Instructions Form 1099

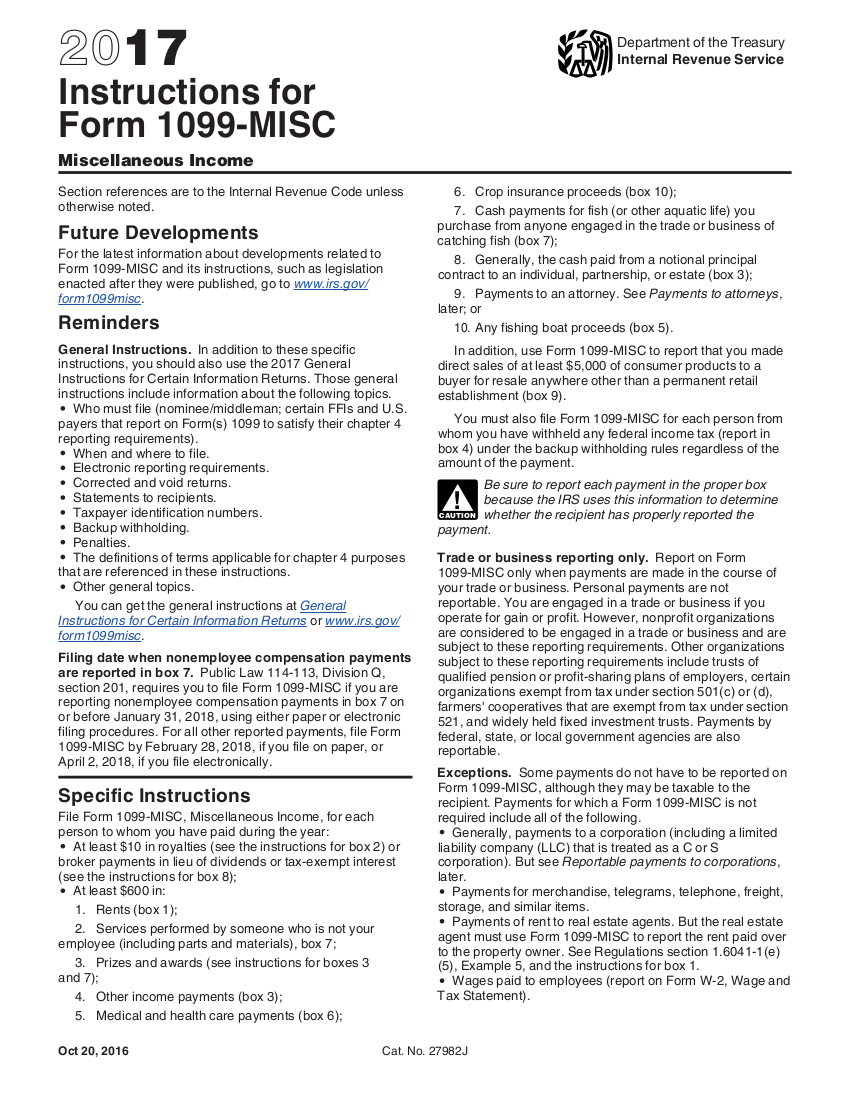

Instructions Form 1099 - It reflects information that is reported to the irs and is designed to assist you. The general instructions for certain information returns contain broad information concerning forms 1097,. Web in this article, we will discuss form 1099 instructions in detail, including what the form is, how to fill it out, and the penalties if you miss submitting it to the irs. There are instructions on the back of the forms with information regarding why you received them, what. Web the 1099 is an information form, not a tax return, and there are different versions that cover a wide spectrum of payment situations. Online pdf fillable copies b. Postal mail recipient copies by mail or online. Web where do i report the information on a 1099 form? Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. Volume based pricing for high volume filers.

Web irs instructions for each type of 1099 form include 1099 rules for filing and types of transactions or information to include. There are instructions on the back of the forms with information regarding why you received them, what. Web up to $32 cash back here’s what you need: Web a 1099 form, also called an information return, is a document sent to you by an entity that paid you certain types of income throughout the tax year. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Volume based pricing for high volume filers. Online pdf fillable copies b. It reflects information that is reported to the irs and is designed to assist you. Web in this article, we will discuss form 1099 instructions in detail, including what the form is, how to fill it out, and the penalties if you miss submitting it to the irs.

Web the 1099 is an information form, not a tax return, and there are different versions that cover a wide spectrum of payment situations. Online pdf fillable copies b. Postal mail recipient copies by mail or online. There are instructions on the back of the forms with information regarding why you received them, what. Volume based pricing for high volume filers. Web irs instructions for each type of 1099 form include 1099 rules for filing and types of transactions or information to include. Web about general instructions for certain information returns. Both the form and instructions. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the.

Free download 1099 form free download pdf

You might receive this form if. Web about general instructions for certain information returns. Volume based pricing for high volume filers. Postal mail recipient copies by mail or online. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations.

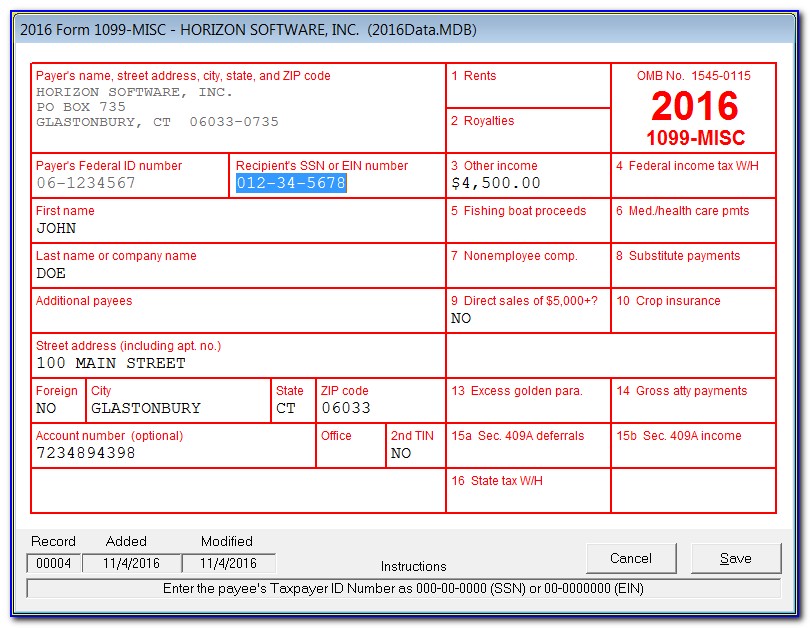

Irs 1099 Template 2016 Beautiful Form 1099 R Instructions Awesome Form

Web about general instructions for certain information returns. Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. Web in this article, we will discuss form 1099 instructions in detail, including what the form is, how to fill it out, and the penalties.

Instructions For Form 1099 Div Blank Sample to Fill out Online in PDF

Postal mail recipient copies by mail or online. Web the 1099 is an information form, not a tax return, and there are different versions that cover a wide spectrum of payment situations. Web a 1099 form, also called an information return, is a document sent to you by an entity that paid you certain types of income throughout the tax.

Inst 1099 General InstructionsGeneral Instructions for Forms 1099, 1…

Web the consolidated form 1099 is the collection of all applicable forms 1099 merged into one document. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web the 1099 is an information form, not a tax return, and there are different versions that cover a wide spectrum of payment situations. Volume based pricing.

1099 form independent contractor Fill Online, Printable, Fillable

Postal mail recipient copies by mail or online. Web in this article, we will discuss form 1099 instructions in detail, including what the form is, how to fill it out, and the penalties if you miss submitting it to the irs. Web about general instructions for certain information returns. Ad ap leaders rely on iofm’s expertise to keep them up.

1099 (2017) Instructions Edit Forms Online PDFFormPro

Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. Postal mail recipient copies by mail or online. Web where do i report the information on a 1099 form? Web up to $32 cash back here’s what you need: Web about general instructions.

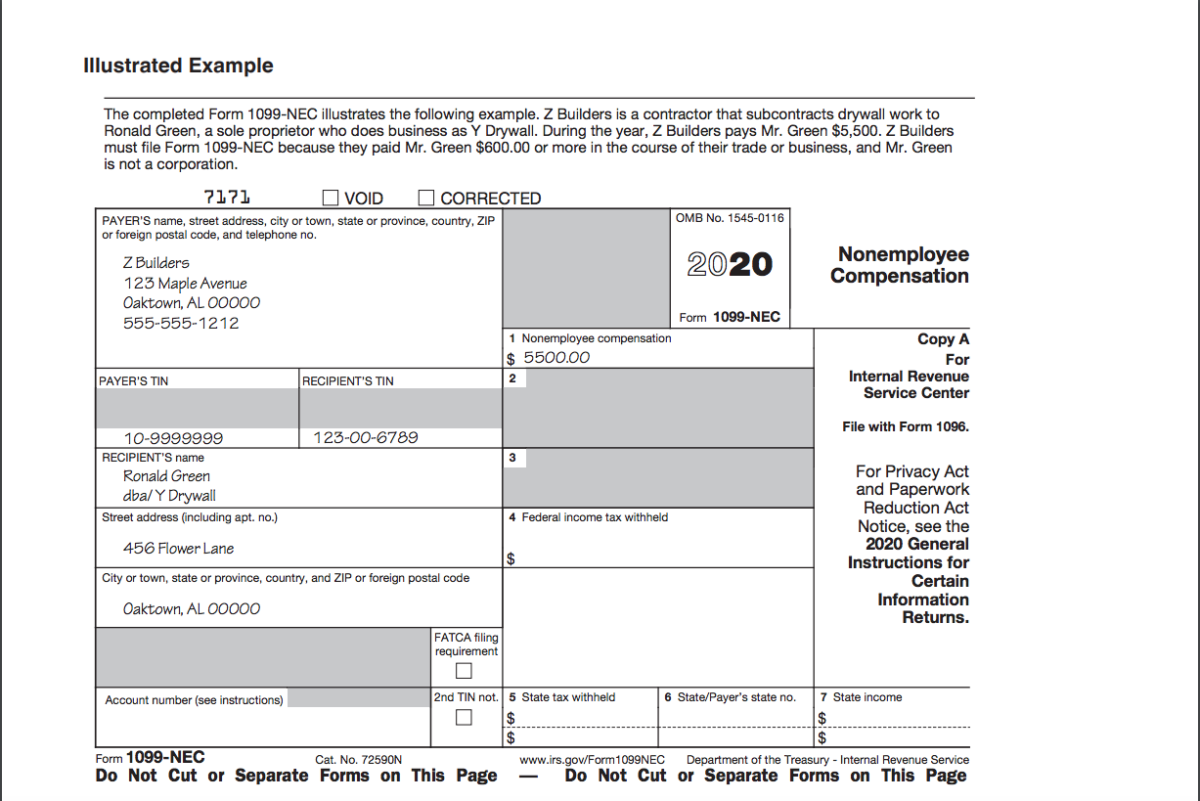

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Both the form and instructions. Online pdf fillable copies b. It reflects information that is reported to the irs and is designed to assist you. Web where do i report the information on a 1099 form? You might receive this form if.

Example Of Non Ssa 1099 Form / Publication 915 (2020), Social Security

Online pdf fillable copies b. Web the 1099 is an information form, not a tax return, and there are different versions that cover a wide spectrum of payment situations. Web in this article, we will discuss form 1099 instructions in detail, including what the form is, how to fill it out, and the penalties if you miss submitting it to.

Form 1099NEC Instructions and Tax Reporting Guide

There are instructions on the back of the forms with information regarding why you received them, what. Web in this article, we will discuss form 1099 instructions in detail, including what the form is, how to fill it out, and the penalties if you miss submitting it to the irs. The general instructions for certain information returns contain broad information.

Introducing the New 1099NEC for Reporting Nonemployee Compensation

Postal mail recipient copies by mail or online. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web the consolidated form 1099 is the collection of all applicable forms 1099 merged into one document. Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to.

Online Pdf Fillable Copies B.

Web in this article, we will discuss form 1099 instructions in detail, including what the form is, how to fill it out, and the penalties if you miss submitting it to the irs. Web the consolidated form 1099 is the collection of all applicable forms 1099 merged into one document. The general instructions for certain information returns contain broad information concerning forms 1097,. Web about general instructions for certain information returns.

Web Where Do I Report The Information On A 1099 Form?

It reflects information that is reported to the irs and is designed to assist you. Web irs instructions for each type of 1099 form include 1099 rules for filing and types of transactions or information to include. Web the 1099 is an information form, not a tax return, and there are different versions that cover a wide spectrum of payment situations. Web a 1099 form, also called an information return, is a document sent to you by an entity that paid you certain types of income throughout the tax year.

Volume Based Pricing For High Volume Filers.

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Both the form and instructions. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Postal mail recipient copies by mail or online.

Web Contractors Are Often Known As 1099 Employees, As Businesses Use The 1099 Tax Form To Report Payments To The Internal Revenue Service (Irs).² Contractors Use The.

Web up to $32 cash back here’s what you need: You might receive this form if. There are instructions on the back of the forms with information regarding why you received them, what.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://formswift.com/seo-pages-assets/images/1099-forms/image-8-box3-2x.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)