Nj Tax Exempt Form St-3

Nj Tax Exempt Form St-3 - Web seller should read and comply with the instructions given on both sides of an exemption certificate. To collect state of new jersey sales and use tax. Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction. Web 30 rows sales and use tax: Web the purchaser certifies that it is exempt from payment of the sales and use tax on purchases to be made from the seller because the property or service is to be used for. Web completed new jersey exemption certificate. Web the materials, supplies, or services purchased by the undersigned are for exclusive use in erecting structures, or building on, or otherwise improving, altering or repairing real. (1) he holds a valid certificate of authority (number shown above) to collect state of new jersey sales. Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt.

Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction. Web the materials, supplies, or services purchased by the undersigned are for exclusive use in erecting structures, or building on, or otherwise improving, altering or repairing real. Web completed new jersey exemption certificate. Used for tax exemption on production machinery and packaging supplies A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Web the purchaser certifies that it is exempt from payment of the sales and use tax on purchases to be made from the seller because the property or service is to be used for. (1) he holds a valid certificate of authority (number shown above) to collect state of new jersey sales. Web 30 rows sales and use tax: Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction. Web seller should read and comply with the instructions given on both sides of an exemption certificate.

Web the purchaser certifies that it is exempt from payment of the sales and use tax on purchases to be made from the seller because the property or service is to be used for. Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction. To collect state of new jersey sales and use tax. Web the materials, supplies, or services purchased by the undersigned are for exclusive use in erecting structures, or building on, or otherwise improving, altering or repairing real. Used for tax exemption on production machinery and packaging supplies Web completed new jersey exemption certificate. Web 30 rows sales and use tax: (1) he holds a valid certificate of authority (number shown above) to collect state of new jersey sales. Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt.

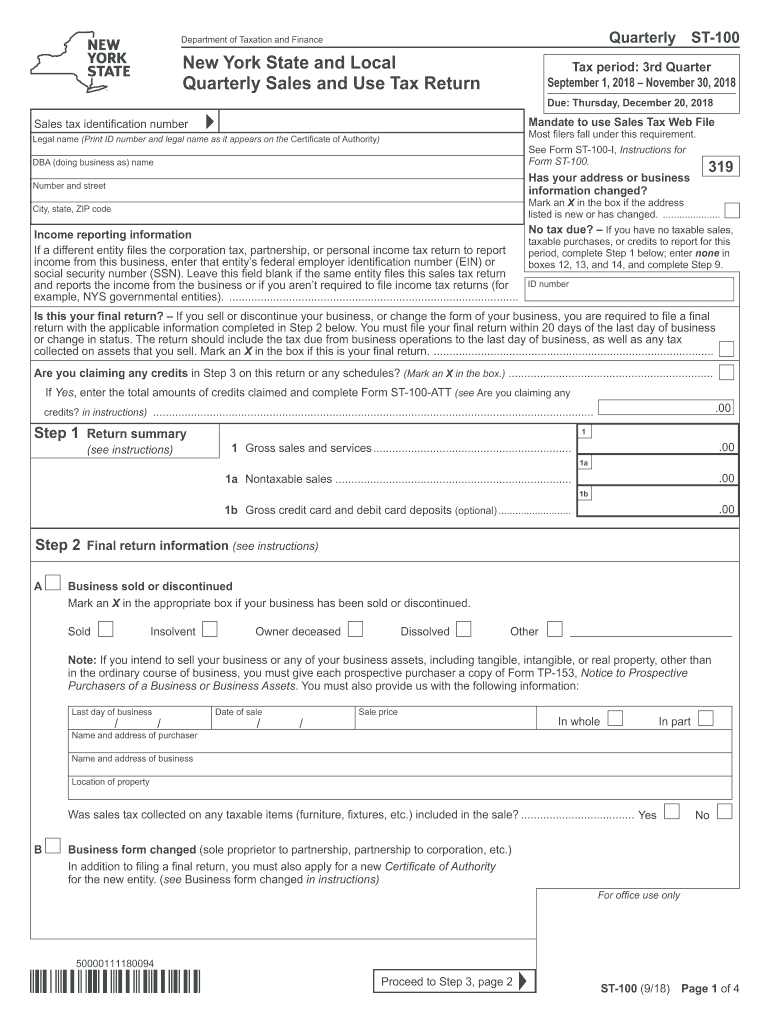

2018 Form NY DTF ST100 Fill Online, Printable, Fillable, Blank pdfFiller

To collect state of new jersey sales and use tax. Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction. Web the purchaser certifies that it is exempt from payment of the sales and use tax on purchases to be made from the seller because the property or service is to be used.

1337 Nj Tax Forms And Templates free to download in PDF

Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction. Web 30 rows sales and use tax: A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Name the seller of the merchandise, enter the seller's address, and the actual date.

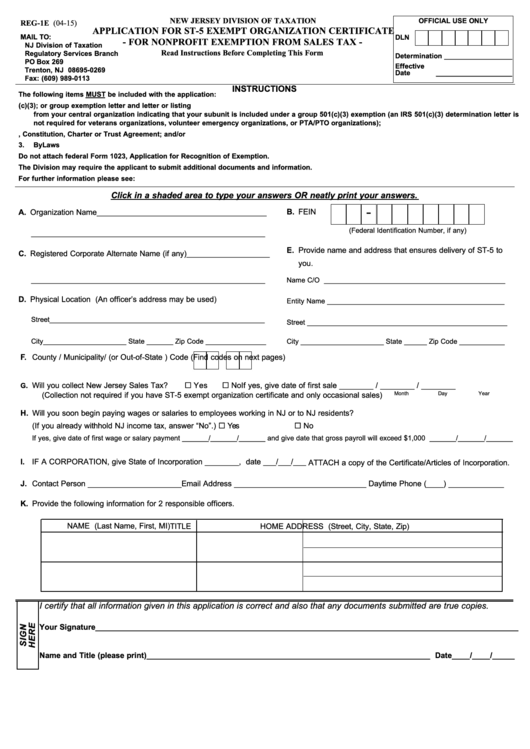

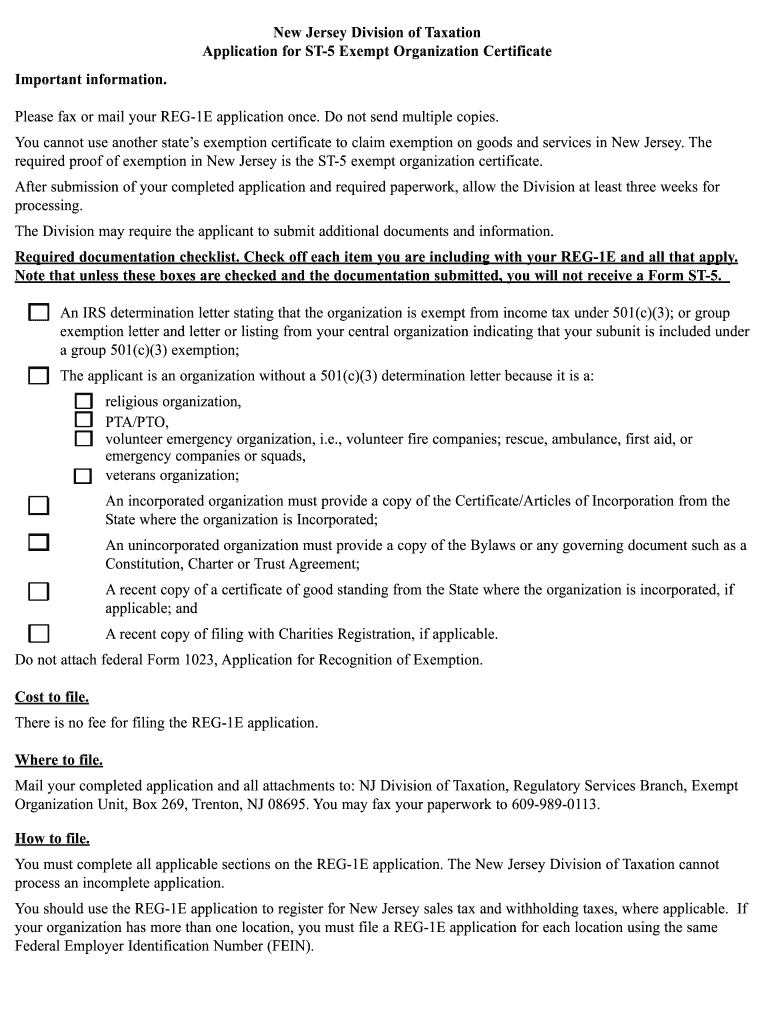

Fillable Form Reg1e Application For St5 Exempt Organization

Web the materials, supplies, or services purchased by the undersigned are for exclusive use in erecting structures, or building on, or otherwise improving, altering or repairing real. Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction. Web the purchaser certifies that it is exempt from payment of the sales and use tax.

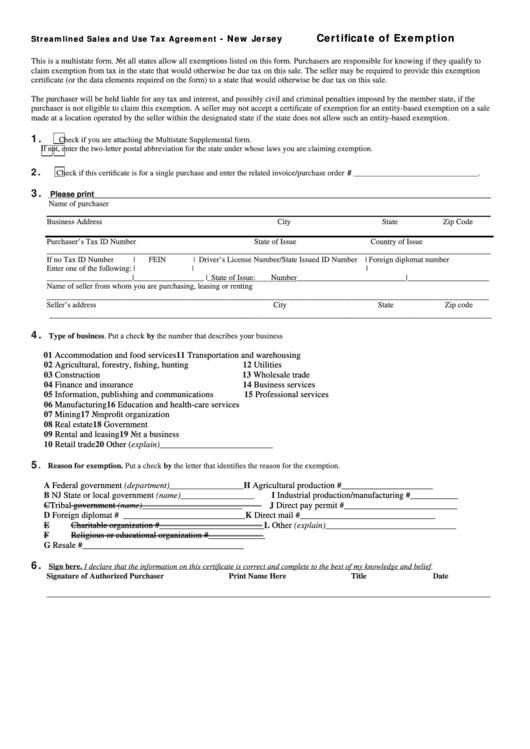

Fillable Streamlined Sales And Use Tax Agreement New Jersey

Web the purchaser certifies that it is exempt from payment of the sales and use tax on purchases to be made from the seller because the property or service is to be used for. Web seller should read and comply with the instructions given on both sides of an exemption certificate. (1) he holds a valid certificate of authority (number.

Nj Tax Exempt Form St 5 Fill Online, Printable, Fillable, Blank

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Used for tax exemption on production machinery and packaging supplies To collect state of new jersey sales and use tax. Web 30 rows sales and use tax: Web the purchaser certifies that it is exempt from payment of.

20162021 Form NJ REG1E Fill Online, Printable, Fillable, Blank

To collect state of new jersey sales and use tax. Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. (1) he holds a valid certificate of authority (number shown above).

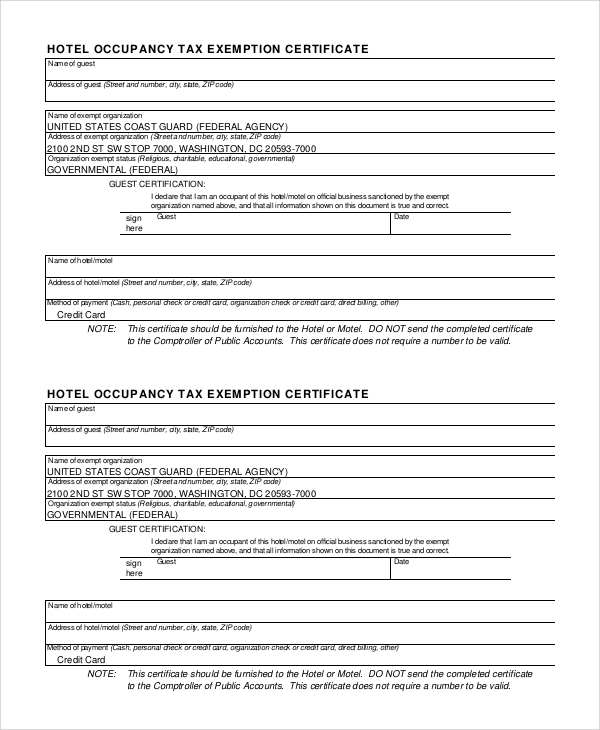

FREE 10+ Sample Tax Exemption Forms in PDF

Used for tax exemption on production machinery and packaging supplies A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. To collect state of new jersey sales and use tax. Web 30 rows sales and use tax: (1) he holds a valid certificate of authority (number shown above).

20172021 Form NJ DoT ST3 Fill Online, Printable, Fillable, Blank

To collect state of new jersey sales and use tax. Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction. Web the materials, supplies, or services purchased by the undersigned are for exclusive use in erecting structures, or building on, or otherwise improving, altering or repairing real. A sales tax exemption certificate can.

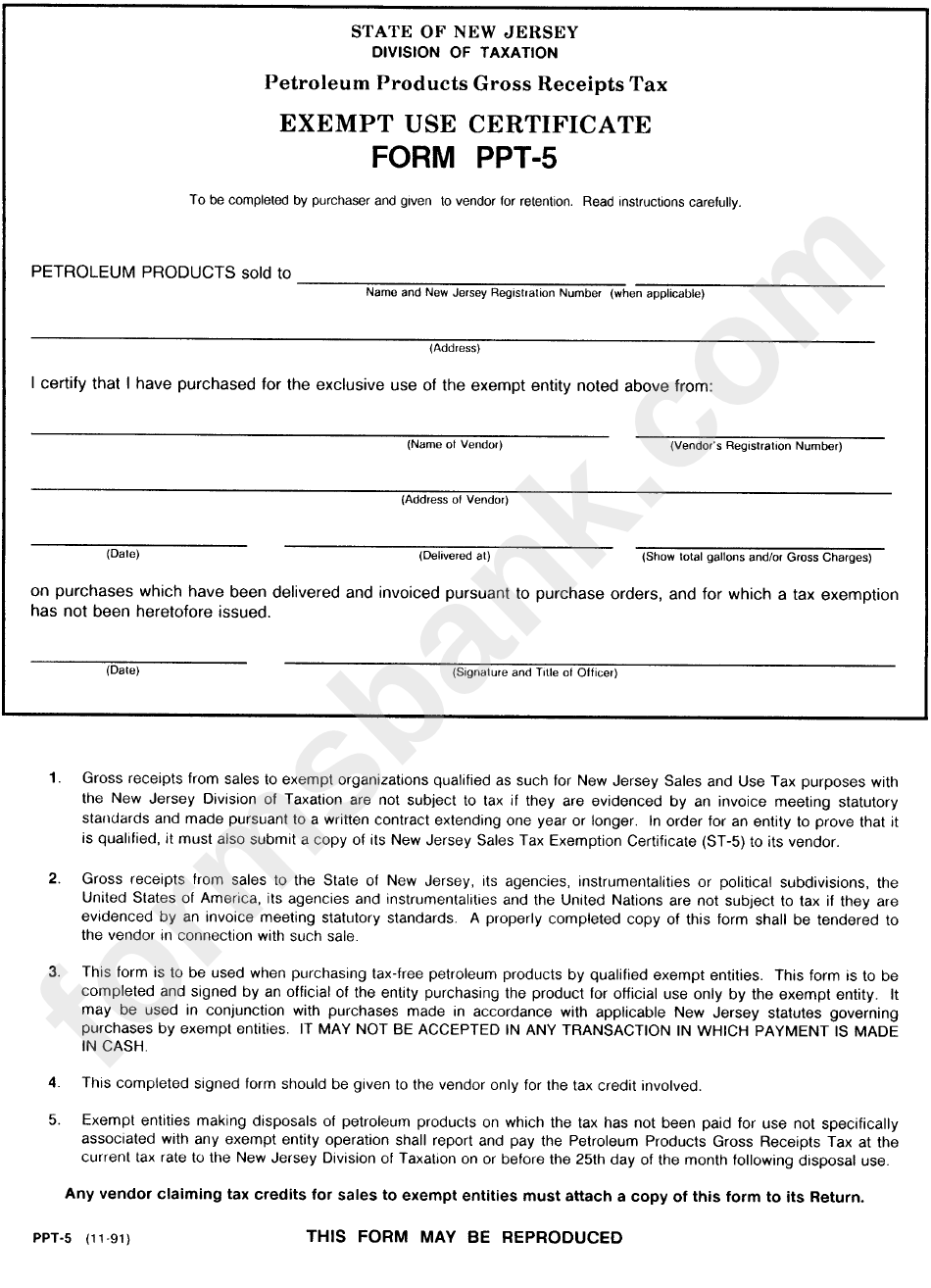

Form Ppt5 Exempt Use Certificate printable pdf download

(1) he holds a valid certificate of authority (number shown above) to collect state of new jersey sales. Web completed new jersey exemption certificate. Web seller should read and comply with the instructions given on both sides of an exemption certificate. Web 30 rows sales and use tax: Name the seller of the merchandise, enter the seller's address, and the.

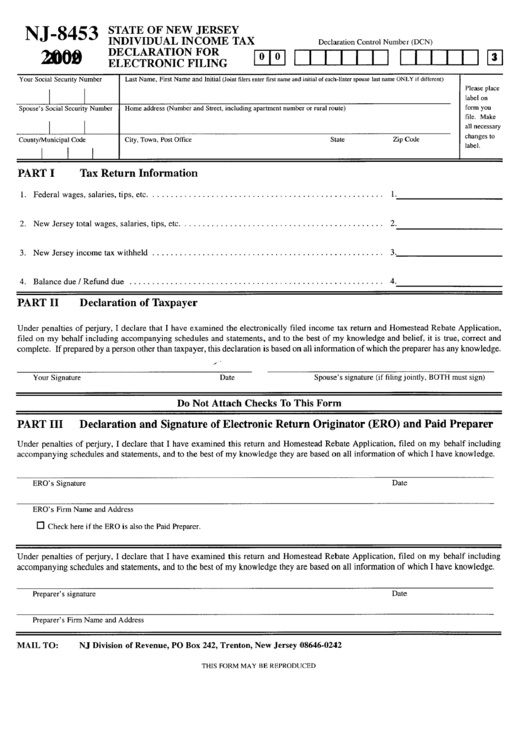

Form Nj8453 State Of New Jersey Individual Tax Declaration

Web completed new jersey exemption certificate. Web the purchaser certifies that it is exempt from payment of the sales and use tax on purchases to be made from the seller because the property or service is to be used for. Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction. A sales tax.

To Collect State Of New Jersey Sales And Use Tax.

Web the materials, supplies, or services purchased by the undersigned are for exclusive use in erecting structures, or building on, or otherwise improving, altering or repairing real. Web completed new jersey exemption certificate. (1) he holds a valid certificate of authority (number shown above) to collect state of new jersey sales. Web seller should read and comply with the instructions given on both sides of an exemption certificate.

Name The Seller Of The Merchandise, Enter The Seller's Address, And The Actual Date Of The Transaction.

Web 30 rows sales and use tax: Used for tax exemption on production machinery and packaging supplies Web the purchaser certifies that it is exempt from payment of the sales and use tax on purchases to be made from the seller because the property or service is to be used for. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt.