How To Fill Out Form 8862 On Turbotax

How To Fill Out Form 8862 On Turbotax - Web irs form 8862 (information to claim certain credits after disallowance) must be included with your tax return if you have previously been denied the earned. Web when you're done in turbotax, you'll need to print out form 8962 and mail or fax it to the irs, along with any other items requested in their letter (irs letter 0012c). Web stick to these simple steps to get irs 8862 completely ready for submitting: Search for 8862 and select the link to go to the section. How it works open the form 8862 pdf and follow the instructions easily sign the irs form 8862 with your finger. Web how do i file an irs extension (form 4868) in turbotax online? Check the box (es) that applies. Open the form in the online editor. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Web taxpayers complete form 8862 and attach it to their tax return if:

Complete, edit or print tax forms instantly. Web stick to these simple steps to get irs 8862 completely ready for submitting: Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web enter the year for which you are filing this form to claim the credit (s) (for example, 2022). Here are a few tips that will help you fill in the needed information. Answer the questions accordingly, and we’ll include form 8862 with your. Open the form in the online editor. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Web taxpayers complete form 8862 and attach it to their tax return if: Web you can fill turbotax form 2106 by entering your details in the two given parts of the form.

Web how do i file an irs extension (form 4868) in turbotax online? Open the form in the online editor. Web it’s easy to do in turbotax. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Here are a few tips that will help you fill in the needed information. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Answer the questions accordingly, and we’ll include form 8862 with your. Find the sample you want in our collection of legal templates. Web when you're done in turbotax, you'll need to print out form 8962 and mail or fax it to the irs, along with any other items requested in their letter (irs letter 0012c). Max refund is guaranteed and 100% accurate.

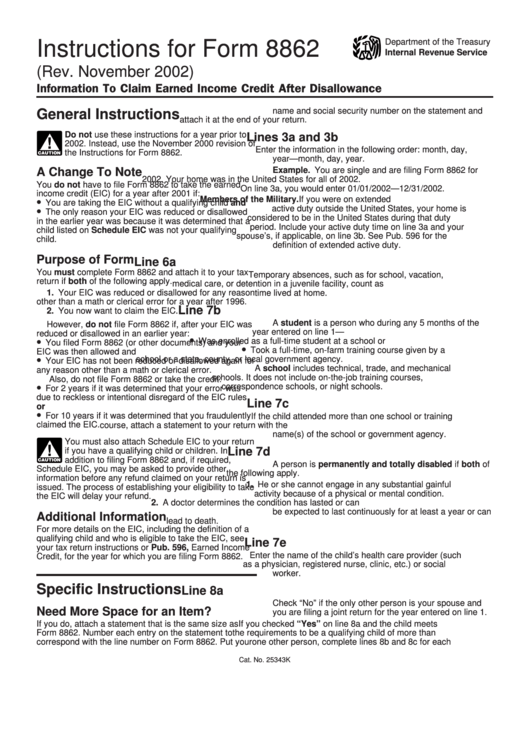

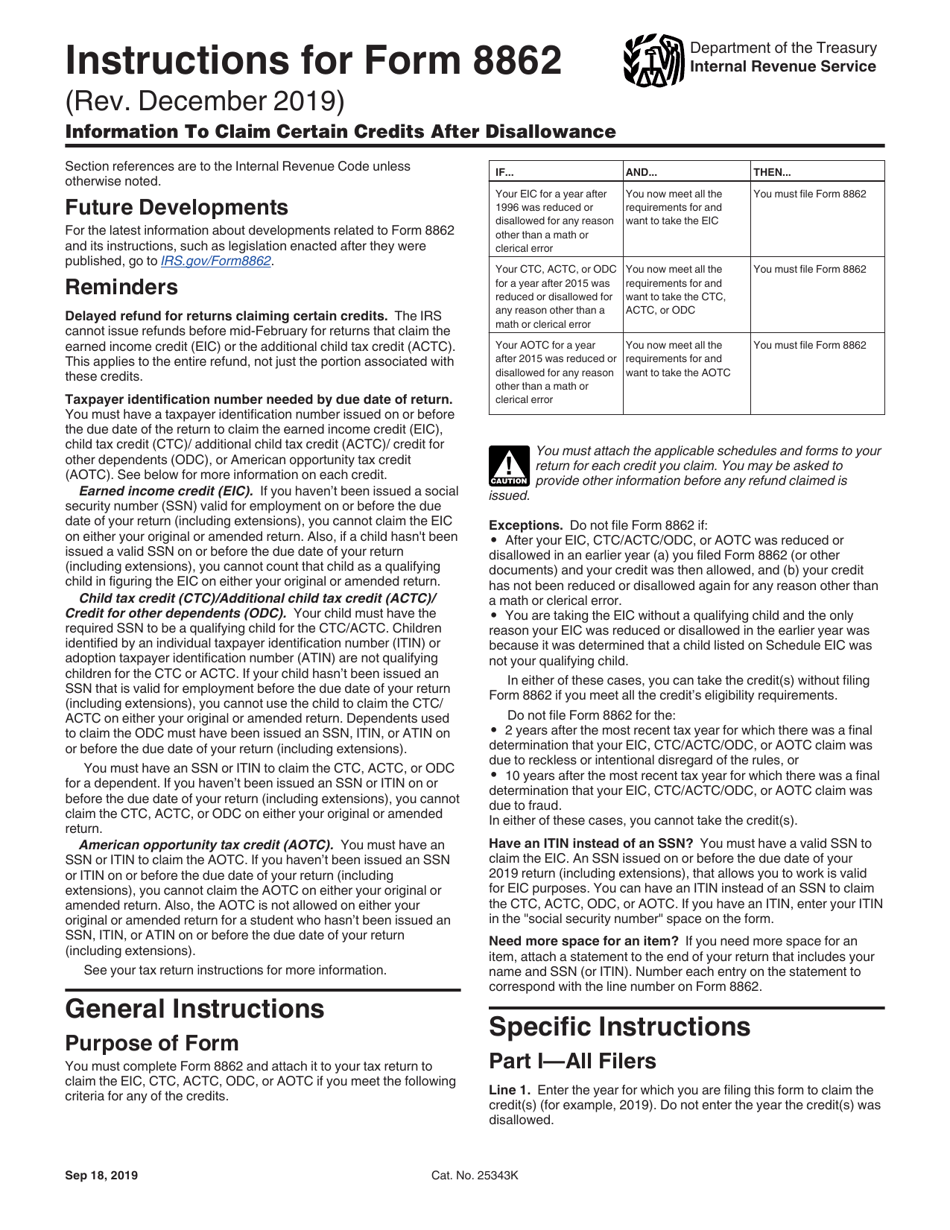

Instructions For Form 8862 Information To Claim Earned Credit

Web taxpayers complete form 8862 and attach it to their tax return if: Information to claim earned income credit after disallowance to your return. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc,.

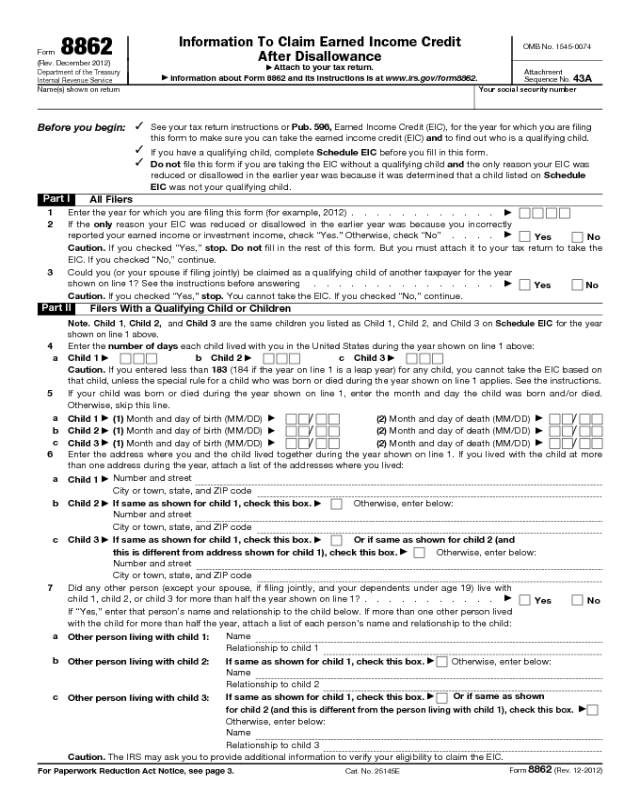

What Does Form 8862 Look Like Fill Online, Printable, Fillable, Blank

Web how do i file an irs extension (form 4868) in turbotax online? Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Web 1 best answer andreac1 level 9 you can use the steps below to help you get to where to fill.

Form 8862 Edit, Fill, Sign Online Handypdf

File an extension in turbotax online before the deadline to avoid a late filing penalty. Web you can fill turbotax form 2106 by entering your details in the two given parts of the form. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their.

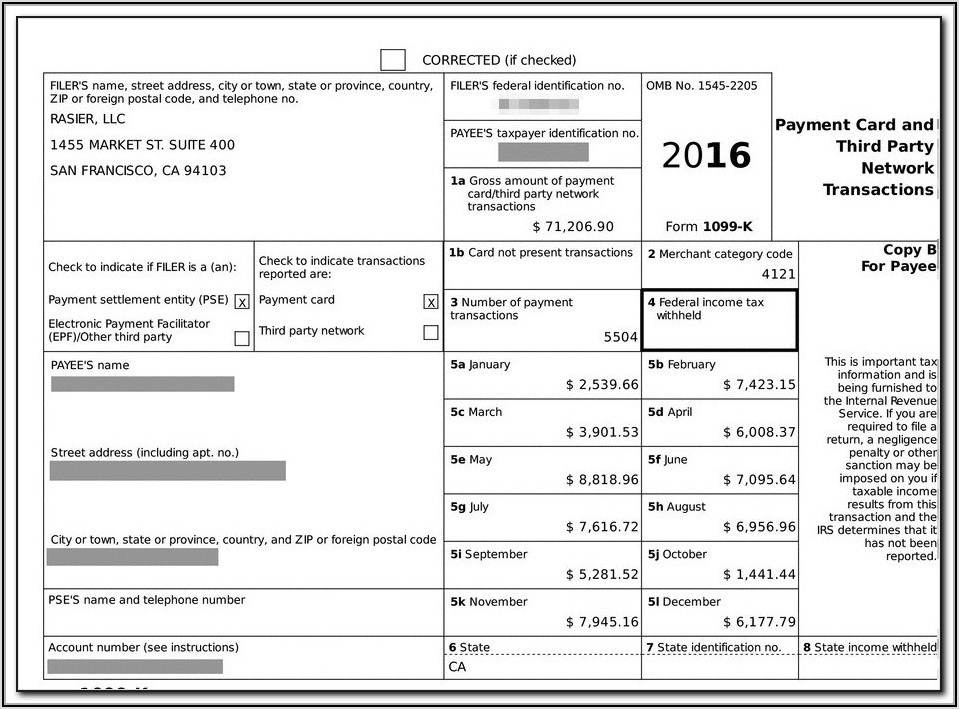

Turbotax 1099 Quick Employer Forms Form Resume Examples 3q9JaRZ2Ar

Do not enter the year the credit (s) was disallowed. Web show details we are not affiliated with any brand or entity on this form. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Web 1 best answer andreac1 level 9 you can use.

Re When will form 8915E 2020 be available in tur... Page 19

Knott 11.4k subscribers join subscribe 4k views 1 year ago #childtaxcredit if you had a child tax credit (ctc) disallowed in a prior year, you likely received an irs cp79. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Ad pay $0 to file all federal tax returns, no upgrades, 100% accurate! Here are a few.

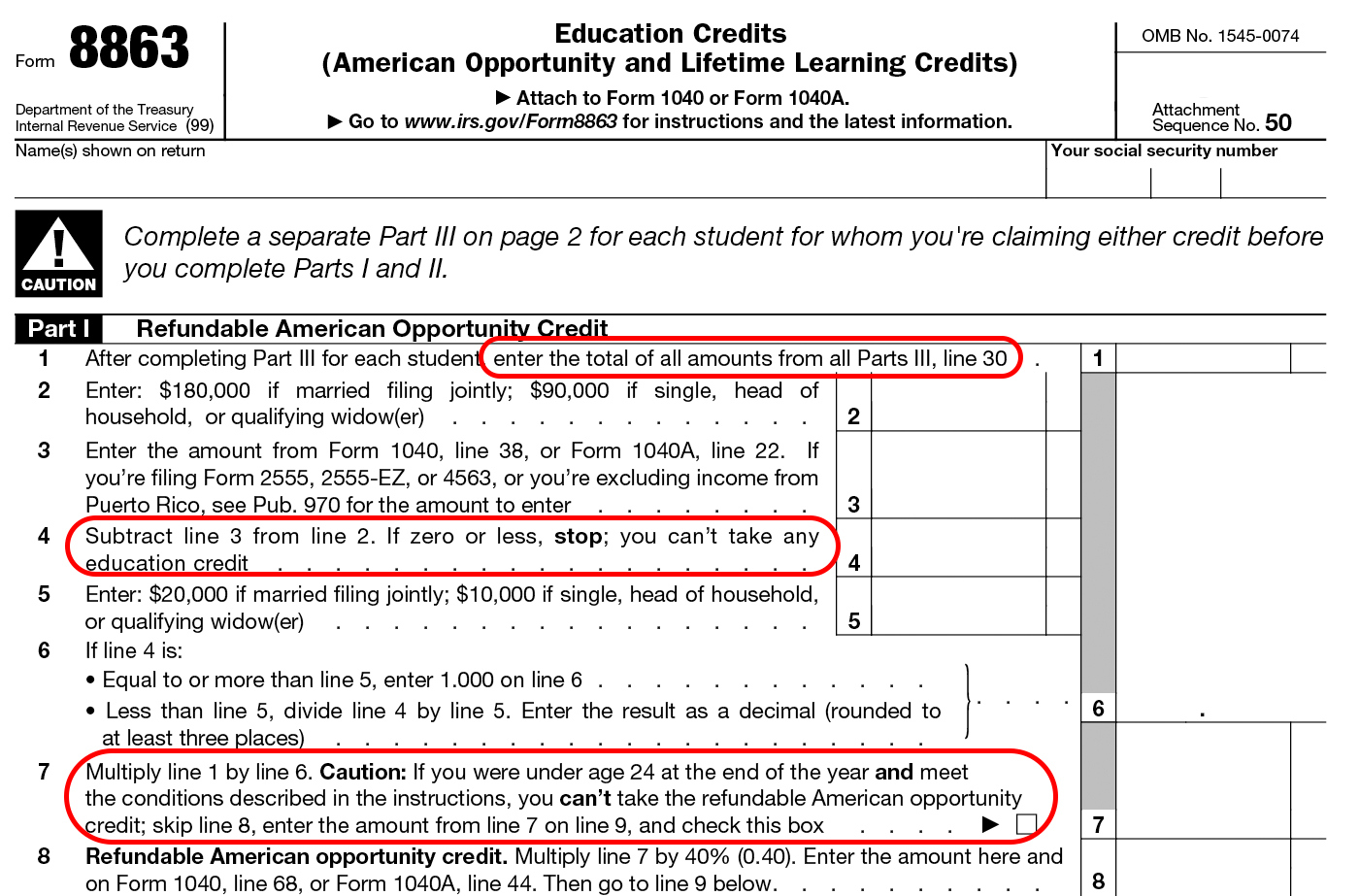

Form 8863 Instructions Information On The Education 1040 Form Printable

Web 1 best answer andreac1 level 9 you can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. Web taxpayers complete form 8862 and attach it to their tax return if: Web you must complete form 8862 and attach it to your tax return to.

2022 Form IRS 8862 Fill Online, Printable, Fillable, Blank pdfFiller

It is meant for tax filers who cannot get the full amount of credit using. Search for 8862 and select the link to go to the section. Answer the questions accordingly, and we’ll include form 8862 with your. Web how do i file an irs extension (form 4868) in turbotax online? How it works open the form 8862 pdf and.

Download Instructions for IRS Form 8862 Information to Claim Certain

Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. It is meant for tax filers who cannot get the full amount of credit using. Here are a few tips that will help you fill in the needed information. Web how do i file an.

What is Form 8862? TurboTax Support Video YouTube

Ad complete irs tax forms online or print government tax documents. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits. Find the sample you want in our collection of legal templates. Here are a few tips that will help you fill in.

Form 8862Information to Claim Earned Credit for Disallowance

Web you can fill turbotax form 2106 by entering your details in the two given parts of the form. Information to claim earned income credit after disallowance to your return. Knott 11.4k subscribers join subscribe 4k views 1 year ago #childtaxcredit if you had a child tax credit (ctc) disallowed in a prior year, you likely received an irs cp79..

Ad Complete Irs Tax Forms Online Or Print Government Tax Documents.

Web enter the year for which you are filing this form to claim the credit (s) (for example, 2022). Answer the questions accordingly, and we’ll include form 8862 with your. Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. Complete, edit or print tax forms instantly.

Web Stick To These Simple Steps To Get Irs 8862 Completely Ready For Submitting:

Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Ad pay $0 to file all federal tax returns, no upgrades, 100% accurate! Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Web you can fill turbotax form 2106 by entering your details in the two given parts of the form.

Knott 11.4K Subscribers Join Subscribe 4K Views 1 Year Ago #Childtaxcredit If You Had A Child Tax Credit (Ctc) Disallowed In A Prior Year, You Likely Received An Irs Cp79.

Web taxpayers complete form 8862 and attach it to their tax return if: Check the box (es) that applies. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits. Information to claim earned income credit after disallowance to your return.

Search For 8862 And Select The Link To Go To The Section.

Web show details we are not affiliated with any brand or entity on this form. Web 1 best answer christyw new member you'll need to add form 8862: Web how do i file an irs extension (form 4868) in turbotax online? Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.