Irs Form 7200 For 2022

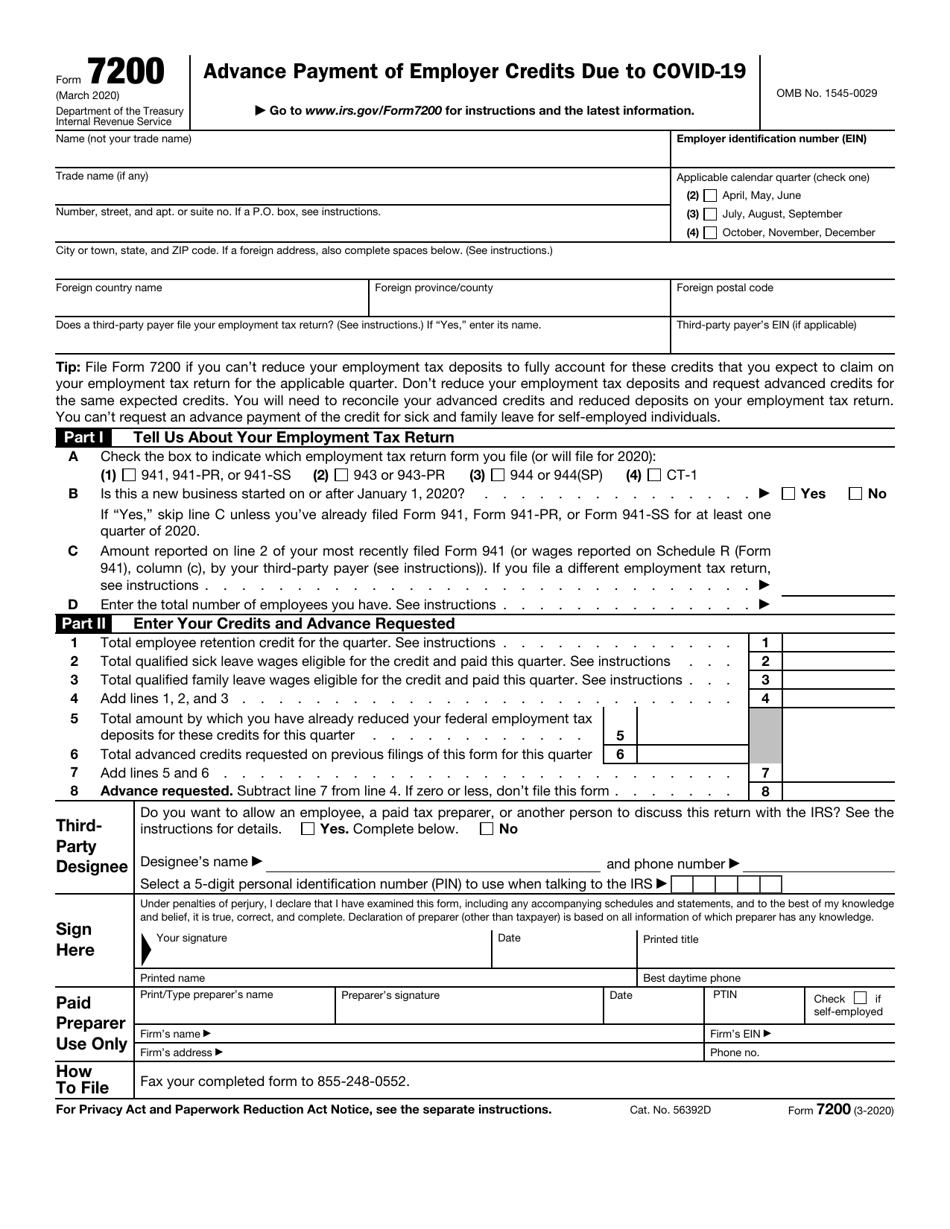

Irs Form 7200 For 2022 - Web the last day to file form 7200 to request an advance payment for the fourth quarter of 2021 is january 31, 2022. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web get started what is form 7200? The advance and credits must be reported on the employment tax return and remember to provide a. Almost every form and publication has a page on irs.gov with a friendly shortcut. Web file form 7200 if you can’t reduce your employment tax deposits to fully account for these credits that you expect to claim on your employment tax return for the applicable quarter. A guide to the 7200 for the rest of 2021. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web form 7200 is an official document issued by the irs in 2020 to request advance payment of employer credits due to the coronavirus pandemic. The document is a final tax return for an.

Web get started what is form 7200? Stephanie glanville | august 6, 2021 | read time: Web form 7200 guidelines in 2022. Web payroll tax returns. Web 7/26/2022 new updates changes in printable form the printable 7200 is used to report a deceased individual's final income tax return. A guide to the 7200 for the rest of 2021. The last day to file form 7200, advance payment of employer credits due to. “also use the form to notify the irs if you did not receive schedule. The document is a final tax return for an. Form 7200 remains on irs.gov only as a historical item at.

Form 7200 covers claims on different. Web payroll tax returns. The advance and credits must be reported on the employment tax return and remember to provide a. Web yes, you can! Stephanie glanville | august 6, 2021 | read time: The instructions for the 8082 say on page 1: Do not file form 7200 after january 31, 2022. Web if you have requested or received funds previously, report it on the form 7200. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web for tax year 2022, please see the 2022 instructions.

IRS Form 7200 LinebyLine Instructions 2022 How to Fill out and File

Web individuals and families. Almost every form and publication has a page on irs.gov with a friendly shortcut. Web if the employer's employment tax deposits are not sufficient to cover the credit, the employer may receive an advance payment from the irs by submitting form. Web instructions, and pubs is at irs.gov/forms. Web payroll tax returns.

IRS Guidance on Form 7200 Sick and Family Leave Tax Credits Blog

Web instructions, and pubs is at irs.gov/forms. Use form 7200 to request an advance payment of the tax credits for qualified sick and qualified family leave wages and the employee retention. Form 7200 remains on irs.gov only as a historical item at. Web file form 7200 if you can’t reduce your employment tax deposits to fully account for these credits.

How to Find out if You Qualify for the ERC Expense To Profit

“also use the form to notify the irs if you did not receive schedule. Web individuals and families. Use form 7200 to request an advance payment of the tax credits for qualified sick and qualified family leave wages and the employee retention. Check out 100+ free tutorials in the. Those returns are processed in.

Avoid These Common Mistakes When Filing Your IRS Form 7200 Blog

Do not file form 7200 after january 31, 2022. Taxpayers filing a form 941, employer's quarterly federal tax return, may submit a form 7200, advance payment of employer credits due to. Web employers were able to take the credit by filing irs form 7200 to request a payment, or by reducing federal employment tax deposits by any erc amount for.

The IRS Released An Updated Form 7200 for Tax Year 2021 Blog TaxBandits

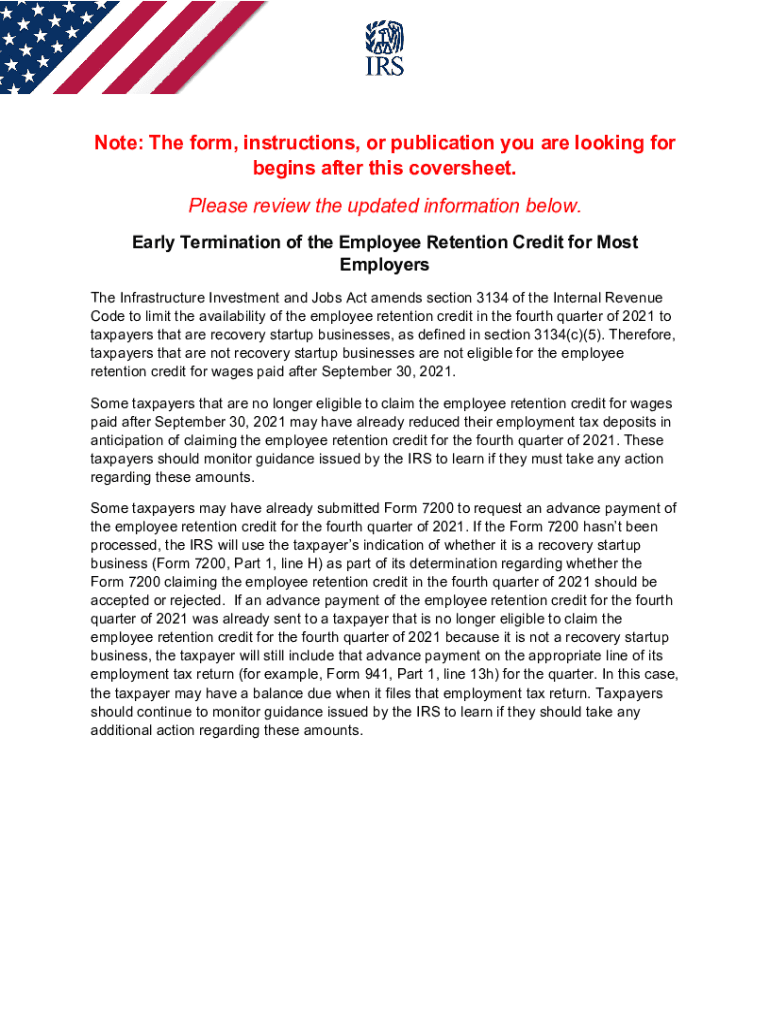

Form 7200 remains on irs.gov only as a historical item at. Web get started what is form 7200? Web 7/26/2022 new updates changes in printable form the printable 7200 is used to report a deceased individual's final income tax return. Web form 7200 guidelines in 2022. Web early termination of the employee retention credit, retaining employment tax deposits in anticipation.

IRS Form 7200 Download Fillable PDF or Fill Online Advance Payment of

Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web individuals and families. Web if you have requested or received funds previously, report it on the form 7200. The last date to file form 7200 is the same whether you file. Web form 7200 guidelines in 2022.

IRS Form 7200 Instructions A Detailed Explanation Guide

Web the irs will continue to accept and process valid forms 7200 during this time, and the payment of valid requests during this time will begin to be processed on. Irs form 7200 allows employers to request an advanced payment of their employee retention credit. Web get started what is form 7200? As of july 13, 2023, the irs had.

IRS Form 7200 2022 IRS Forms

Check out 100+ free tutorials in the. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. The instructions for the 8082 say on page 1: Form 7200 remains on irs.gov only as a historical item at. Web the last day to file form 7200 to request an advance payment for the fourth.

Form 7200 Instructions 2022 StepbyStep TaxRobot

Web form 7200 is an official document issued by the irs in 2020 to request advance payment of employer credits due to the coronavirus pandemic. Do not file form 7200 after january 31, 2022. The last date to file form 7200 is the same whether you file. Form 7200 covers claims on different. The advance and credits must be reported.

2021 Form IRS Instructions 7200 Fill Online, Printable, Fillable, Blank

Web last day to file form 7200. The last date to file form 7200 is the same whether you file. Web for tax year 2022, please see the 2022 instructions. Almost every form and publication has a page on irs.gov with a friendly shortcut. The instructions for the 8082 say on page 1:

Web Instructions, And Pubs Is At Irs.gov/Forms.

The advance and credits must be reported on the employment tax return and remember to provide a. Web last day to file form 7200. The document is a final tax return for an. Web early termination of the employee retention credit, retaining employment tax deposits in anticipation of credits, shut down of the fax line and helpful form.

Web Or Go To Irs.gov/Employmenttaxes.

Web form 7200 is an official document issued by the irs in 2020 to request advance payment of employer credits due to the coronavirus pandemic. Irs form 7200 allows employers to request an advanced payment of their employee retention credit. Form 7200 covers claims on different. The last date to file form 7200 is the same whether you file.

Watch Now And See More Below.

Since april 15 falls on a saturday, and emancipation day. Web get started what is form 7200? As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Do not file form 7200 after january 31, 2022.

For Example, The Form 1040 Page Is At.

Web 7/26/2022 new updates changes in printable form the printable 7200 is used to report a deceased individual's final income tax return. The last day to file form 7200, advance payment of employer credits due to. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web the last day to file form 7200 to request an advance payment for the fourth quarter of 2021 is january 31, 2022.