Plan Restatement Certification Form

Plan Restatement Certification Form - The restatement deadline is july 31, 2022. Web irs explains impact of missed deadline for plan restatements in the may 23, 2022, issue of employee plans news , the irs explains the applicability of the. Web for form 5300 applications submitted after december 31, 2017, the plan should be restated to comply with the applicable required amendments list and it should incorporate all. Generally, the application file includes the: If a plan was not restated by the deadline, then the plan does not have a “favorable letter”. Web what is the restatement deadline? Many retirement plans that use. Web the restatement satisfies the need to update the plan for the pension protection act of 2006 (“ppa”). Web two of the key rules for retirement plans, according to arthur a. Since the current plan document.

Web the deadlines for adopting these updates are usually dependent on the type of plan and plan document. Sign online button or tick the preview image of the document. Web how you can complete the extra restatement certification forms online: Web if you are an employer who sponsors a qualified retirement plan, we want to remind you about the requirement to restate your plan document. Generally, the application file includes the: For example, a defined contribution plan, e.g. Web for form 5300 applications submitted after december 31, 2017, the plan should be restated to comply with the applicable required amendments list and it should incorporate all. Upload egtrra restatement certification forms from your device, the cloud, or a secure url. It incorporates changes from any plan amendments that may have been adopted since the last time the. To begin the blank, utilize the fill camp;

Since the current plan document. If a plan was not restated by the deadline, then the plan does not have a “favorable letter”. This is true for traditional defined benefit plans, as well as. Web the restatement satisfies the need to update the plan for the pension protection act of 2006 (“ppa”). Many retirement plans that use. Web determine the rights or benefits of any person under the plan or to inquire into the right or power of the plan administrator to direct any such distribution. Web overall, pozek suggests mandatory restatements should be used as a time to think deeply about a plan’s goals and objectives, and how operations can be. Web two of the key rules for retirement plans, according to arthur a. Web the deadlines for adopting these updates are usually dependent on the type of plan and plan document. It incorporates changes from any plan amendments that may have been adopted since the last time the.

2013 Form Invesco AIMFRM26 Fill Online, Printable, Fillable, Blank

Web two of the key rules for retirement plans, according to arthur a. 1, 2020 and will close on july 31, 2022. For example, a defined contribution plan, e.g. This is true for traditional defined benefit plans, as well as. Web you may request a copy of a retirement plan’s determination letter application and certain other related documents from the.

Plan Documents Cycle 3 Restatement FAQs

If a plan was not restated by the deadline, then the plan does not have a “favorable letter”. Irs opinion letter for the solo 401(k). Web click on new document and choose the file importing option: Web overall, pozek suggests mandatory restatements should be used as a time to think deeply about a plan’s goals and objectives, and how operations.

Cycle 3 DC Plan Restatement FAQs DWC

Web you may request a copy of a retirement plan’s determination letter application and certain other related documents from the irs. Web trust beneficiary certification form. For example, a defined contribution plan, e.g. Many retirement plans that use. Web the restatement satisfies the need to update the plan for the pension protection act of 2006 (“ppa”).

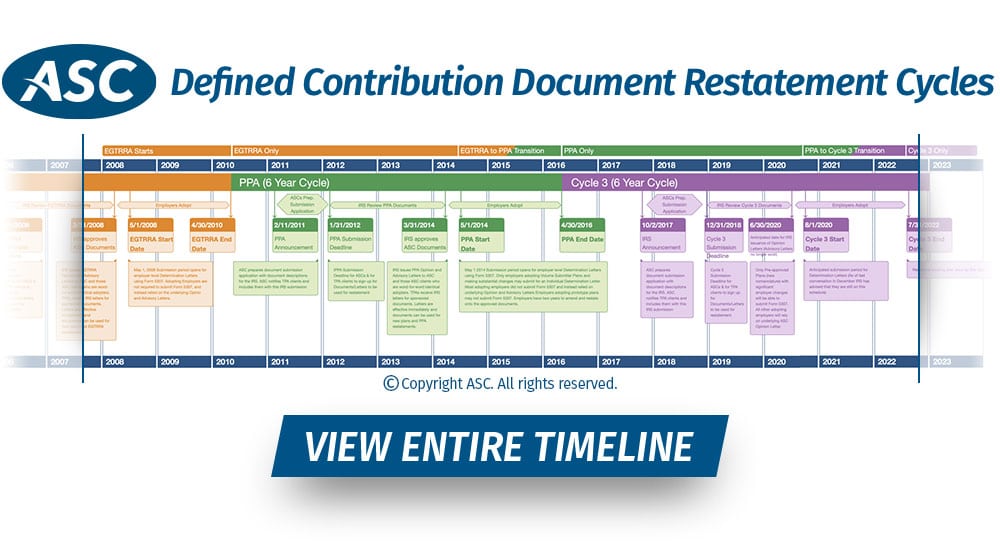

Defined contribution plan restatement period begins McAfee & Taft

Web you may request a copy of a retirement plan’s determination letter application and certain other related documents from the irs. This is true for traditional defined benefit plans, as well as. Web two of the key rules for retirement plans, according to arthur a. Web trust beneficiary certification form. If a plan was not restated by the deadline, then.

Cycle 3 Restatement What Plan Sponsors Need to Know

Many retirement plans that use. Web two of the key rules for retirement plans, according to arthur a. Web the restatement satisfies the need to update the plan for the pension protection act of 2006 (“ppa”). Successor plan administrator designation form. Generally, the application file includes the:

Arizona Limited Liability Partnership Amendment to Certificate

Generally, the application file includes the: Web you may request a copy of a retirement plan’s determination letter application and certain other related documents from the irs. Web the restatement satisfies the need to update the plan for the pension protection act of 2006 (“ppa”). Successor plan administrator designation form. This is true for traditional defined benefit plans, as well.

Retirement Plan Restatements What Plan Sponsors & Advisors Need to

Web trust beneficiary certification form. Can we pay for the restatement from plan assets? Web two of the key rules for retirement plans, according to arthur a. 1, 2020 and will close on july 31, 2022. Web #1 missed restatement form for solo 401k now what?

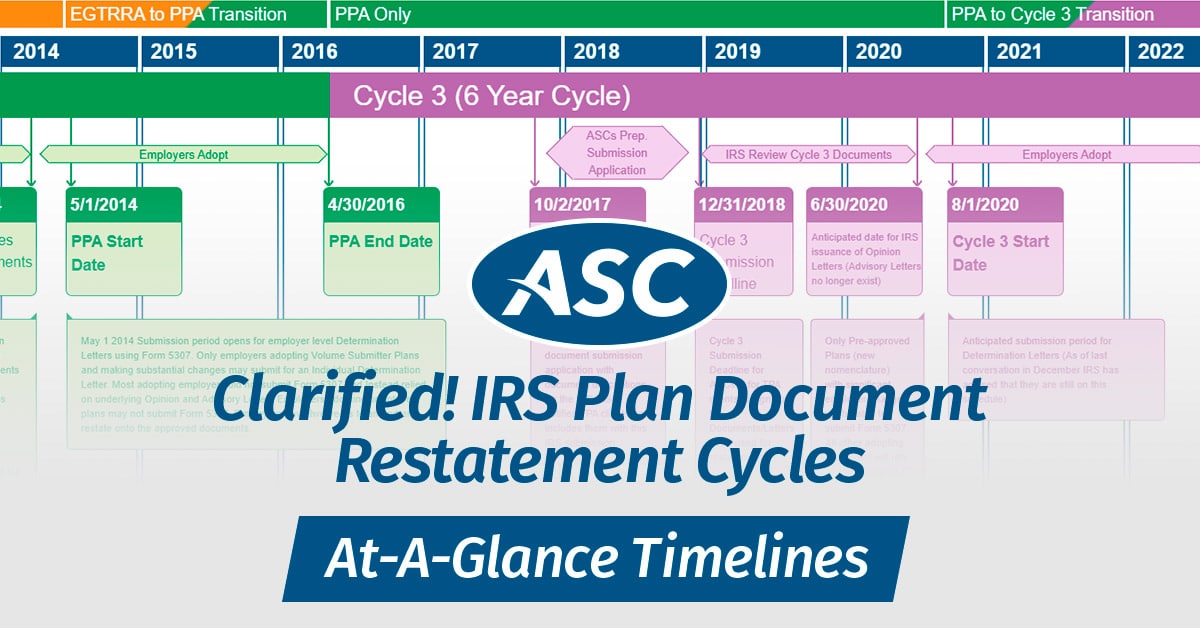

IRS Plan Document Restatement Cycles

Can we pay for the restatement from plan assets? Successor plan administrator designation form. Web you may request a copy of a retirement plan’s determination letter application and certain other related documents from the irs. Web what is the restatement deadline? Upload egtrra restatement certification forms from your device, the cloud, or a secure url.

Cycle 3 Restatement FAQ Atlantic Pension Services

Sign online button or tick the preview image of the document. If a plan was not restated by the deadline, then the plan does not have a “favorable letter”. Successor plan administrator designation form. This is true for traditional defined benefit plans, as well as. Web you may request a copy of a retirement plan’s determination letter application and certain.

IRS Plan Document Restatement Cycles Clarified

Web irs explains impact of missed deadline for plan restatements in the may 23, 2022, issue of employee plans news , the irs explains the applicability of the. This is true for traditional defined benefit plans, as well as. Web determine the rights or benefits of any person under the plan or to inquire into the right or power of.

Web Two Of The Key Rules For Retirement Plans, According To Arthur A.

Irs opinion letter for the solo 401(k). It incorporates changes from any plan amendments that may have been adopted since the last time the. Many retirement plans that use. Web plan documents august 20, 2020 presented by:

Upload Egtrra Restatement Certification Forms From Your Device, The Cloud, Or A Secure Url.

Web if you are an employer who sponsors a qualified retirement plan, we want to remind you about the requirement to restate your plan document. Web how you can complete the extra restatement certification forms online: If a plan was not restated by the deadline, then the plan does not have a “favorable letter”. 1, 2020 and will close on july 31, 2022.

Successor Plan Administrator Designation Form.

Generally, the application file includes the: Sign online button or tick the preview image of the document. Web irs explains impact of missed deadline for plan restatements in the may 23, 2022, issue of employee plans news , the irs explains the applicability of the. The restatement deadline is july 31, 2022.

Since The Current Plan Document.

Web overall, pozek suggests mandatory restatements should be used as a time to think deeply about a plan’s goals and objectives, and how operations can be. Web the deadlines for adopting these updates are usually dependent on the type of plan and plan document. Web #1 missed restatement form for solo 401k now what? To begin the blank, utilize the fill camp;