Form 1120 Nonprofit

Form 1120 Nonprofit - Web form 4720, return of certain excise taxes on charities and other persons under chapters 41 and 42 of the internal revenue codepdf, is intended primarily for. Corporations operating on a cooperative basis file this form to report their. Web first, according to irs documents, at least 85% of the units within the association must be for residential use. Income tax return for cooperative associations. Second, at least 60% of the association’s gross income for the. Complete, edit or print tax forms instantly. Income tax return for homeowners associations. Web when a business is taxed as a sole proprietorship, its profit and loss is reported on schedule c. The entity must also file form 8832,. Ad access irs tax forms.

Find your nonprofit filing requirements in one place! Income tax return for homeowners associations. Corporation income tax return, due by the 15th day of the 3rd month after the end of your organization’s tax year, or form 1041, u.s. Web form 1120, u.s. Web corporation must file form 1120, unless it is required to or elects to file a special return listed under special returns for certain organizations. The entity must also file form 8832,. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Income tax return of political organizations form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code form. Income tax return for cooperative associations. Complete, edit or print tax forms instantly.

Corporation income tax return, due by the 15th day of the 3rd month after the end of your organization’s tax year, or form 1041, u.s. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Complete, edit or print tax forms instantly. Web form 4720, return of certain excise taxes on charities and other persons under chapters 41 and 42 of the internal revenue codepdf, is intended primarily for. Income tax return for certain political organizations pdf form 1128, application to adopt, change, or retain a tax year pdf instructions. Income tax return of political organizations form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code form. Corporations operating on a cooperative basis file this form to report their. Corporation income tax return, due by the 15th day of the 3rd month after the end of your organization's tax year, or form 1041, u.s. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

Form 1120F U.S. Tax Return of a Foreign Corporation (2014

Corporation income tax return, due by the 15th day of the 3rd month after the end of your organization's tax year, or form 1041, u.s. Web organizations are required to file the variant that matches their gross receipts , assets , and primary source of funding. Second, at least 60% of the association’s gross income for the. Income tax return.

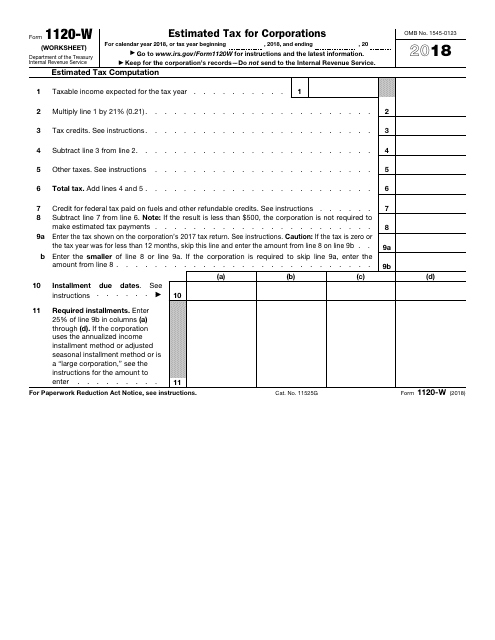

IRS Form 1120W Download Fillable PDF or Fill Online Estimated Tax for

Income tax return for cooperative associations. Income tax return for certain political organizations pdf form 1128, application to adopt, change, or retain a tax year pdf instructions. The entity must also file form 8832,. Complete, edit or print tax forms instantly. A homeowners association files this form as its income tax return to take advantage.

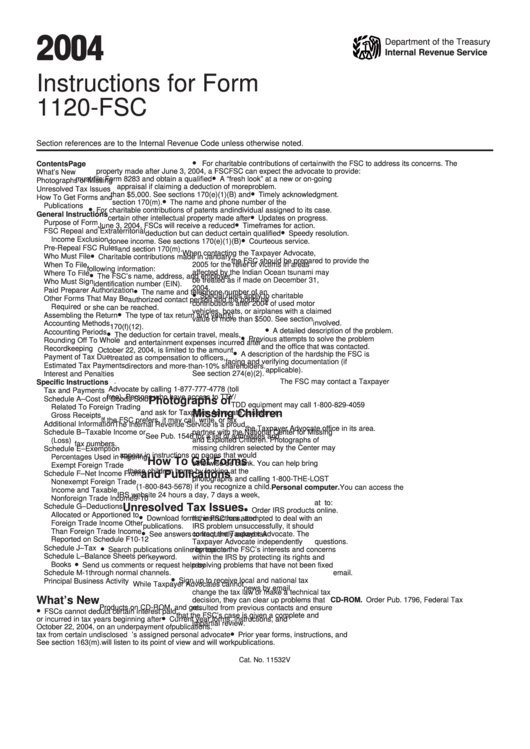

Form 1120FSC Tax Return of Foreign Sales Corporation (2012

Income tax return of political organizations form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code form. Corporation income tax return, due by the 15th day of the 3rd month after the end of your organization’s tax year, or form 1041, u.s. Second, at least 60% of the association’s gross income for the..

Form 1120F U.S. Tax Return of a Foreign Corporation (2014

Income tax return for cooperative associations. Get ready for tax season deadlines by completing any required tax forms today. Corporations operating on a cooperative basis file this form to report their. Web organizations are required to file the variant that matches their gross receipts , assets , and primary source of funding. Income tax return for certain political organizations pdf.

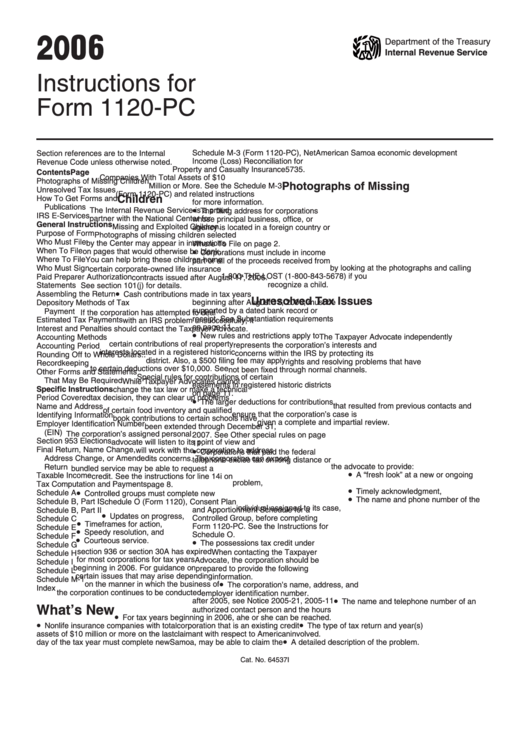

Instructions For Form 1120Pc 2006 printable pdf download

Income tax return for homeowners associations. Income tax return for certain political organizations pdf form 1128, application to adopt, change, or retain a tax year pdf instructions. Web when a business is taxed as a sole proprietorship, its profit and loss is reported on schedule c. Second, at least 60% of the association’s gross income for the. Income tax return.

2020 Form IRS 1120 Fill Online, Printable, Fillable, Blank pdfFiller

Income tax return for cooperative associations. Corporation income tax return, due by the 15th day of the 3rd month after the end of your organization's tax year, or form 1041, u.s. Get ready for tax season deadlines by completing any required tax forms today. Web corporation must file form 1120, unless it is required to or elects to file a.

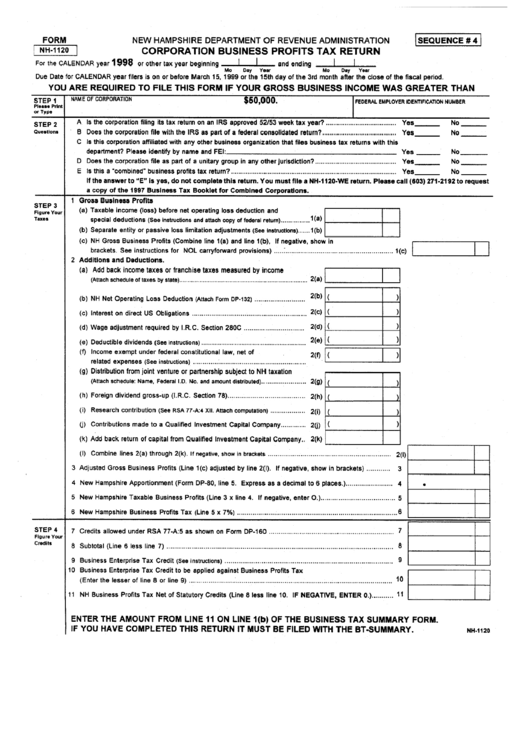

Fillable Form Nh1120 Corporation Business Profits Tax Return

Second, at least 60% of the association’s gross income for the. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Find your nonprofit filing requirements in one place! Income tax return for cooperative associations. Get ready for tax season deadlines by completing any required tax forms today.

Form 1120L U.S. Life Insurance Company Tax Return (2015) Free

A homeowners association files this form as its income tax return to take advantage. Corporation income tax return, due by the 15th day of the 3rd month after the end of your organization’s tax year, or form 1041, u.s. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Income tax return of political organizations form.

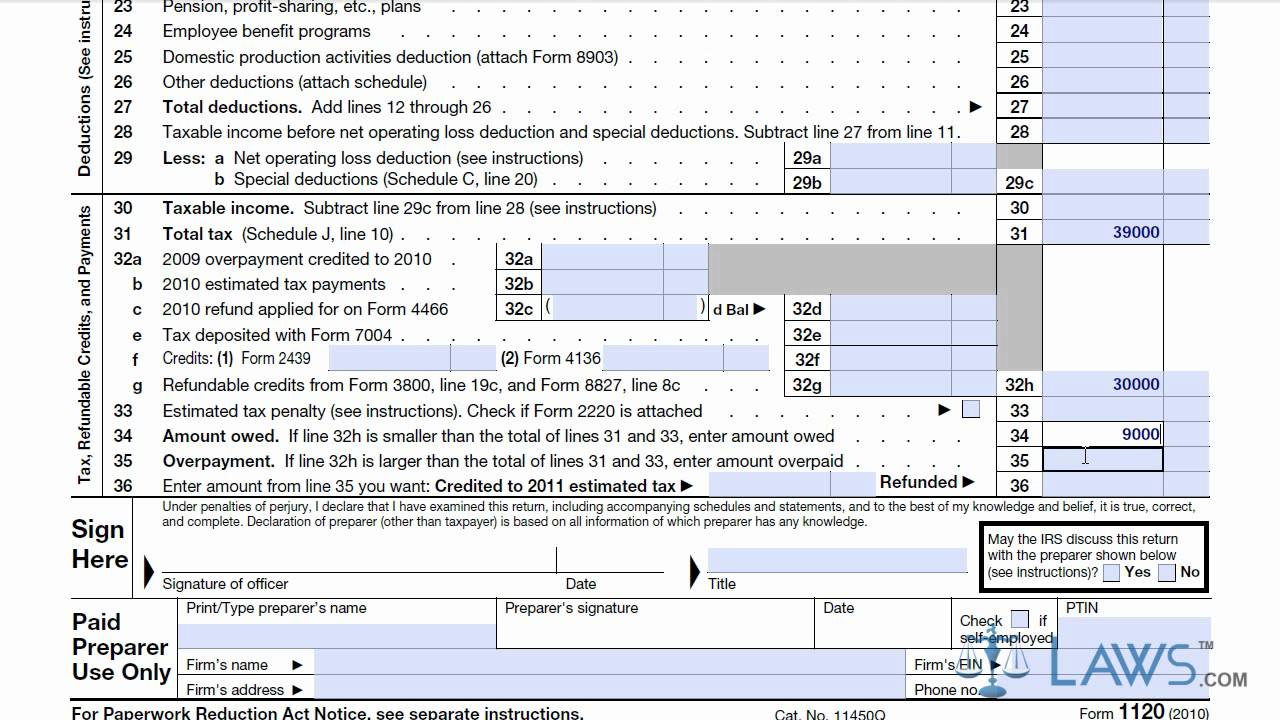

Form 1120 YouTube

Income tax return for cooperative associations. Income tax return for certain political organizations pdf form 1128, application to adopt, change, or retain a tax year pdf instructions. Find your nonprofit filing requirements in one place! Web first, according to irs documents, at least 85% of the units within the association must be for residential use. Ad access irs tax forms.

Instructions For Form 1120Fsc U.s. Tax Return Of A Foreign

Corporation income tax return, due by the 15th day of the 3rd month after the end of your organization’s tax year, or form 1041, u.s. Get ready for tax season deadlines by completing any required tax forms today. Web first, according to irs documents, at least 85% of the units within the association must be for residential use. Complete, edit.

Income Tax Return For Cooperative Associations.

Ad access irs tax forms. Complete, edit or print tax forms instantly. Corporation income tax return, due by the 15th day of the 3rd month after the end of your organization’s tax year, or form 1041, u.s. Income tax return for homeowners associations.

A Homeowners Association Files This Form As Its Income Tax Return To Take Advantage.

Complete, edit or print tax forms instantly. Web when a business is taxed as a sole proprietorship, its profit and loss is reported on schedule c. Web form 1120, u.s. Web first, according to irs documents, at least 85% of the units within the association must be for residential use.

Income Tax Return Of Political Organizations Form 4720, Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code Form.

Find your nonprofit filing requirements in one place! The entity must also file form 8832,. Corporations operating on a cooperative basis file this form to report their. Corporation income tax return, due by the 15th day of the 3rd month after the end of your organization's tax year, or form 1041, u.s.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web form 4720, return of certain excise taxes on charities and other persons under chapters 41 and 42 of the internal revenue codepdf, is intended primarily for. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Second, at least 60% of the association’s gross income for the. Income tax return for certain political organizations pdf form 1128, application to adopt, change, or retain a tax year pdf instructions.