Schedule K 1 Form 1065 Instructions

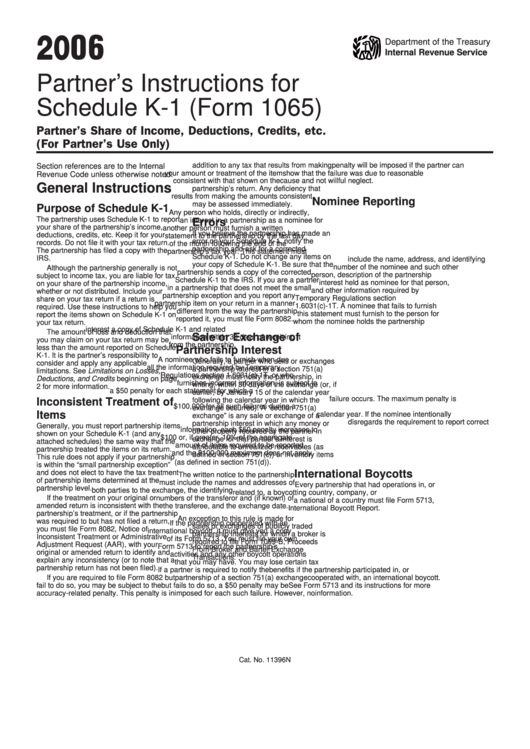

Schedule K 1 Form 1065 Instructions - For calendar year 2021, or tax year beginning / / 2021. Department of the treasury internal revenue service. Page numbers refer to this instruction. Sale or exchange of partnership interest; Report the amount as it is reported to you. Box 1 ordinary business income (loss): These instructions provide additional information specific to schedule k. Precontribution gain (loss) form 8949 and/or schedule d (form 1040); You can also reference these irs partnership instructions for additional information. Part i information about the partnership.

Box 1 ordinary business income (loss): For calendar year 2021, or tax year beginning / / 2021. Page numbers refer to this instruction. Electing large partnerships (elps) errors; These instructions provide additional information specific to schedule k. Department of the treasury internal revenue service. Precontribution gain (loss) form 8949 and/or schedule d (form 1040); Part i information about the partnership. Net operating losses aren't deductible by the members but may be carried back or forward by the organization under the rules of section 172. See back of form and separate instructions.

Electing large partnerships (elps) errors; Department of the treasury internal revenue service. Precontribution gain (loss) form 8949 and/or schedule d (form 1040); Net operating losses aren't deductible by the members but may be carried back or forward by the organization under the rules of section 172. These instructions provide additional information specific to schedule k. Report the amount as it is reported to you. See back of form and separate instructions. Part i information about the partnership. Page numbers refer to this instruction. Ending / / partner’s share of income, deductions, credits, etc.

What is a Schedule K1 Tax Form, Meru Accounting

Other information (continued) code w. For calendar year 2021, or tax year beginning / / 2021. Ending / / partner’s share of income, deductions, credits, etc. You can also reference these irs partnership instructions for additional information. Department of the treasury internal revenue service.

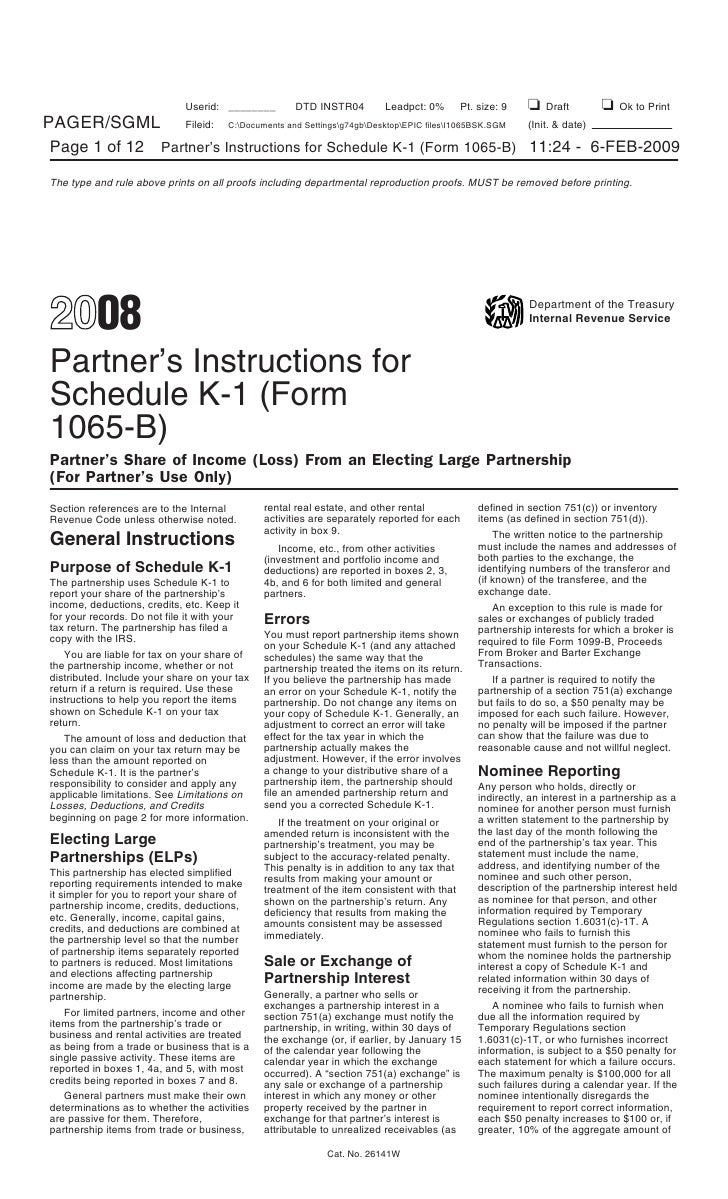

Inst 1065B (Schedule K1)Instructions for Schedule K1 (Form 1065B…

Part i information about the partnership. These instructions provide additional information specific to schedule k. Sale or exchange of partnership interest; Ending / / partner’s share of income, deductions, credits, etc. Electing large partnerships (elps) errors;

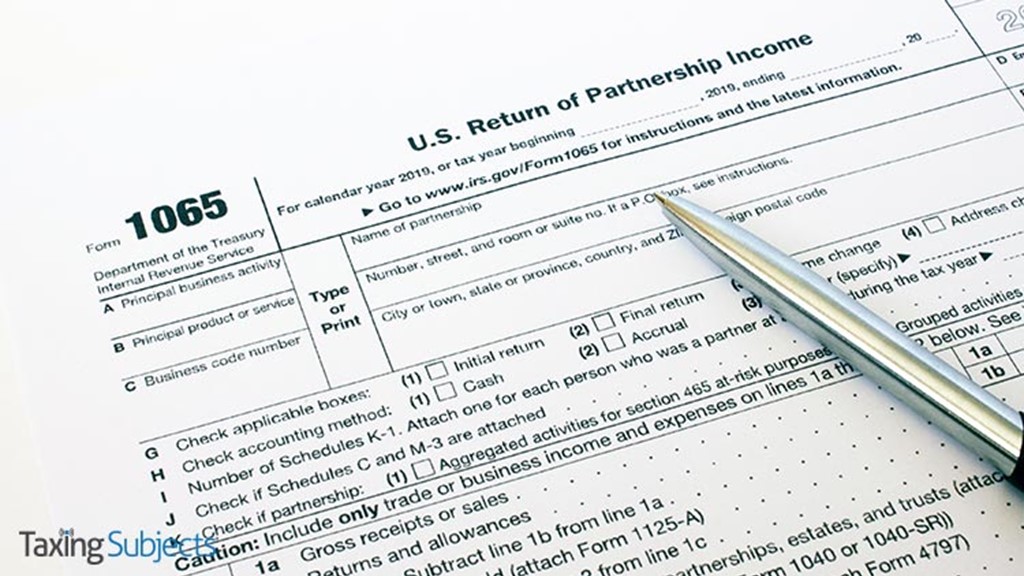

Llc Tax Form 1065 Universal Network

Report the amount as it is reported to you. Page numbers refer to this instruction. Sale or exchange of partnership interest; See back of form and separate instructions. Box 1 ordinary business income (loss):

Inst 1065B (Schedule K1)Instructions for Schedule K1 (Form 1065B…

Box 1 ordinary business income (loss): See back of form and separate instructions. Other information (continued) code w. Precontribution gain (loss) form 8949 and/or schedule d (form 1040); For calendar year 2021, or tax year beginning / / 2021.

Publication 541 Partnerships; Form 1065 Example

Part i information about the partnership. Department of the treasury internal revenue service. Page numbers refer to this instruction. Ending / / partner’s share of income, deductions, credits, etc. Sale or exchange of partnership interest;

Inst 1065B (Schedule K1)Instructions for Schedule K1 (Form 1065B…

For calendar year 2021, or tax year beginning / / 2021. You can also reference these irs partnership instructions for additional information. Net operating losses aren't deductible by the members but may be carried back or forward by the organization under the rules of section 172. Report the amount as it is reported to you. Ending / / partner’s share.

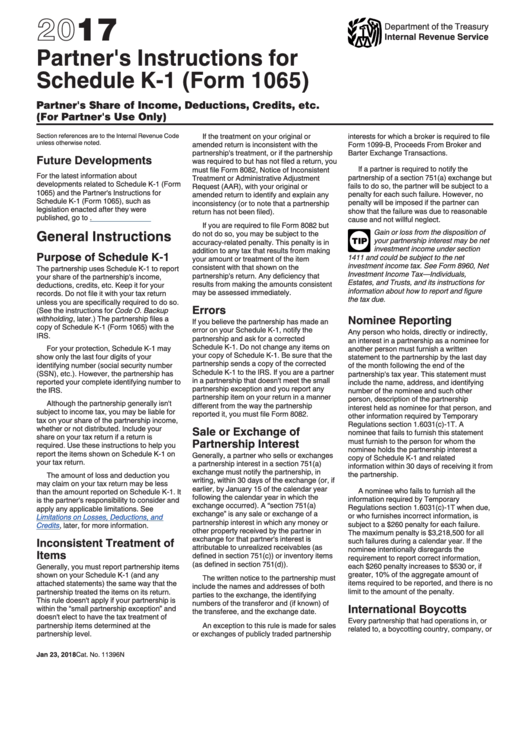

Instructions For Schedule K1 (Form 1065) Partner'S Share Of

Sale or exchange of partnership interest; These instructions provide additional information specific to schedule k. For calendar year 2021, or tax year beginning / / 2021. Page numbers refer to this instruction. Report the amount as it is reported to you.

schedule k1 Taxing Subjects

For calendar year 2021, or tax year beginning / / 2021. You can also reference these irs partnership instructions for additional information. Other information (continued) code w. Precontribution gain (loss) form 8949 and/or schedule d (form 1040); Report the amount as it is reported to you.

Instructions For Schedule K1 (Form 1065) Partner'S Share Of

Part i information about the partnership. Report the amount as it is reported to you. Other information (continued) code w. Page numbers refer to this instruction. These instructions provide additional information specific to schedule k.

Form 1065 (Schedule K1) Partner's Share of Deductions and

Ending / / partner’s share of income, deductions, credits, etc. These instructions provide additional information specific to schedule k. Report the amount as it is reported to you. For calendar year 2021, or tax year beginning / / 2021. Electing large partnerships (elps) errors;

Other Information (Continued) Code W.

Precontribution gain (loss) form 8949 and/or schedule d (form 1040); Department of the treasury internal revenue service. You can also reference these irs partnership instructions for additional information. Report the amount as it is reported to you.

Electing Large Partnerships (Elps) Errors;

Part i information about the partnership. These instructions provide additional information specific to schedule k. Ending / / partner’s share of income, deductions, credits, etc. Page numbers refer to this instruction.

See Back Of Form And Separate Instructions.

Net operating losses aren't deductible by the members but may be carried back or forward by the organization under the rules of section 172. For calendar year 2021, or tax year beginning / / 2021. Box 1 ordinary business income (loss): Sale or exchange of partnership interest;