Form 8936 Example

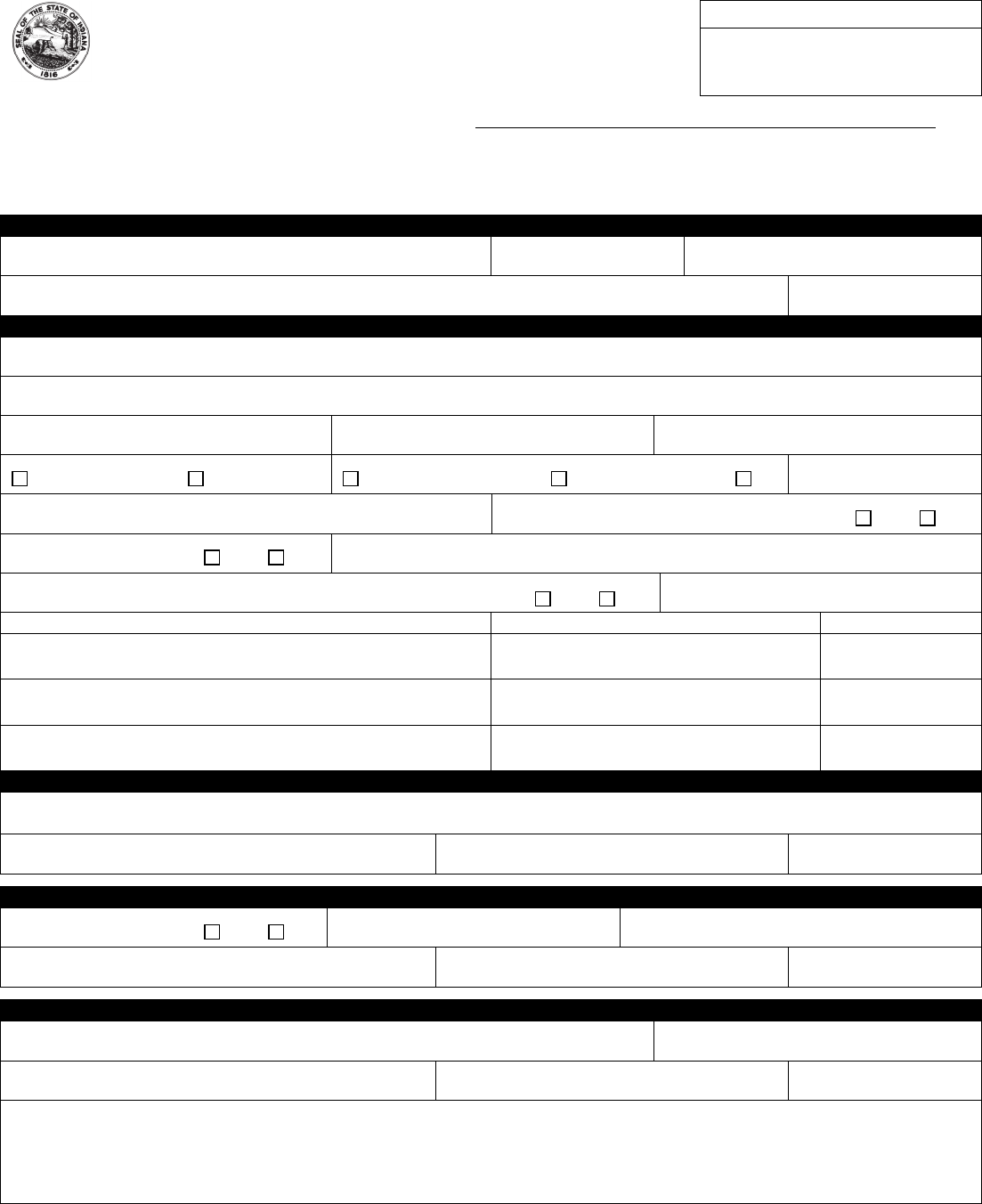

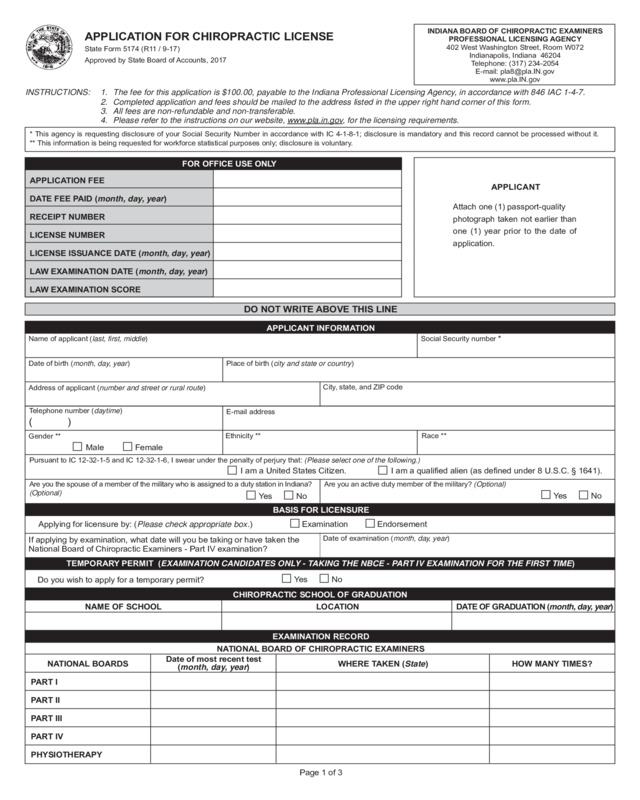

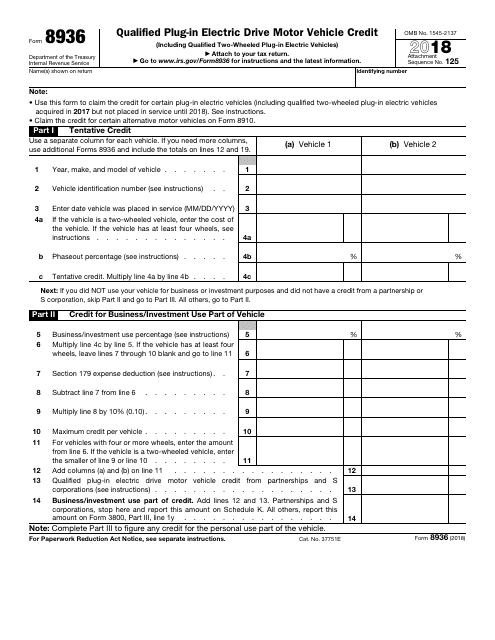

Form 8936 Example - For vehicles purchased before 2022 Web form 8936 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8936. = your total vehicle credit. • claim the credit for certain alternative motor vehicles on form 8910. Use a separate column for each vehicle. Web information about form 8936 and its instructions is at www.irs.gov/form8936. You will need to provide your vehicle's vin. Understanding the function of the three parts of the form sometimes helps. Get your online template and fill it in using progressive features. • claim the credit for certain alternative motor vehicles on form 8910.

Which revision to use use the january 2021 revision of form 8936 for tax years beginning in 2020 or later, until a later revision is issued. Web form 8936 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8936. Web the credit's current value of $2,500. • claim the credit for certain alternative motor vehicles on form 8910. The irs publishes a list of eligible vehicles and the credit amount on its website. Web solved • by intuit • 3 • updated july 19, 2022. Web information about form 8936 and its instructions is at www.irs.gov/form8936. Instead, they can report this credit directly on line 1y in part iii of form 3800, general business credit. For example, a car with a 10 kwh battery would be eligible for a credit of $5,002. Use a separate column for each vehicle.

Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save how to fill out form 8936 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 41 votes how to fill out and sign sample form 8936 online? Which revision to use use the january 2021 revision of form 8936 for tax years beginning in 2020 or later, until a later revision is issued. But not placed in service until 2018). Get everything done in minutes. Use a separate column for each vehicle. Part i calculates your tentative credit amount, which, typically, the manufacturer will have provided with its certification. Web the credit's current value of $2,500. Revised filing requirements how to fill out form 3800 Web form 8936 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8936. Web i've looked high and low and cannot find an example, so i'll opt out after providing this.

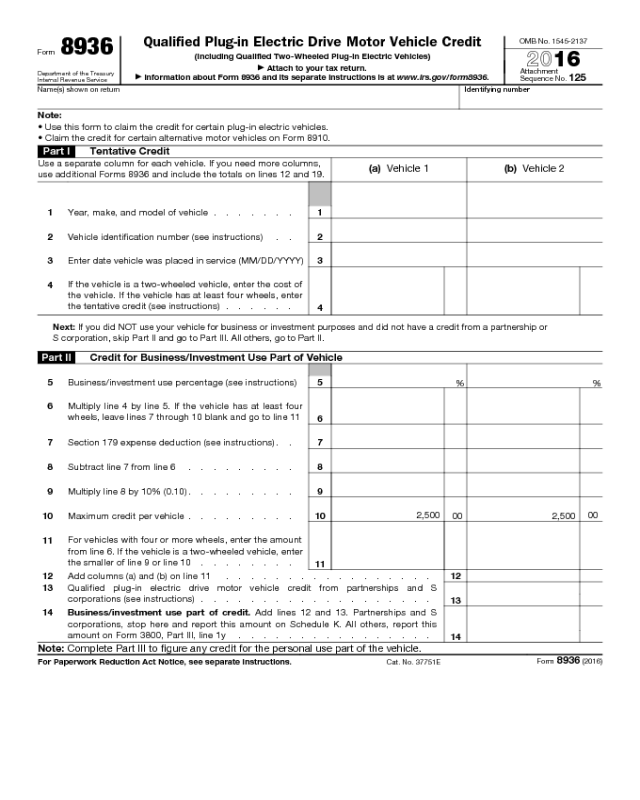

Form 54861 Edit, Fill, Sign Online Handypdf

• claim the credit for certain alternative motor vehicles on form 8910. Get your online template and fill it in using progressive features. Web complete or file this form if their only source for this credit is a partnership or s corporation. Web solved • by intuit • 3 • updated july 19, 2022. Instead, they can report this credit.

Form 8936 Qualified Plugin Electric Drive Motor Vehicle Credit (2014

What vehicles should a taxpayer report? Instead, they can report this credit directly on line 1y in part iii of form 3800, general business credit. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. • claim the credit for certain alternative motor vehicles on form 8910. You will need to.

Form 8936 Qualified Plugin Electric Drive Motor Vehicle Credit (2014

But not placed in service until 2018). If you need more columns, use additional forms 8936 and include the totals on lines 12 and 19. The irs publishes a list of eligible vehicles and the credit amount on its website. Web form 8936 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8936. Which revision to.

Form 8936 Qualified Plugin Electric Drive Motor Vehicle Credit (2014

If you need more columns, use additional forms 8936 and include the totals on lines 12 and 19. Get your online template and fill it in using progressive features. Web information about form 8936 and its instructions is at www.irs.gov/form8936. For example, a car with a 10 kwh battery would be eligible for a credit of $5,002. Check out how.

Form 8910 Alternative Motor Vehicle Credit (2014) Free Download

Web complete or file this form if their only source for this credit is a partnership or s corporation. You will need to provide your vehicle's vin. The irs publishes a list of eligible vehicles and the credit amount on its website. Which revision to use use the january 2021 revision of form 8936 for tax years beginning in 2020.

Entering Expenses for MultiUnit Rentals (Drake15) (ScheduleE)

For vehicles purchased before 2022 Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save how to fill out form 8936 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 41 votes how to fill out and sign.

2021 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

• claim the credit for certain alternative motor vehicles on form 8910. (a) vehicle 1 (b) vehicle 2 Web solved • by intuit • 3 • updated july 19, 2022. Web download your fillable irs form 8936 in pdf table of contents primary objectives and legal basis when to use the form? Part i tentative credit use a separate column.

EV process and its documentation SSL Certificates

What vehicles should a taxpayer report? • claim the credit for certain alternative motor vehicles on form 8910. Get your online template and fill it in using progressive features. Get everything done in minutes. • claim the credit for certain alternative motor vehicles on form 8910.

Form 05174 Edit, Fill, Sign Online Handypdf

The irs publishes a list of eligible vehicles and the credit amount on its website. Part i calculates your tentative credit amount, which, typically, the manufacturer will have provided with its certification. If you need more columns, use additional forms 8936 and include the totals on lines 12 and 19. January 2023) department of the treasury internal revenue service. Check.

IRS Form 8936 Download Fillable PDF or Fill Online Qualified PlugIn

(a) vehicle 1 (b) vehicle 2 Web form 8936 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8936. Web download your fillable irs form 8936 in pdf table of contents primary objectives and legal basis when to use the form? Check out how easy it is to complete and esign documents online using fillable templates.

Web Form 8936 And Its Instructions, Such As Legislation Enacted After They Were Published, Go To Irs.gov/Form8936.

Revised filing requirements how to fill out form 3800 Part i calculates your tentative credit amount, which, typically, the manufacturer will have provided with its certification. Part i tentative credit use a separate column for each vehicle. • claim the credit for certain alternative motor vehicles on form 8910.

Which Revision To Use Use The January 2021 Revision Of Form 8936 For Tax Years Beginning In 2020 Or Later, Until A Later Revision Is Issued.

Understanding the function of the three parts of the form sometimes helps. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save how to fill out form 8936 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 41 votes how to fill out and sign sample form 8936 online? Web i've looked high and low and cannot find an example, so i'll opt out after providing this.

For Vehicles Purchased Before 2022

• claim the credit for certain alternative motor vehicles on form 8910. The irs publishes a list of eligible vehicles and the credit amount on its website. Web download your fillable irs form 8936 in pdf table of contents primary objectives and legal basis when to use the form? What vehicles should a taxpayer report?

But Not Placed In Service Until 2018).

Get everything done in minutes. For instructions and the latest information. (a) vehicle 1 (b) vehicle 2 For example, a car with a 10 kwh battery would be eligible for a credit of $5,002.