K 1 Form For Ira Account

K 1 Form For Ira Account - Complete, edit or print tax forms instantly. Most likely, yes, you can file it away and keep it with your tax records. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Depending on the investment, your retirement plan. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. (for shareholder's use only) section references are to. Ending / / partner’s share of income,. Complete, edit or print tax forms instantly.

Complete, edit or print tax forms instantly. Web if you want to move funds from a 401(k), 457(b), 403(b), or tsp account to a gold ira, the process is called a gold ira rollover. You only need to complete column a for unrelated business. So, if you retired at. Complete, edit or print tax forms instantly. In most cases, you can only roll over funds when. Ending / / partner’s share of income,. Web the national average savings account rate was just 0.52% as of july 17, according to bankrate. For calendar year 2022, or tax year beginning / / 2022. Web enter a description of the activity in line h.

For calendar year 2022, or tax year beginning / / 2022. So, if you retired at. Most likely, yes, you can file it away and keep it with your tax records. Web if you want to move funds from a 401(k), 457(b), 403(b), or tsp account to a gold ira, the process is called a gold ira rollover. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Depending on the investment, your retirement plan. In most cases, you can only roll over funds when. (for shareholder's use only) section references are to.

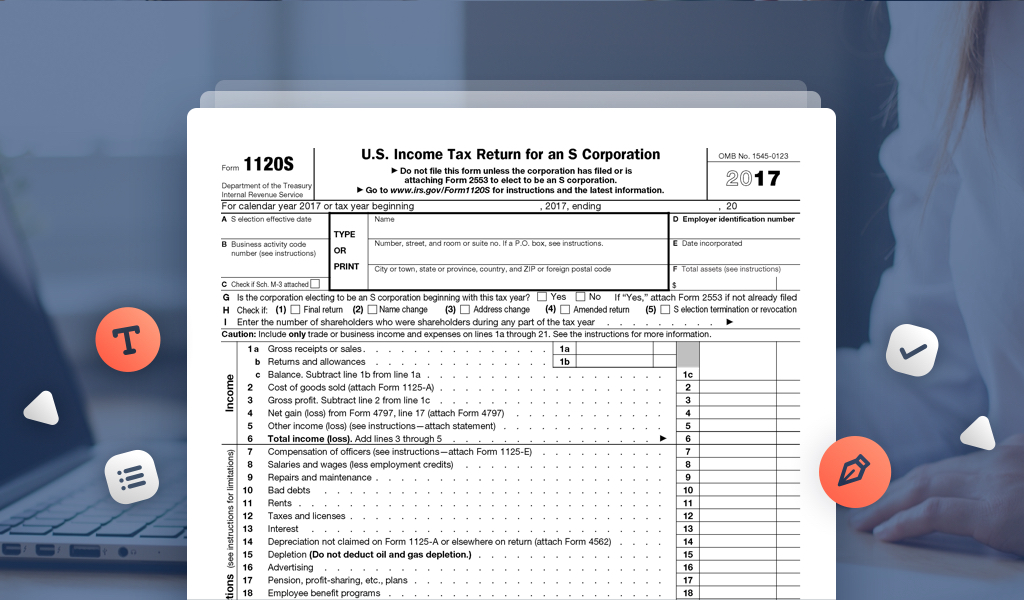

Don’t Miss the Deadline for Reporting Your Shareholding with

Ending / / partner’s share of income,. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Most likely, yes, you can file it away and keep it with your tax records. Web enter a description of the activity in line h.

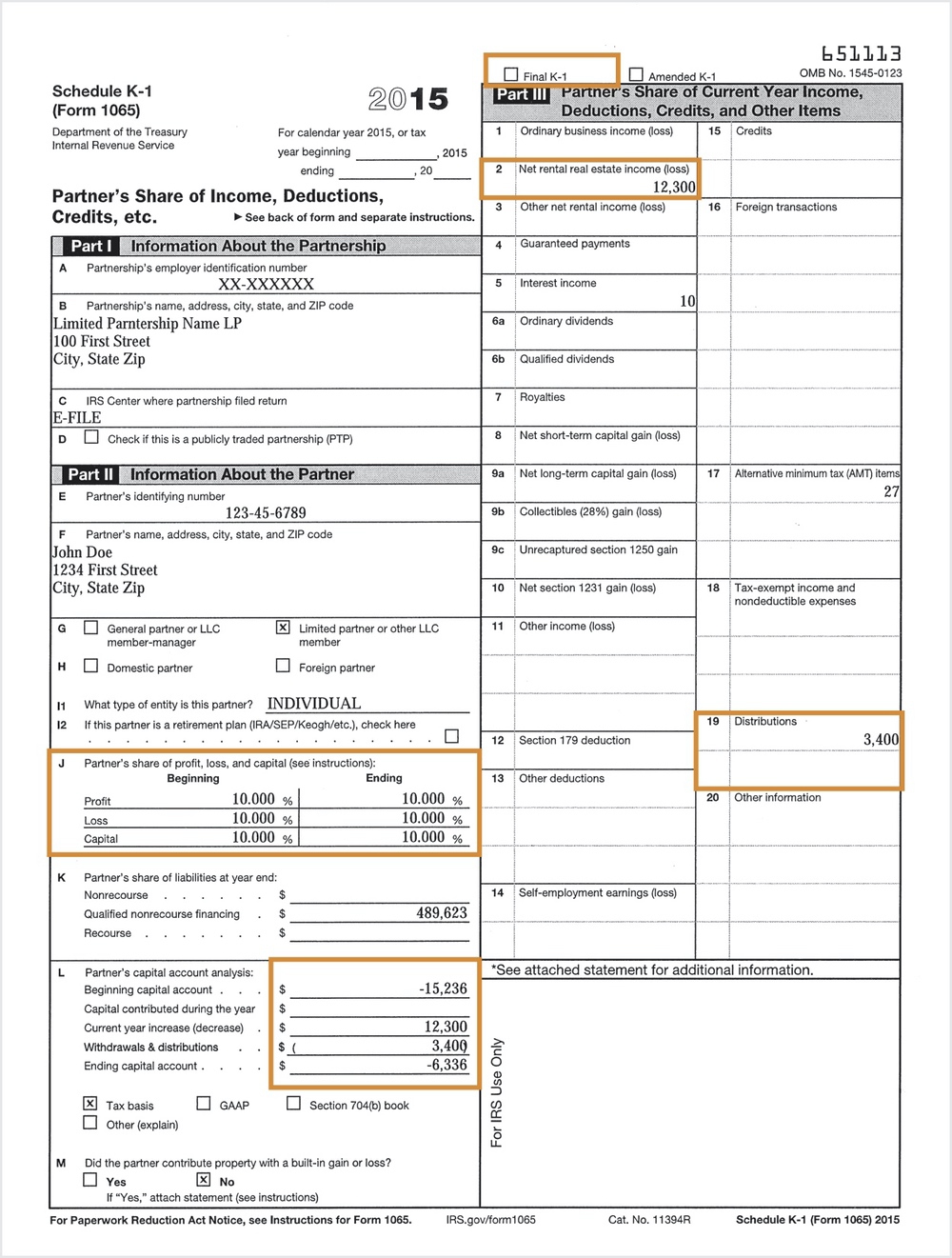

Schedule K1 / 1065 Tax Form Guide LP Equity

You only need to complete column a for unrelated business. Depending on the investment, your retirement plan. Ad access irs tax forms. Ending / / partner’s share of income,. Ad access irs tax forms.

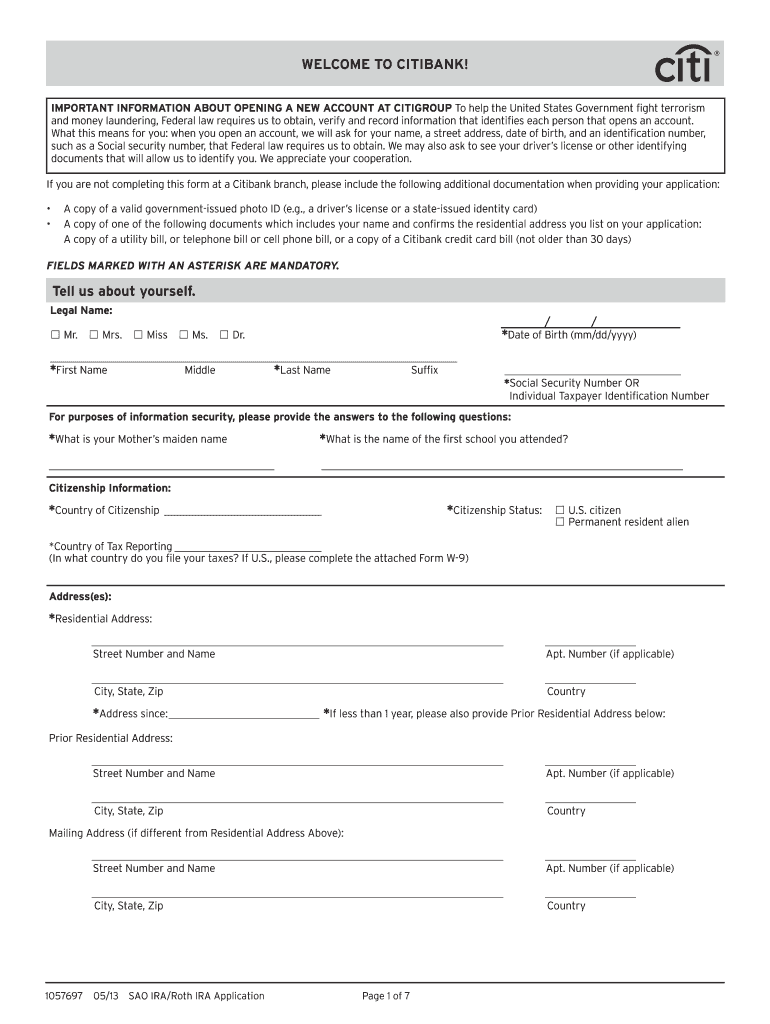

Citibank Ira Withdrawal Form Fill Online, Printable, Fillable, Blank

Most likely, yes, you can file it away and keep it with your tax records. Depending on the investment, your retirement plan. Complete, edit or print tax forms instantly. Department of the treasury internal revenue service. For calendar year 2022, or tax year beginning / / 2022.

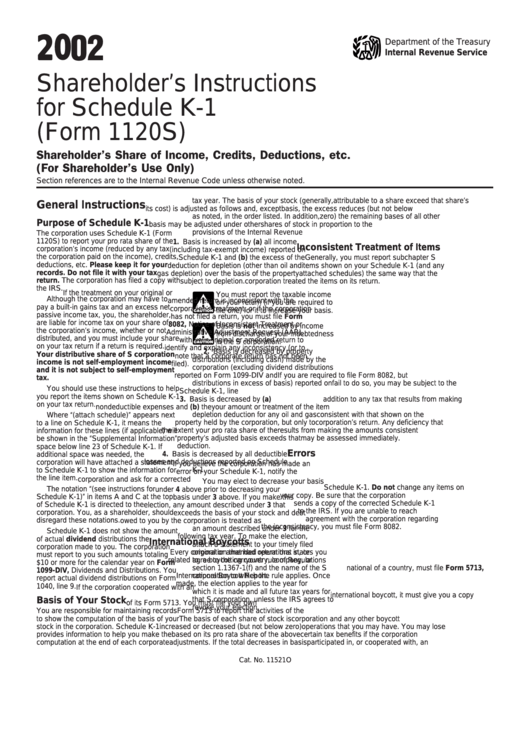

Form K1 1065 Instructions Ethel Hernandez's Templates

Web the national average savings account rate was just 0.52% as of july 17, according to bankrate. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. In most cases, you can only roll over funds when. For calendar year 2022, or tax year beginning / / 2022.

Schedule K1 Tax Form What Is It and Who Needs to Know? mojafarma

Ad access irs tax forms. Depending on the investment, your retirement plan. Complete, edit or print tax forms instantly. Most likely, yes, you can file it away and keep it with your tax records. Department of the treasury internal revenue service.

Traditional IRA Withdrawal Request All States PDF Withholding Tax

Ending / / partner’s share of income,. Ad access irs tax forms. Complete, edit or print tax forms instantly. Depending on the investment, your retirement plan. Most likely, yes, you can file it away and keep it with your tax records.

Schedule K1 Tax Form What Is It and Who Needs to Know? mojafarma

Ad access irs tax forms. Web if you want to move funds from a 401(k), 457(b), 403(b), or tsp account to a gold ira, the process is called a gold ira rollover. In most cases, you can only roll over funds when. Ending / / partner’s share of income,. Most likely, yes, you can file it away and keep it.

Instructions For Schedule K1 (Form 1120s) Shareholder'S Share Of

Get ready for tax season deadlines by completing any required tax forms today. Most likely, yes, you can file it away and keep it with your tax records. (for shareholder's use only) section references are to. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

Box 14 Code A Of Irs Schedule K1 (form 1065) Fafsa Armando Friend's

Complete, edit or print tax forms instantly. Ad access irs tax forms. So, if you retired at. In most cases, you can only roll over funds when. Complete, edit or print tax forms instantly.

K1 Form Basics to Help You Meet the Tax Deadline The TurboTax Blog

Complete, edit or print tax forms instantly. You only need to complete column a for unrelated business. Ad access irs tax forms. Most likely, yes, you can file it away and keep it with your tax records. Web if you want to move funds from a 401(k), 457(b), 403(b), or tsp account to a gold ira, the process is called.

Web The National Average Savings Account Rate Was Just 0.52% As Of July 17, According To Bankrate.

Complete, edit or print tax forms instantly. You only need to complete column a for unrelated business. (for shareholder's use only) section references are to. Web one of the most simple and effective formulas says you'll need 10 to 12 times the amount of money you made in your final year before retirement.

Ad Access Irs Tax Forms.

In most cases, you can only roll over funds when. Get ready for tax season deadlines by completing any required tax forms today. Department of the treasury internal revenue service. For calendar year 2022, or tax year beginning / / 2022.

So, If You Retired At.

Ending / / partner’s share of income,. Complete, edit or print tax forms instantly. Web enter a description of the activity in line h. Depending on the investment, your retirement plan.

Most Likely, Yes, You Can File It Away And Keep It With Your Tax Records.

Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web if you want to move funds from a 401(k), 457(b), 403(b), or tsp account to a gold ira, the process is called a gold ira rollover.