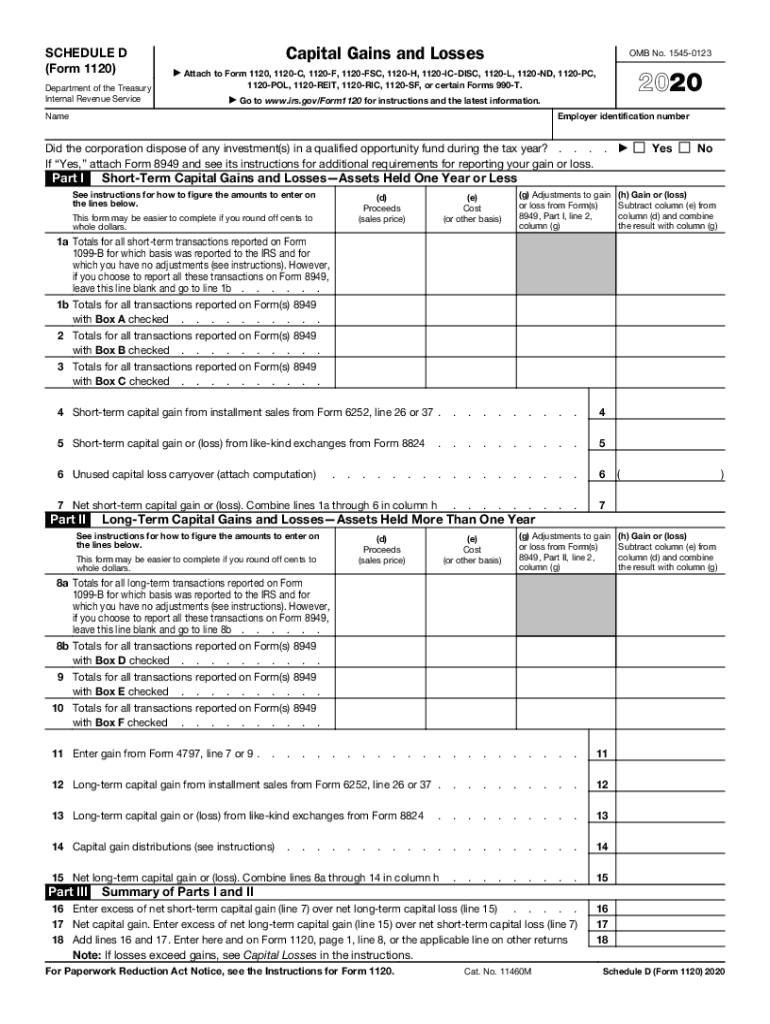

2015 Form Schedule D Fill Out and Sign Printable PDF Template signNow

If you do not follow these instructions, your election will be considered invalid and we will not apply your credit as you requested.if you submit a valid request, we will apply your credit as you requested and notify you. Web information about form 1120, u.s. Web your fein, the tax year of the return creating the overpayment, and the tax.

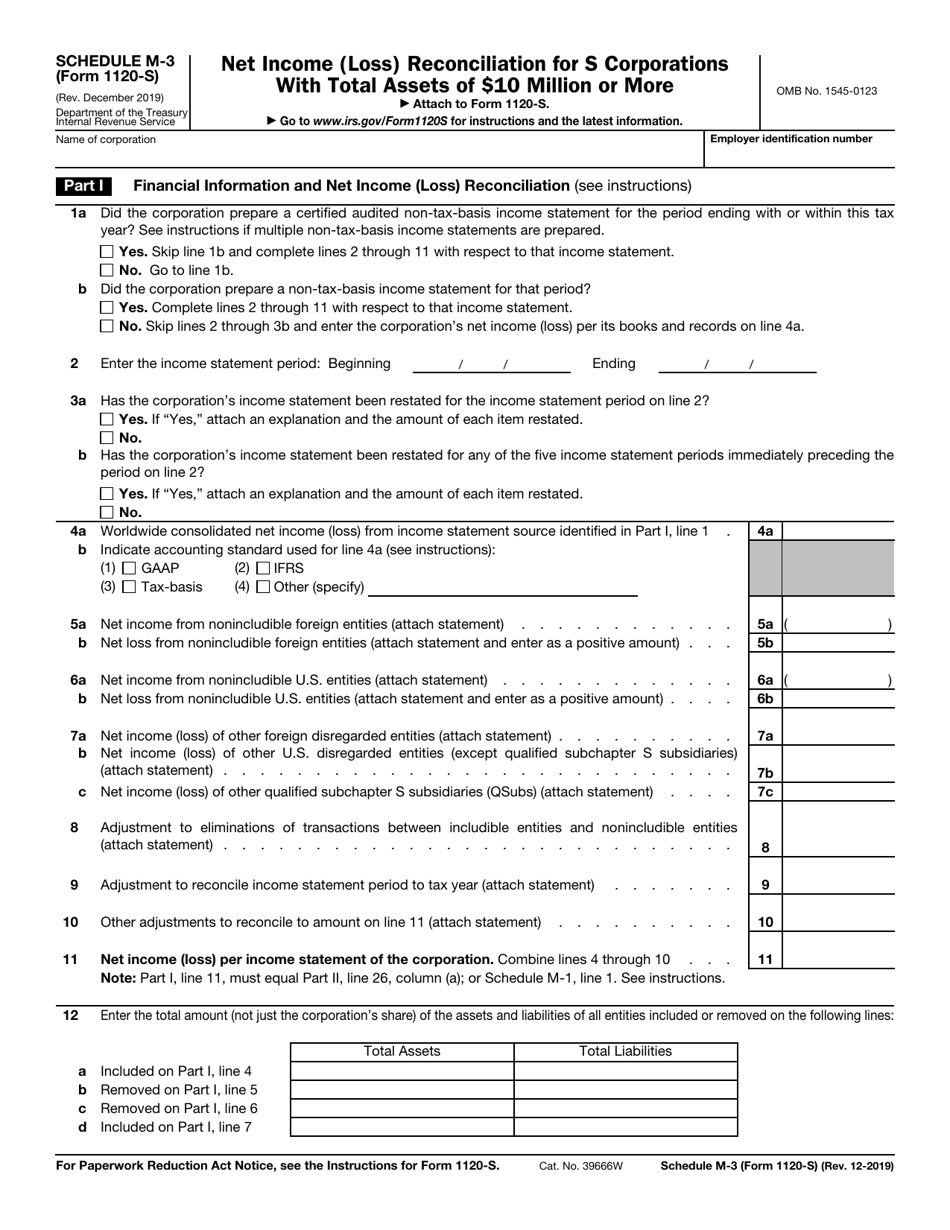

IRS Form 1120S Schedule M3 Download Fillable PDF or Fill Online Net

Web information about form 1120, u.s. We will compute any penalty or interest dueand notify you. However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year. Web your fein, the tax year of the return creating the overpayment, and the tax year you.

We Will Compute Any Penalty Or Interest Dueand Notify You.

See faq #17 for a link to the instructions. Web for tax year 2022, please see the 2022 instructions. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Web information about form 1120, u.s.

Corporation Income Tax Return, Including Recent Updates, Related Forms And Instructions On How To File.

If you do not follow these instructions, your election will be considered invalid and we will not apply your credit as you requested.if you submit a valid request, we will apply your credit as you requested and notify you. Corporation income and replacement tax return. However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year. Web your fein, the tax year of the return creating the overpayment, and the tax year you wish to have the credit apply.