Form Rut-50

Form Rut-50 - In other words, you should file this form if you purchased. Web the bill of sale. Engaged parties names, addresses and. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form rut 50 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★. Complete the required boxes that are colored in yellow. Web find and fill out the correct illinois rut 50 form pdf. Hit the green arrow with the inscription next to. Web find the illinois rut 50 printable forms you require. Hitting the orange button down below will bring up our pdf tool. Click on the new document option above, then drag and drop the document to the upload area, import it from the cloud, or via a link.

Click on the new document option above, then drag and drop the document to the upload area, import it from the cloud, or via a link. Hit the green arrow with the inscription next to. If arecentlypurchasedvehiclehasnot been titled or registered in this state,. Web find the illinois rut 50 printable forms you require. In other words, you should file this form if you purchased. Web the illinois department of revenue dec. Or if you purchased a passenger car from an unregistered. Web find and fill out the correct illinois rut 50 form pdf. One of these forms must be presented with a separate tax payment made out to the illinois department of. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form rut 50 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★.

Web the bill of sale. This editor allows anyone to fill out this form. Web the illinois department of revenue dec. Web find and fill out the correct illinois rut 50 form pdf. Web add the rut 50 form illinois for editing. Web tax form rut 50 is a tax form that helps you find the right forms. Hitting the orange button down below will bring up our pdf tool. A tax form (available from il sos offices) if the vehicle has been registered for less than 3 months: If you need to obtain the forms prior to. Web find the illinois rut 50 printable forms you require.

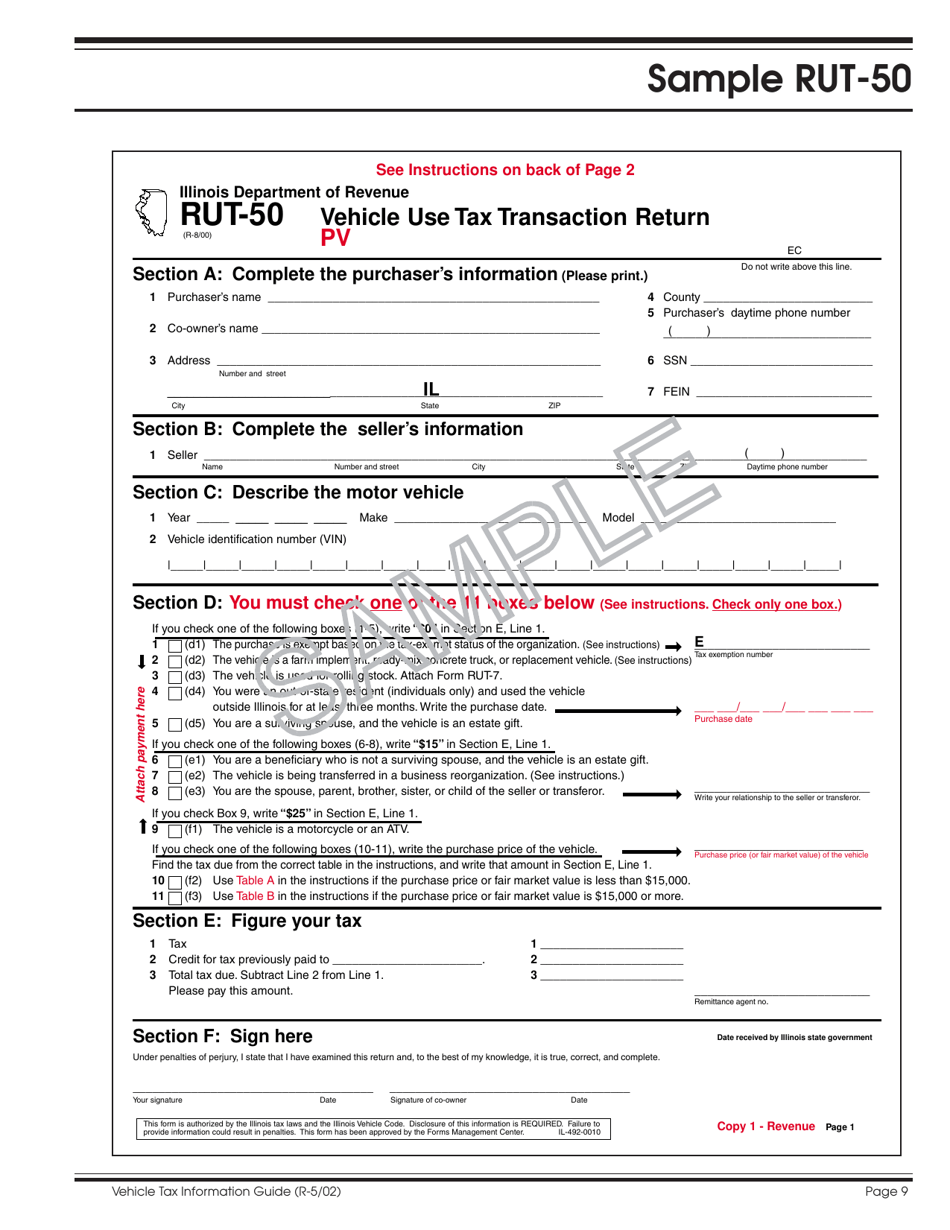

Sample Form RUT50 Fill Out, Sign Online and Download Printable PDF

If you need to obtain the forms prior to. Web add the rut 50 form illinois for editing. Choose the correct version of the editable pdf form. A tax form (available from il sos offices) if the vehicle has been registered for less than 3 months: Hitting the orange button down below will bring up our pdf tool.

Tax Form Rut50 Printable

Web find the illinois rut 50 printable forms you require. In other words, you should file this form if you purchased. Web find and fill out the correct illinois rut 50 form pdf. Hit the green arrow with the inscription next to. A tax form (available from il sos offices) if the vehicle has been registered for less than 3.

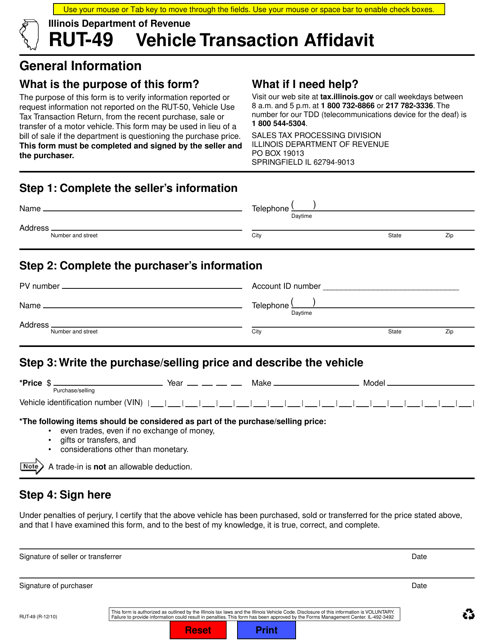

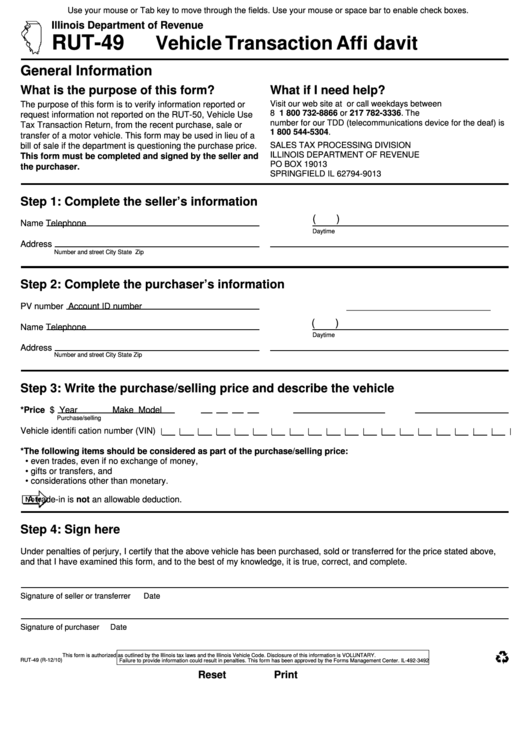

Form RUT49 Download Fillable PDF or Fill Online Vehicle Transaction

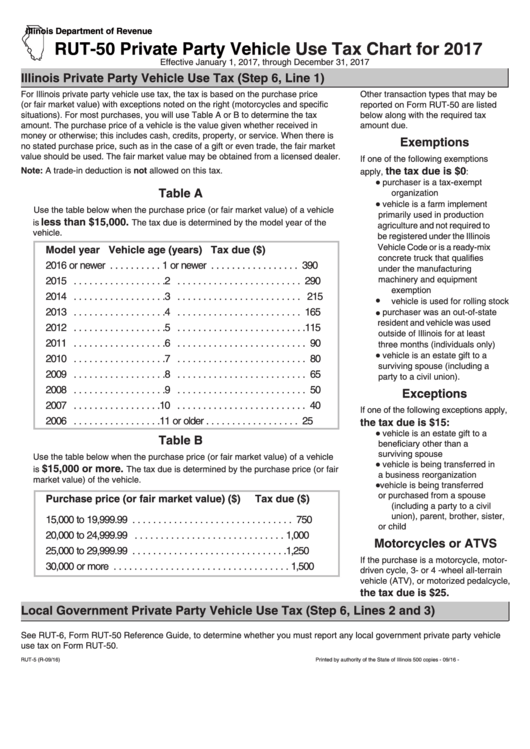

Web tax form rut 50 is a tax form that helps you find the right forms. Web the bill of sale. In other words, you should file this form if you purchased. Or if you purchased a passenger car from an unregistered. A tax form (available from il sos offices) if the vehicle has been registered for less than 3.

Rut 25 20202021 Fill and Sign Printable Template Online US Legal Forms

This editor allows anyone to fill out this form. Complete the required boxes that are colored in yellow. Engaged parties names, addresses and. Choose the correct version of the editable pdf form. One of these forms must be presented with a separate tax payment made out to the illinois department of.

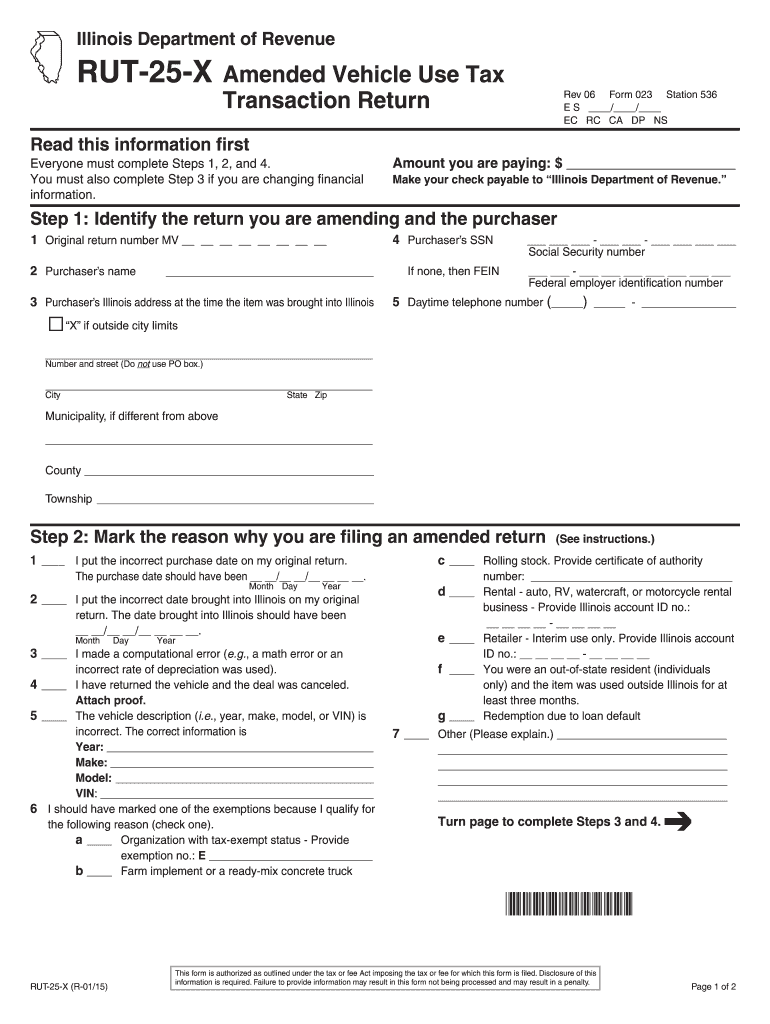

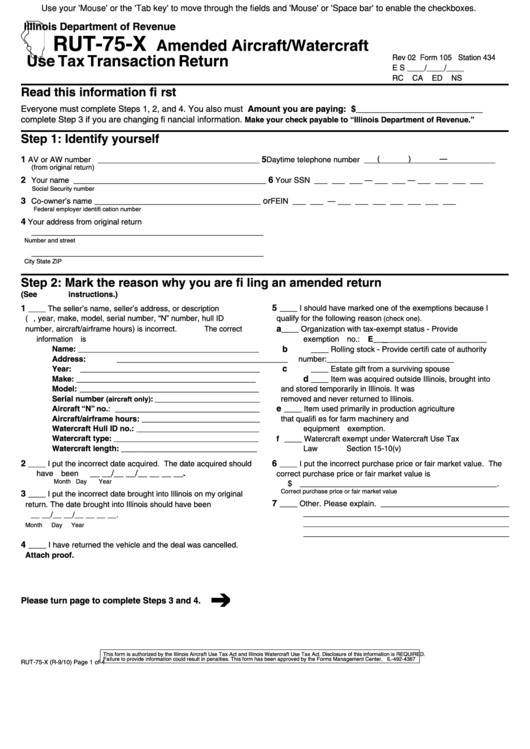

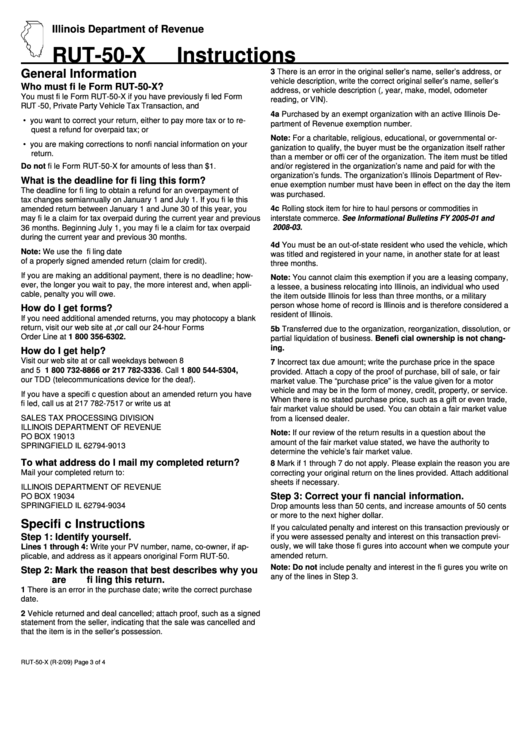

Instructions for Form Rut50x Amended Private Party Vehicle Use Tax

Choose the correct version of the editable pdf form. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form rut 50 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★. A tax form (available from il sos offices) if the.

Tax Form Rut50 Printable Printable World Holiday

This editor allows anyone to fill out this form. Web the bill of sale. Complete the required boxes that are colored in yellow. Engaged parties names, addresses and. Web add the rut 50 form illinois for editing.

Top Illinois Form Rut50 Templates free to download in PDF format

Or if you purchased a passenger car from an unregistered. Click on the new document option above, then drag and drop the document to the upload area, import it from the cloud, or via a link. Web find the illinois rut 50 printable forms you require. In other words, you should file this form if you purchased. Complete the required.

Top Illinois Form Rut50 Templates free to download in PDF format

Or if you purchased a passenger car from an unregistered. This editor allows anyone to fill out this form. Web tax form rut 50 is a tax form that helps you find the right forms. Choose the correct version of the editable pdf form. Web find the illinois rut 50 printable forms you require.

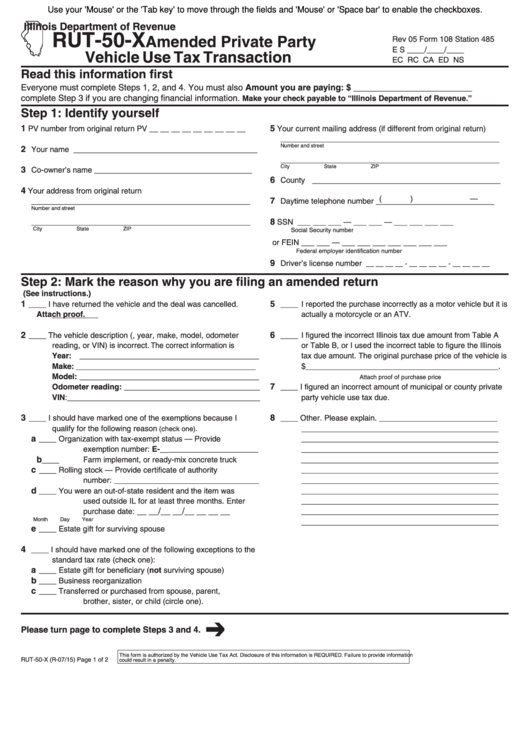

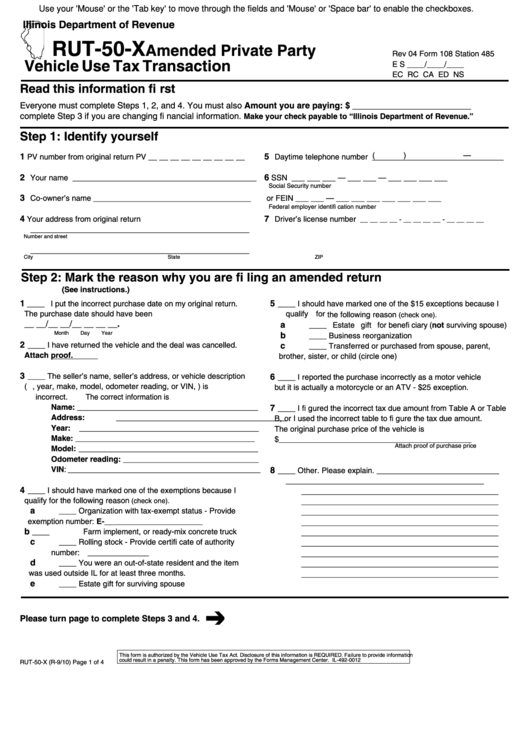

Fillable Form Rut50X Amended Private Party Vehicle Use Tax

Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form rut 50 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★. Click on the new document option above, then drag and drop the document to the upload area, import it.

Fillable Form Rut49 Vehicle Transaction Affidavit 2010 printable

Hitting the orange button down below will bring up our pdf tool. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form rut 50 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★. Web the illinois department of revenue dec..

Complete The Required Boxes That Are Colored In Yellow.

Click on the new document option above, then drag and drop the document to the upload area, import it from the cloud, or via a link. If arecentlypurchasedvehiclehasnot been titled or registered in this state,. Web find and fill out the correct illinois rut 50 form pdf. Web the bill of sale.

Web Find The Illinois Rut 50 Printable Forms You Require.

Web add the rut 50 form illinois for editing. Web the illinois department of revenue dec. Hit the green arrow with the inscription next to. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form rut 50 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★.

Or If You Purchased A Passenger Car From An Unregistered.

Hitting the orange button down below will bring up our pdf tool. Web tax form rut 50 is a tax form that helps you find the right forms. One of these forms must be presented with a separate tax payment made out to the illinois department of. Choose the correct version of the editable pdf form.

If You Need To Obtain The Forms Prior To.

A tax form (available from il sos offices) if the vehicle has been registered for less than 3 months: This editor allows anyone to fill out this form. Engaged parties names, addresses and. In other words, you should file this form if you purchased.