Form It 2105

Form It 2105 - Web send form it 2105 via email, link, or fax. Enjoy smart fillable fields and interactivity. Technical help individuals, fiduciaries, businesses, and tax professionals. You can also download it, export it or print it out. This form must be filled out an approved by your regional office of the workers compensation board. Fill out the notice of election of a corporation which is required to have. The new form it 2105 is a great way to find the business forms you need. Web how do i file an irs extension (form 4868) in turbotax online? Web as you enter your federal information, taxact automatically calculates and enters your data into your state tax forms. The following group of people should mail their forms to department of the treasury internal revenue service, austin,.

You can also download it, export it or print it out. This form software allows you to print and fill out hundreds of. Edit your form 2105 online type text, add images, blackout confidential details, add. This form must be filled out an approved by your regional office of the workers compensation board. Web how to fill out and sign ny it 2105 online? File an extension in turbotax online before the deadline to avoid a late filing penalty. Enjoy smart fillable fields and interactivity. How do i clear and. Web how do i file an irs extension (form 4868) in turbotax online? The new form it 2105 is a great way to find the business forms you need.

The following group of people should mail their forms to department of the treasury internal revenue service, austin,. In showing what fields to fill in, i am making the. This form must be filled out an approved by your regional office of the workers compensation board. You can also download it, export it or print it out. The new form it 2105 is a great way to find the business forms you need. File an extension in turbotax online before the deadline to avoid a late filing penalty. How do i clear and. Technical help individuals, fiduciaries, businesses, and tax professionals. Edit your form 2105 online type text, add images, blackout confidential details, add. This form software allows you to print and fill out hundreds of.

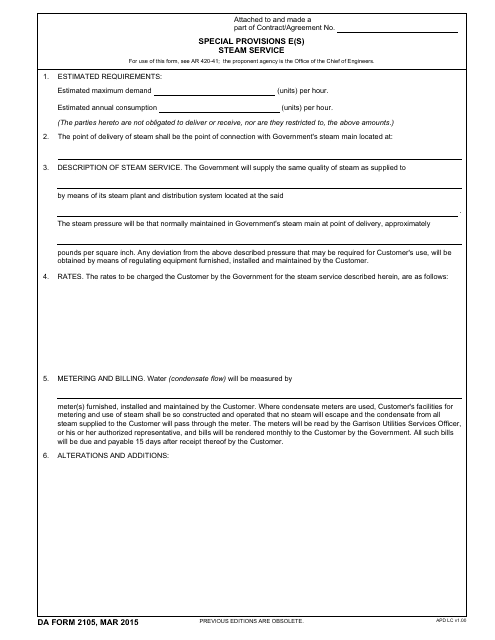

DA Form 2105 Download Fillable PDF or Fill Online Special Provisions E

Fill out the notice of election of a corporation which is required to have. This form must be filled out an approved by your regional office of the workers compensation board. The new form it 2105 is a great way to find the business forms you need. Web how do i file an irs extension (form 4868) in turbotax online?.

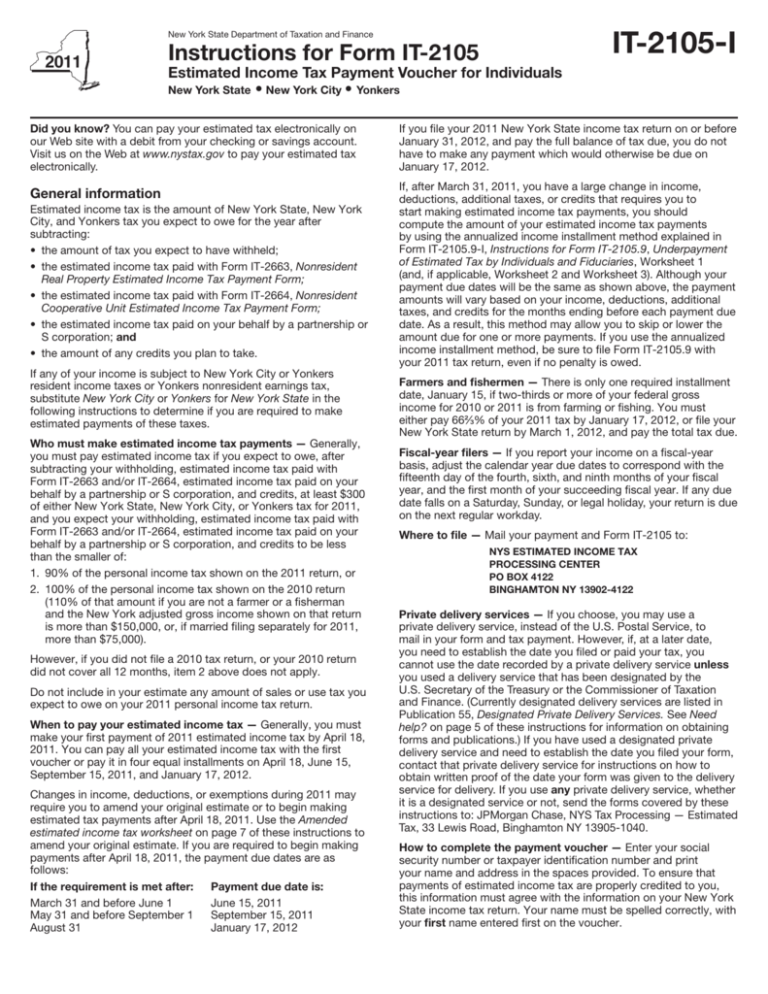

Form IT2105I(2011)Instructions for Form IT

Use a 2021 it 2105 template to make your document workflow more streamlined. Web as you enter your federal information, taxact automatically calculates and enters your data into your state tax forms. Fill out the notice of election of a corporation which is required to have. Edit your form 2105 online type text, add images, blackout confidential details, add. Enter.

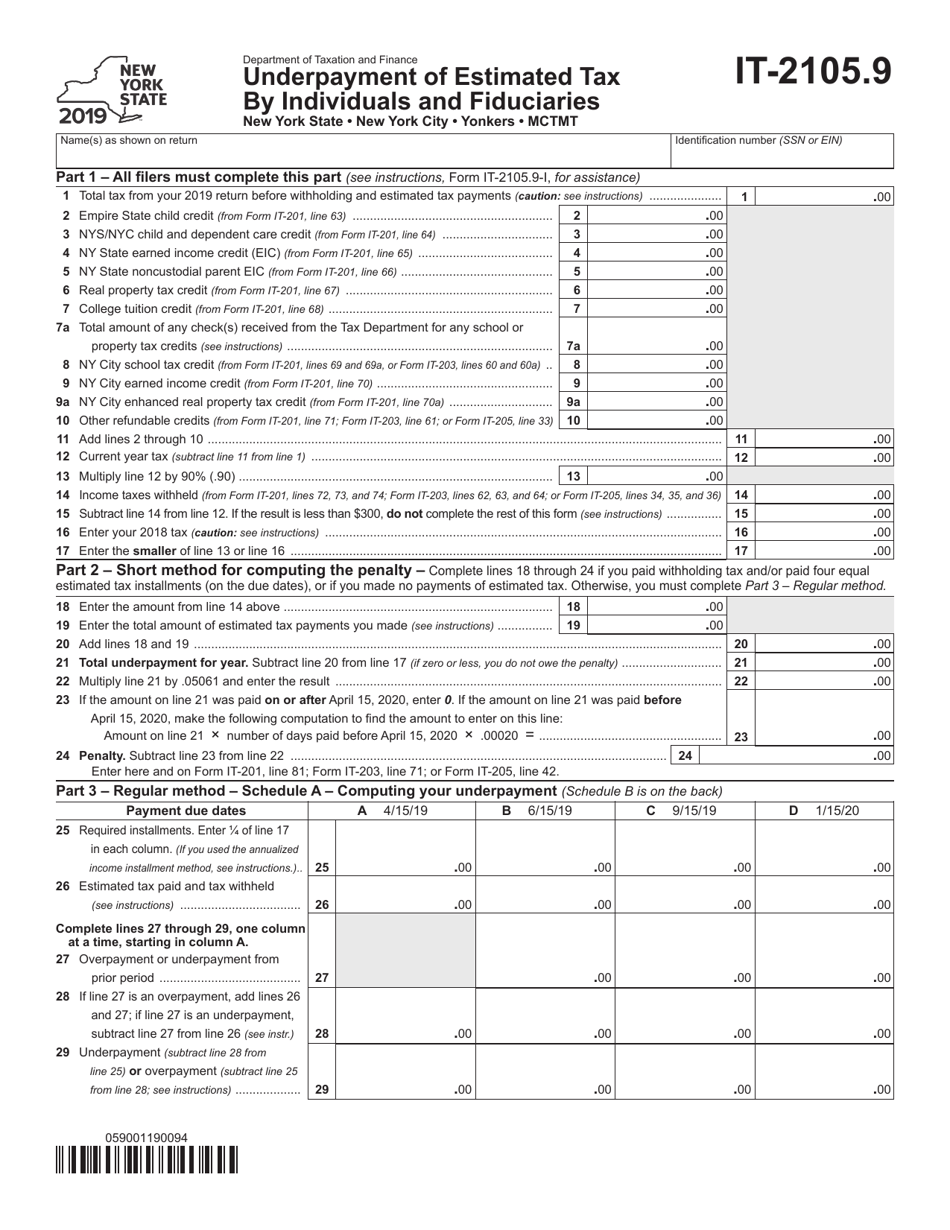

2010 Form NY DTF IT2105.9 Fill Online, Printable, Fillable, Blank

File an extension in turbotax online before the deadline to avoid a late filing penalty. Web how to fill out and sign ny it 2105 online? Fill out the notice of election of a corporation which is required to have. This form must be filled out an approved by your regional office of the workers compensation board. Edit your form.

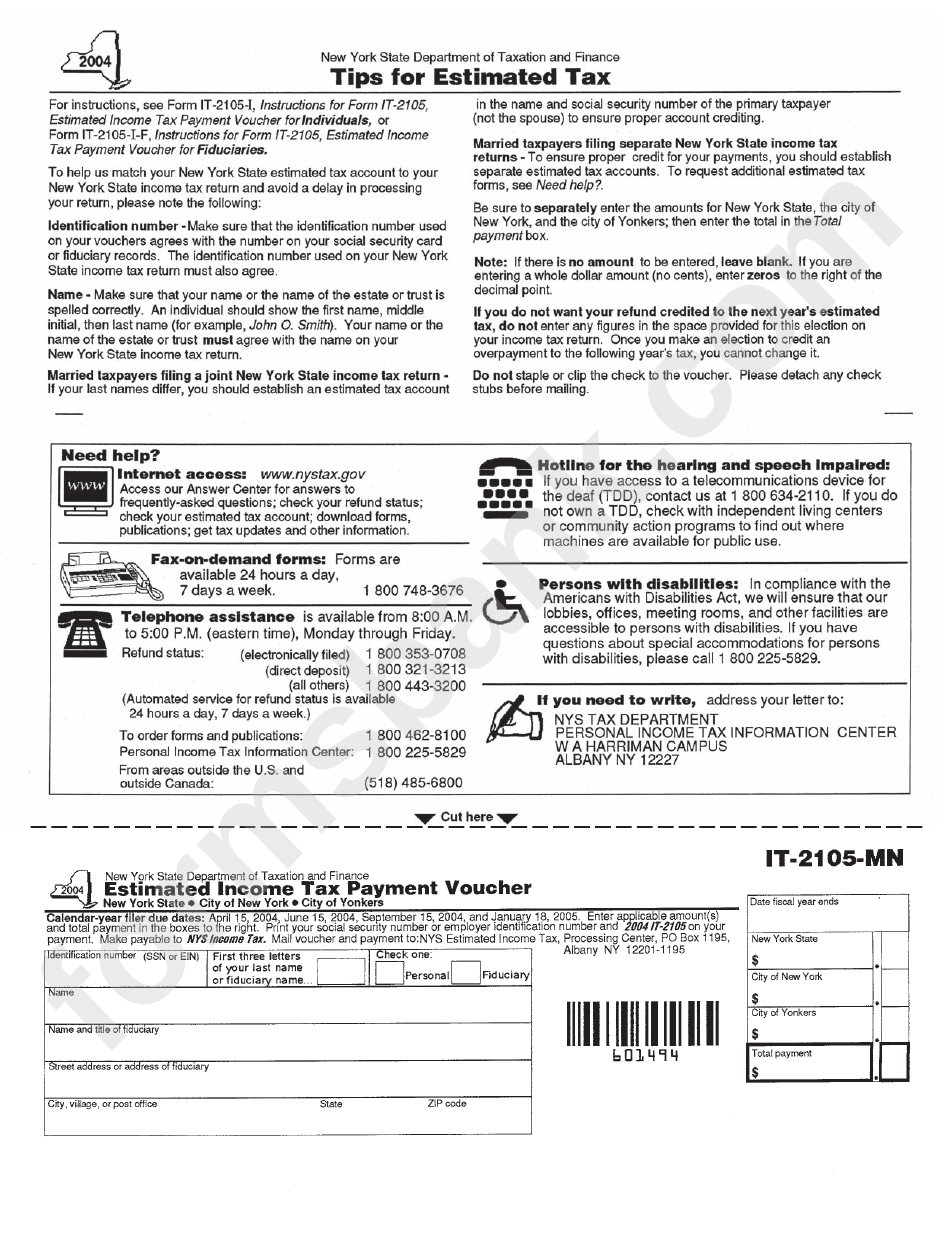

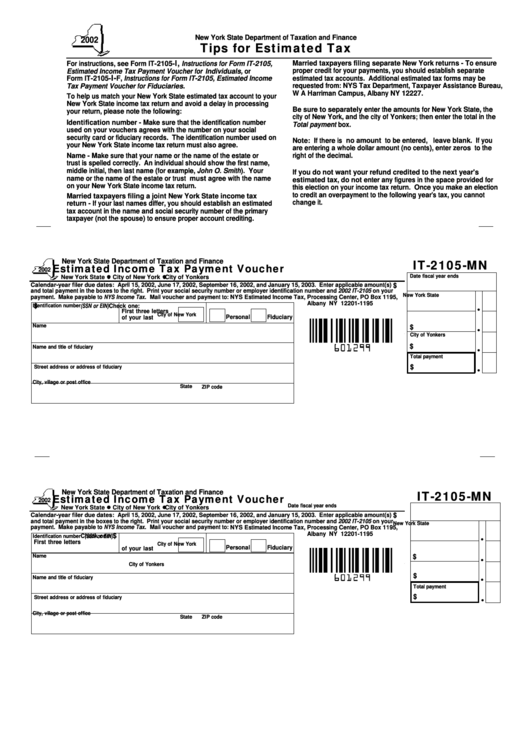

Fillable Form It2105Mn Estimated Tax Payment Voucher 2004

Part a of chapter 59 of the laws of 2021 replaced the highest personal income tax bracket and rate for 2021 with three new brackets and. Web how to fill out and sign ny it 2105 online? Enjoy smart fillable fields and interactivity. Web how do i file an irs extension (form 4868) in turbotax online? Enter applicable amount(s) and.

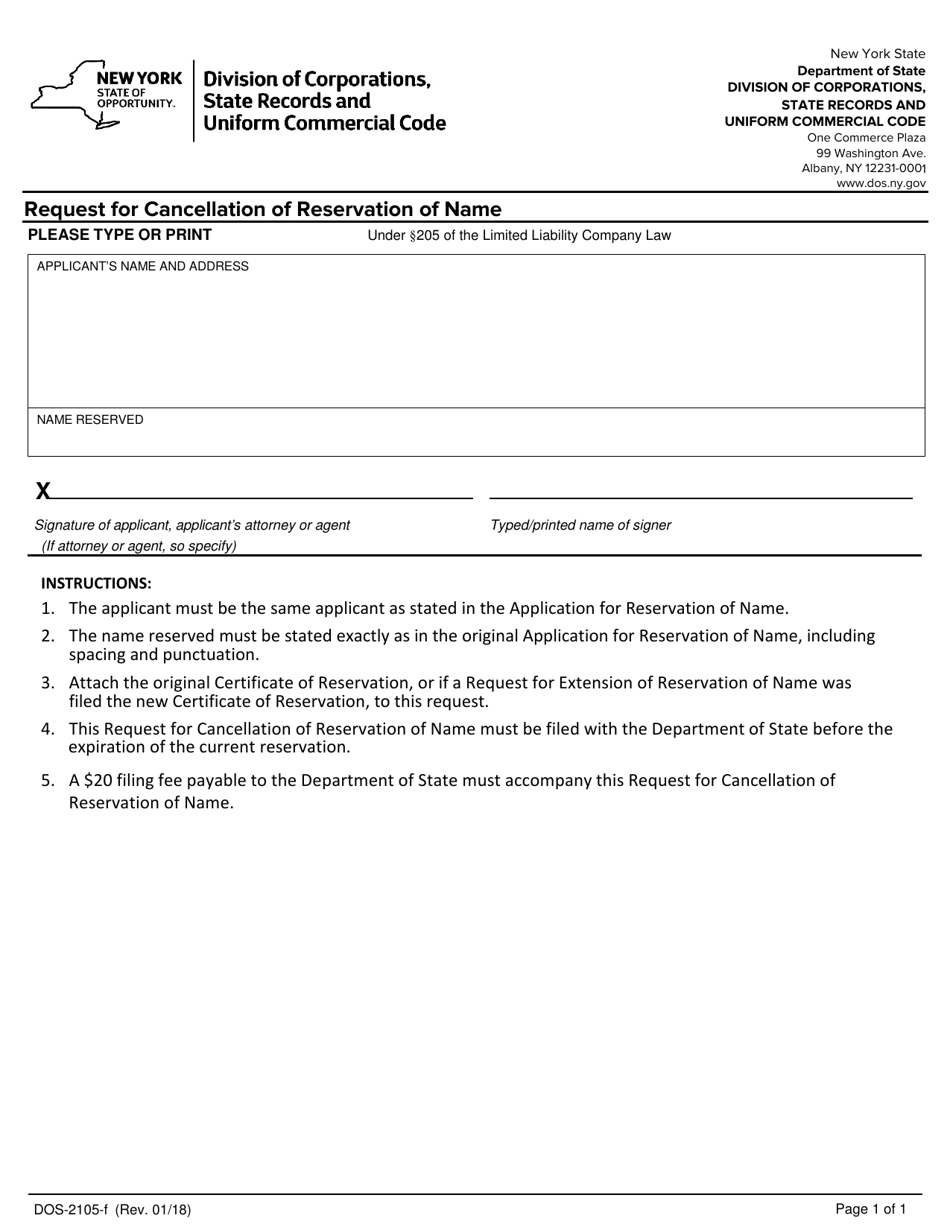

Form DOS2105F Download Fillable PDF or Fill Online Request for

You may make estimated tax. Use a 2021 it 2105 template to make your document workflow more streamlined. Web send form it 2105 via email, link, or fax. In showing what fields to fill in, i am making the. Web how do i file an irs extension (form 4868) in turbotax online?

Form IT2105.9 Download Fillable PDF or Fill Online Underpayment of

Edit your form 2105 online type text, add images, blackout confidential details, add. Technical help individuals, fiduciaries, businesses, and tax professionals. In showing what fields to fill in, i am making the. Use a 2021 it 2105 template to make your document workflow more streamlined. Enjoy smart fillable fields and interactivity.

Form It 2105 ≡ Fill Out Printable PDF Forms Online

Web as you enter your federal information, taxact automatically calculates and enters your data into your state tax forms. The new form it 2105 is a great way to find the business forms you need. Web send form it 2105 via email, link, or fax. Enter applicable amount(s) and total payment in the boxes to the. You can also download.

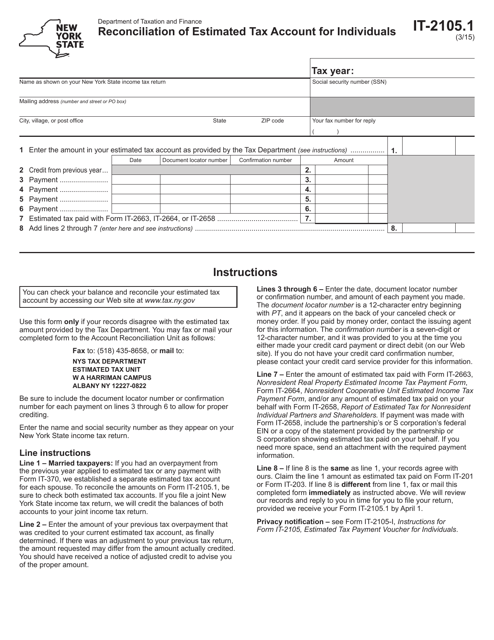

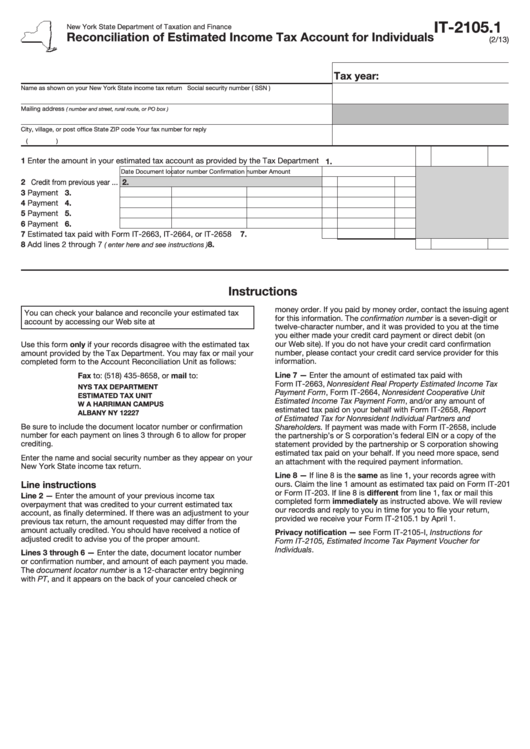

Form IT2105.1 Download Fillable PDF or Fill Online Reconciliation of

The following group of people should mail their forms to department of the treasury internal revenue service, austin,. The new form it 2105 is a great way to find the business forms you need. This form software allows you to print and fill out hundreds of. Forgot your username or password?. You can also download it, export it or print.

Form It2105Mn Estimated Tax Payment Voucher Form State Of

How do i clear and. This form must be filled out an approved by your regional office of the workers compensation board. Enjoy smart fillable fields and interactivity. Part a of chapter 59 of the laws of 2021 replaced the highest personal income tax bracket and rate for 2021 with three new brackets and. You may make estimated tax.

Fillable Form It2105.1 Reconciliation Of Estimated Tax

Web how to fill out and sign ny it 2105 online? Get your online template and fill it in using progressive features. Web as you enter your federal information, taxact automatically calculates and enters your data into your state tax forms. Forgot your username or password?. You may make estimated tax.

In Showing What Fields To Fill In, I Am Making The.

You can also download it, export it or print it out. Web how to fill out and sign ny it 2105 online? Edit your form 2105 online type text, add images, blackout confidential details, add. Enjoy smart fillable fields and interactivity.

Fill Out The Notice Of Election Of A Corporation Which Is Required To Have.

You may make estimated tax. Forgot your username or password?. This form must be filled out an approved by your regional office of the workers compensation board. Web how do i file an irs extension (form 4868) in turbotax online?

Enter Applicable Amount(S) And Total Payment In The Boxes To The.

File an extension in turbotax online before the deadline to avoid a late filing penalty. Web as you enter your federal information, taxact automatically calculates and enters your data into your state tax forms. This form software allows you to print and fill out hundreds of. The new form it 2105 is a great way to find the business forms you need.

Get Your Online Template And Fill It In Using Progressive Features.

How do i clear and. Web send form it 2105 via email, link, or fax. Part a of chapter 59 of the laws of 2021 replaced the highest personal income tax bracket and rate for 2021 with three new brackets and. Technical help individuals, fiduciaries, businesses, and tax professionals.