Form 941 B

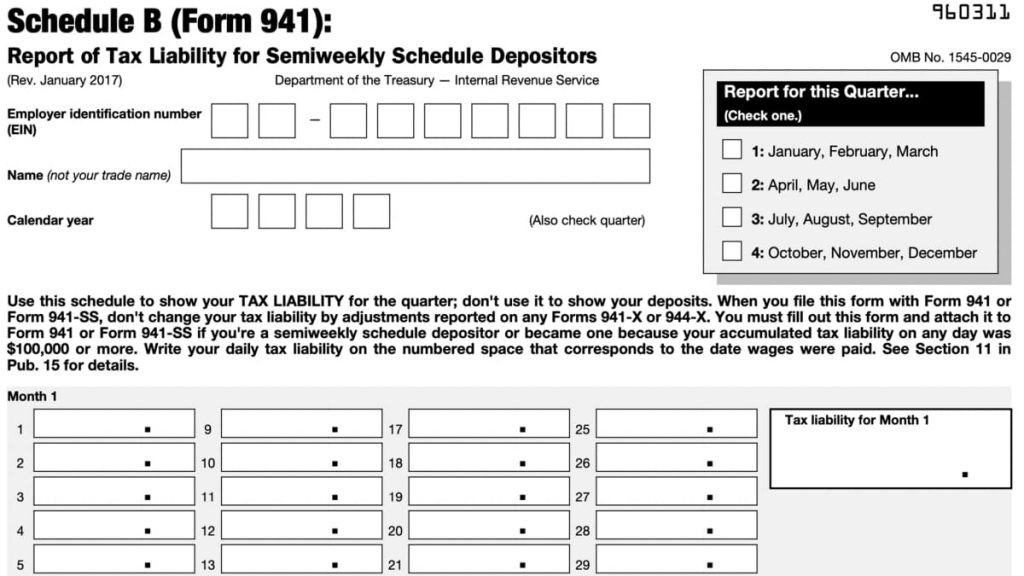

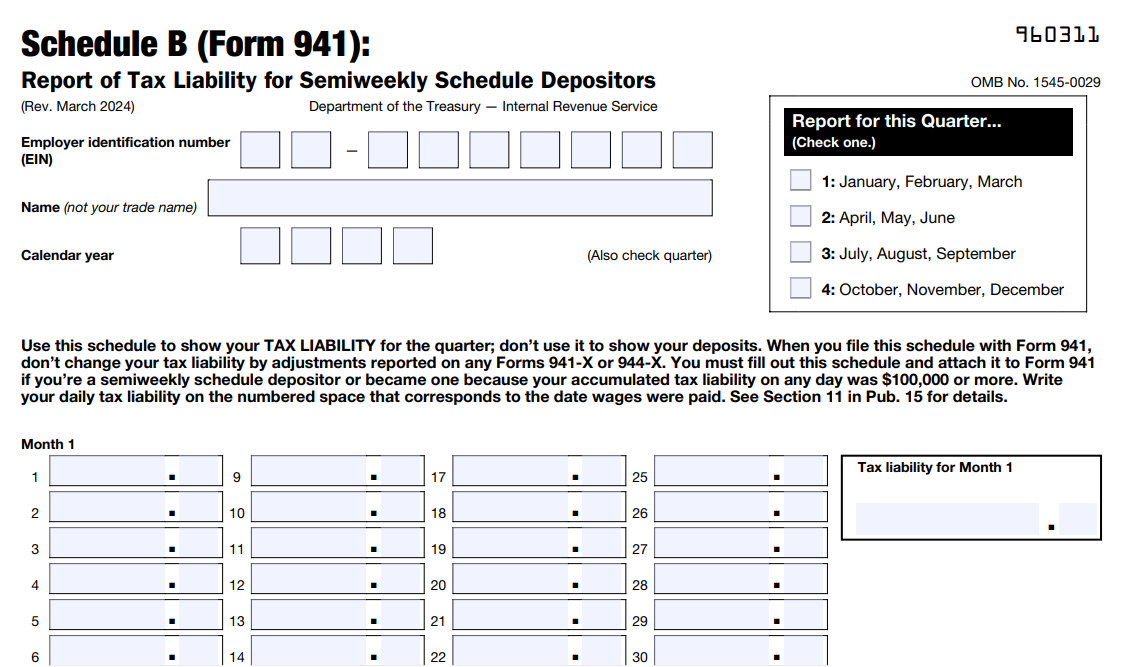

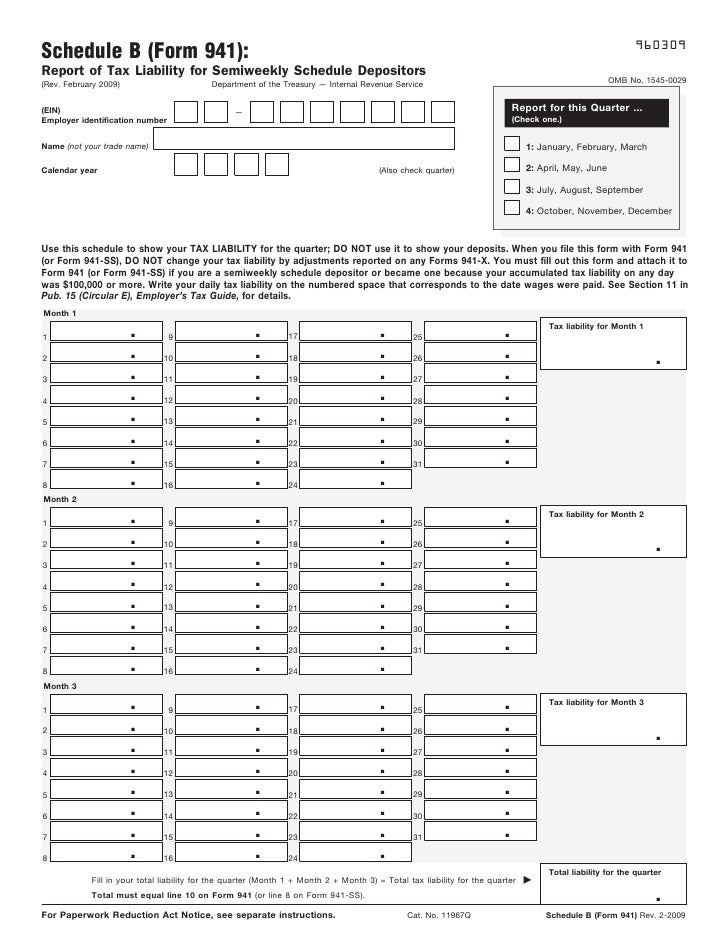

Form 941 B - Web here’s a simple tax guide to help you understand form 941 schedule b. Employers are required to withhold a. You must complete all three pages. Web more about the federal 941 (schedule b) corporate income tax ty 2022. See deposit penalties in section 11 of pub. Web what is form 941 schedule b? Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. Web irs form 941 is the employer’s quarterly tax return. Completes schedule b by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941.

See deposit penalties in section 11 of pub. Completes schedule b by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social. You must complete all three pages. Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Explore instructions, filing requirements, and tips. This form must be completed by a semiweekly schedule depositor who. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web here’s a simple tax guide to help you understand form 941 schedule b. You must fill out this form and.

Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Schedule b is filed with form 941. Web don’t complete schedule b if you have a tax liability on form 941, line 12, that is less than $2,500 during the quarter. This form must be completed by a semiweekly schedule depositor who. Employers are required to withhold a. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. See deposit penalties in section 11 of pub. Web more about the federal 941 (schedule b) corporate income tax ty 2022. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

Web the irs has updated form 8974, qualified small business payroll tax credit for increasing research activities, to allow small businesses to claim up to $250,000 in credit against. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Web information about form 941, employer's quarterly federal.

Fillable Form 941 Schedule B 2020 Download Printable 941 for Free

Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. Web here’s a simple tax guide to help you understand form 941 schedule b. 15 or section 8 of pub. Employers engaged in a trade or business who pay compensation form 9465; Web complete schedule b (form 941), report of tax.

FREE 8+ Sample Schedule Forms in PDF

Web don’t complete schedule b if you have a tax liability on form 941, line 12, that is less than $2,500 during the quarter. Explore instructions, filing requirements, and tips. This form reports withholding of federal income taxes from employees’ wages or salaries, as well as. You must complete all three. Web the irs has updated form 8974, qualified small.

Fillable Schedule B Form 941 Schedule Printable

Web the irs has updated form 8974, qualified small business payroll tax credit for increasing research activities, to allow small businesses to claim up to $250,000 in credit against. Explore instructions, filing requirements, and tips. Schedule b is filed with form 941. 15 or section 8 of pub. We last updated the report of tax liability for semiweekly schedule depositors.

Form 941 Schedule B YouTube

Explore instructions, filing requirements, and tips. This form must be completed by a semiweekly schedule depositor who. See deposit penalties in section 11 of pub. You must complete all three pages. Web the irs has updated form 8974, qualified small business payroll tax credit for increasing research activities, to allow small businesses to claim up to $250,000 in credit against.

IRS Fillable Form 941 2023

Form 941 is used by employers. Employers are required to withhold a. Web what is form 941 schedule b? Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. You must complete all three.

Schedule B 941 Create A Digital Sample in PDF

Web irs form 941 is the employer’s quarterly tax return. This form must be completed by a semiweekly schedule depositor who. Web the irs has updated form 8974, qualified small business payroll tax credit for increasing research activities, to allow small businesses to claim up to $250,000 in credit against. You must complete all three. Employers engaged in a trade.

File 941 Online How to File 2023 Form 941 electronically

Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. We last updated the report of tax liability for semiweekly schedule depositors in january 2023, so this. Explore instructions, filing requirements, and tips. You must complete all three. You must fill out this form and.

Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedul…

Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. You must fill out this form and. Employers are required to withhold a. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Employers engaged in a trade or business.

Schedule B (Form 941) Report of Tax Liability for Semiweekly Schedule

You must fill out this form and. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Explore instructions, filing requirements, and tips. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. You must complete all three.

Web Complete Schedule B (Form 941), Report Of Tax Liability For Semiweekly Schedule Depositors, And Attach It To Form 941.

Web irs form 941 is the employer’s quarterly tax return. Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. Schedule b is filed with form 941. Web the irs has updated form 8974, qualified small business payroll tax credit for increasing research activities, to allow small businesses to claim up to $250,000 in credit against.

Employers Are Required To Withhold A.

You must fill out this form and. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Completes schedule b by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social. You must complete all three pages.

Web Complete Schedule B (Form 941), Report Of Tax Liability For Semiweekly Schedule Depositors, And Attach It To Form 941.

Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. 15 or section 8 of pub. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941.

Web Here’s A Simple Tax Guide To Help You Understand Form 941 Schedule B.

This form reports withholding of federal income taxes from employees’ wages or salaries, as well as. Web what is form 941 schedule b? Web more about the federal 941 (schedule b) corporate income tax ty 2022. This form must be completed by a semiweekly schedule depositor who.