Tax Form 6251

Tax Form 6251 - In order for wealthy individuals to pay their fair share of income tax, congress mandated an in 1969. It applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. The amt is a separate tax that is imposed in addition to your regular tax. The irs imposes the alternative minimum tax (amt) on certain taxpayers who earn a significant amount of income, but are able to eliminate most, if not all, income from taxation using deductions and credits. Web form 6251, “alternative minimum tax—individuals,” is a tax form that calculates whether you’re liable for paying the alternative minimum tax and if so, how much you should pay. Web form 6251 alternative minimum tax. The program calculates and prints form 6251, if it applies to the taxpayer's return. Web what happens to my tax credits? Although reducing your taxable income to zero is perfectly legal, the irs uses amt to insure everyone pays their fair share. It adds back various tax breaks you might have claimed on your form 1040 tax return, then determines your taxes owed.

The amt is a separate tax that is imposed in addition to your regular tax. Alternative minimum tax shows that your tentative minimum tax is less than your regular tax, you don't owe any amt, but you may still be affected by the amt in other ways. The program calculates and prints form 6251, if it applies to the taxpayer's return. It adds back various tax breaks you might have claimed on your form 1040 tax return, then determines your taxes owed. Web form 6251, “alternative minimum tax—individuals,” is a tax form that calculates whether you’re liable for paying the alternative minimum tax and if so, how much you should pay. Although reducing your taxable income to zero is perfectly legal, the irs uses amt to insure everyone pays their fair share. Web you enter a total negative adjustment of $118,000 on line 2k of your 2022 form 6251, figured as follows. It applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. If the calculation on form 6251: You figure a negative adjustment of $65,000 for the difference between the $65,000 of regular tax ordinary income and the $0 of amt ordinary income for the first sale.

Web you enter a total negative adjustment of $118,000 on line 2k of your 2022 form 6251, figured as follows. It applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. Web what happens to my tax credits? Although reducing your taxable income to zero is perfectly legal, the irs uses amt to insure everyone pays their fair share. Alternative minimum tax shows that your tentative minimum tax is less than your regular tax, you don't owe any amt, but you may still be affected by the amt in other ways. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). It adds back various tax breaks you might have claimed on your form 1040 tax return, then determines your taxes owed. Web form 6251 2022 alternative minimum tax—individuals department of the treasury internal revenue service go to www.irs.gov/form6251 for instructions and the latest information. You figure a negative adjustment of $65,000 for the difference between the $65,000 of regular tax ordinary income and the $0 of amt ordinary income for the first sale. If the calculation on form 6251:

Form 6251 Alternative Minimum Tax Individuals (2014) Free Download

It applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. Web irs form 6251, titled alternative minimum tax—individuals, determines how much alternative minimum tax (amt) you could owe. The program calculates and prints form 6251, if it applies to the taxpayer's return. Web form 6251 alternative.

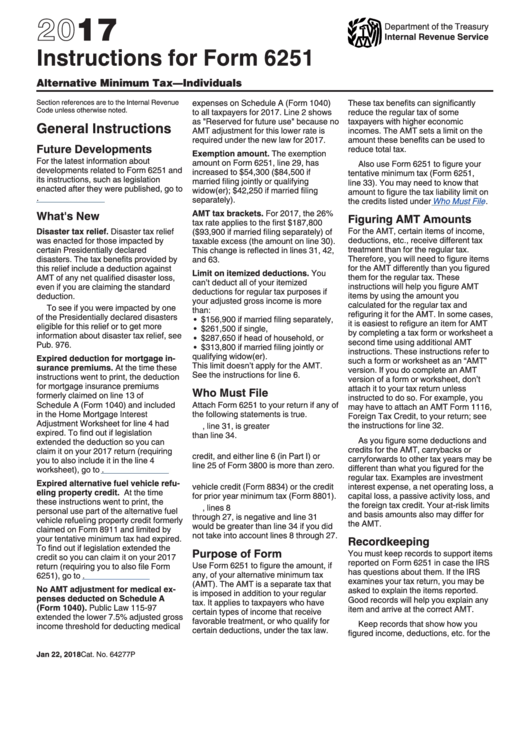

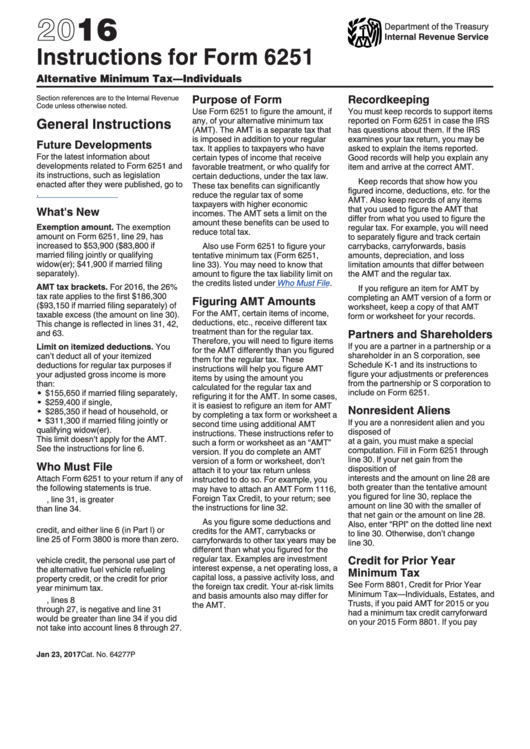

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2017

In order for wealthy individuals to pay their fair share of income tax, congress mandated an in 1969. Web form 6251 2022 alternative minimum tax—individuals department of the treasury internal revenue service go to www.irs.gov/form6251 for instructions and the latest information. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web you enter a.

Download Instructions for IRS Form 6251 Alternative Minimum Tax

1= force form 6251, 2= when applicable. Web form 6251, “alternative minimum tax—individuals,” is a tax form that calculates whether you’re liable for paying the alternative minimum tax and if so, how much you should pay. The amt applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax.

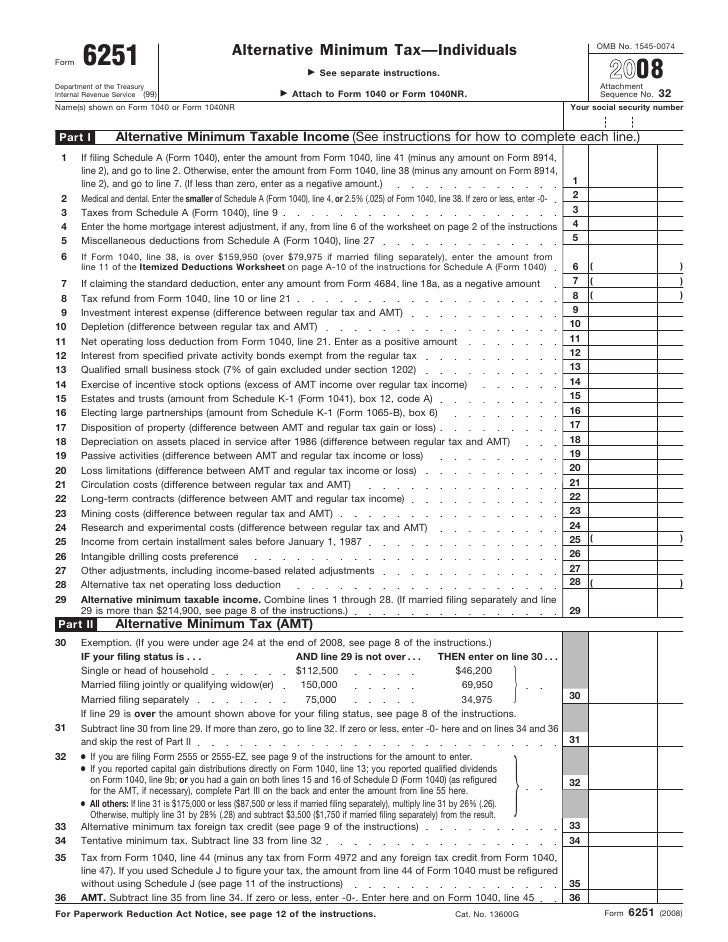

Form 6251Alternative Minimum Tax

The amt applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. It adds back various tax breaks you might have claimed on your form 1040 tax return, then determines your taxes owed. The program calculates and prints form 6251, if it applies to the taxpayer's return..

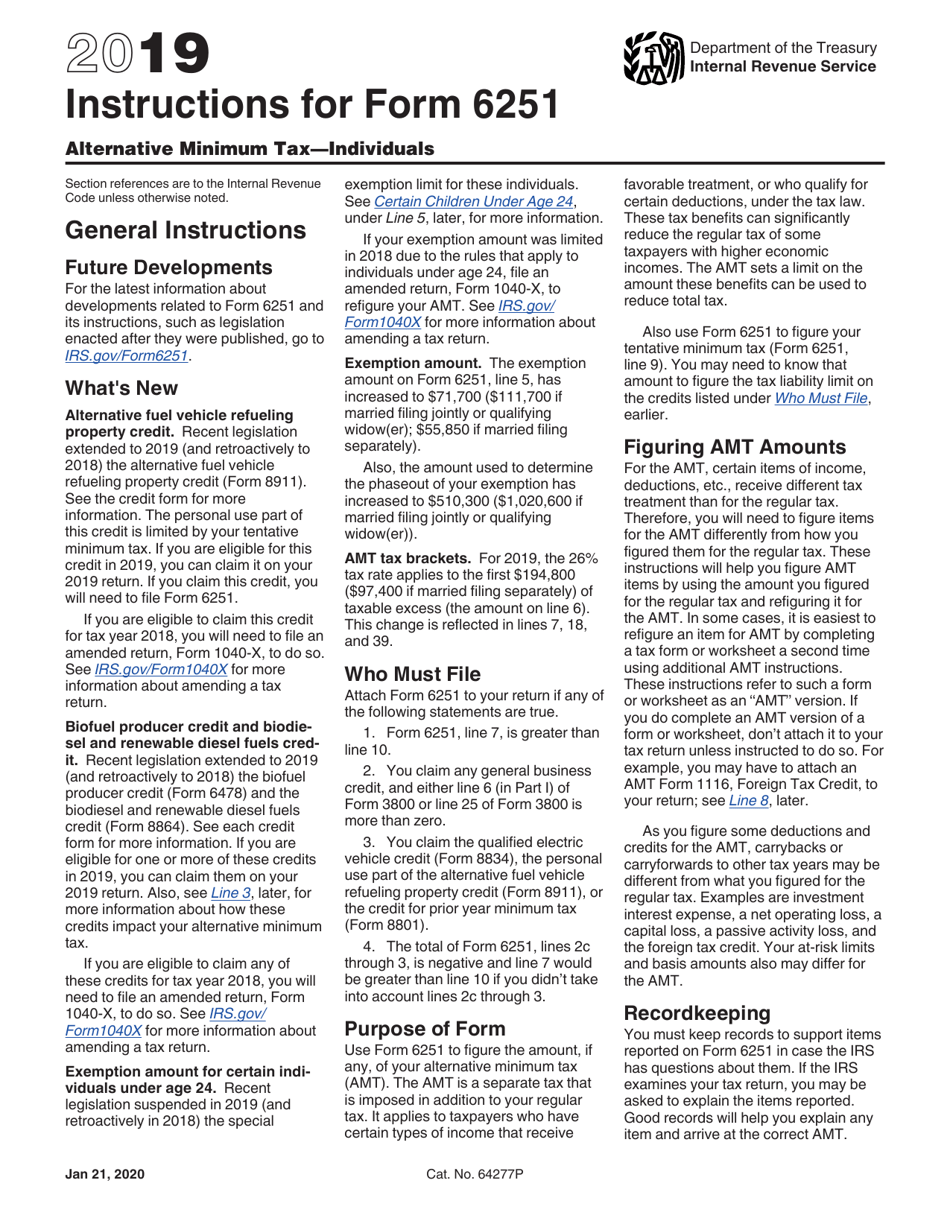

irs 2019 tax form 6251 Fill Online, Printable, Fillable Blank form

You figure a negative adjustment of $65,000 for the difference between the $65,000 of regular tax ordinary income and the $0 of amt ordinary income for the first sale. Web form 6251 2022 alternative minimum tax—individuals department of the treasury internal revenue service go to www.irs.gov/form6251 for instructions and the latest information. Use form 6251 to figure the amount, if.

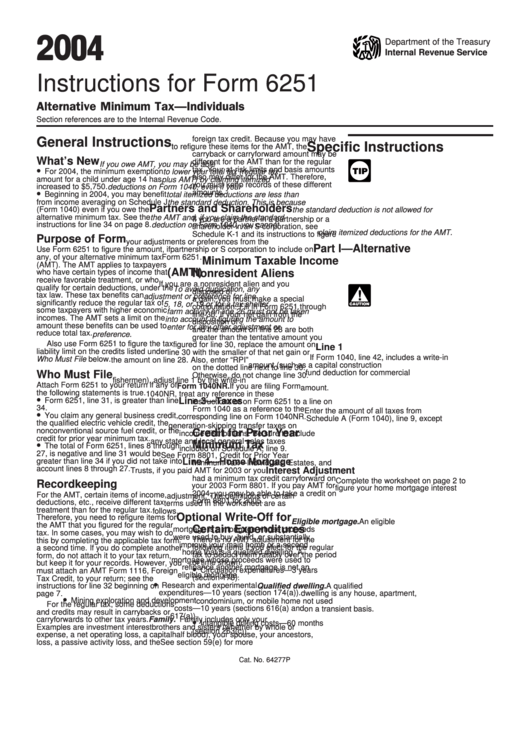

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2004

In order for wealthy individuals to pay their fair share of income tax, congress mandated an in 1969. The amt applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. If the calculation on form 6251: Although reducing your taxable income to zero is perfectly legal, the.

Instructions For Form 6251 2016 printable pdf download

The amt is a separate tax that is imposed in addition to your regular tax. 1= force form 6251, 2= when applicable. Web form 6251 alternative minimum tax. In order for wealthy individuals to pay their fair share of income tax, congress mandated an in 1969. If the calculation on form 6251:

Instructions for IRS Form 6251 Alternative Minimum Taxindividuals

Web you enter a total negative adjustment of $118,000 on line 2k of your 2022 form 6251, figured as follows. Web form 6251, “alternative minimum tax—individuals,” is a tax form that calculates whether you’re liable for paying the alternative minimum tax and if so, how much you should pay. Web irs form 6251, titled alternative minimum tax—individuals, determines how much.

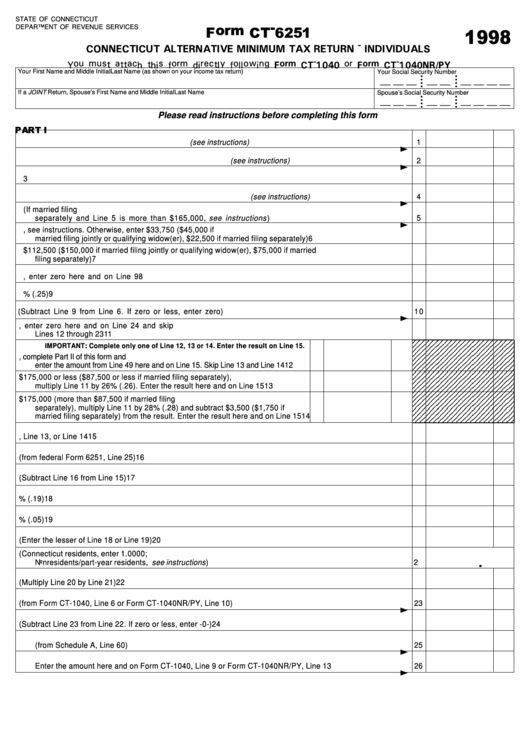

Fillable Form Ct6251 Connecticut Alternative Minimum Tax Return For

1= force form 6251, 2= when applicable. Web form 6251 2022 alternative minimum tax—individuals department of the treasury internal revenue service go to www.irs.gov/form6251 for instructions and the latest information. Web form 6251 alternative minimum tax. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). In order for wealthy individuals to pay their fair.

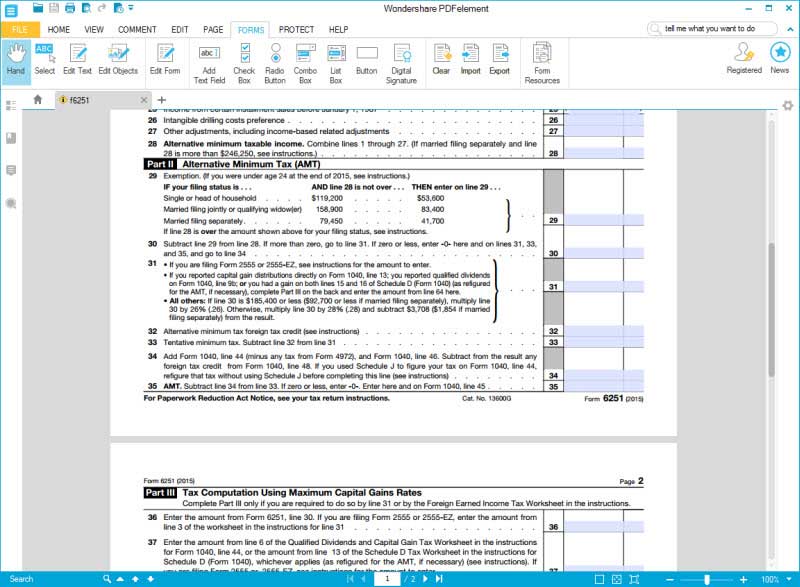

Instructions for How to Fill in IRS Form 6251

Web irs form 6251, titled alternative minimum tax—individuals, determines how much alternative minimum tax (amt) you could owe. Although reducing your taxable income to zero is perfectly legal, the irs uses amt to insure everyone pays their fair share. Web form 6251 alternative minimum tax. In order for wealthy individuals to pay their fair share of income tax, congress mandated.

The Amt Applies To Taxpayers Who Have Certain Types Of Income That Receive Favorable Treatment, Or Who Qualify For Certain Deductions, Under The Tax Law.

The program calculates and prints form 6251, if it applies to the taxpayer's return. It adds back various tax breaks you might have claimed on your form 1040 tax return, then determines your taxes owed. You have to pay the alternative minimum tax if you report taxable income greater than certain income. It applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law.

Use Form 6251 To Figure The Amount, If Any, Of Your Alternative Minimum Tax (Amt).

If the calculation on form 6251: Web you enter a total negative adjustment of $118,000 on line 2k of your 2022 form 6251, figured as follows. The irs imposes the alternative minimum tax (amt) on certain taxpayers who earn a significant amount of income, but are able to eliminate most, if not all, income from taxation using deductions and credits. Web form 6251, “alternative minimum tax—individuals,” is a tax form that calculates whether you’re liable for paying the alternative minimum tax and if so, how much you should pay.

Alternative Minimum Tax Shows That Your Tentative Minimum Tax Is Less Than Your Regular Tax, You Don't Owe Any Amt, But You May Still Be Affected By The Amt In Other Ways.

Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Although reducing your taxable income to zero is perfectly legal, the irs uses amt to insure everyone pays their fair share. 1= force form 6251, 2= when applicable. The amt is a separate tax that is imposed in addition to your regular tax.

Web Form 6251 2022 Alternative Minimum Tax—Individuals Department Of The Treasury Internal Revenue Service Go To Www.irs.gov/Form6251 For Instructions And The Latest Information.

Web what happens to my tax credits? Web form 6251 alternative minimum tax. In order for wealthy individuals to pay their fair share of income tax, congress mandated an in 1969. You figure a negative adjustment of $65,000 for the difference between the $65,000 of regular tax ordinary income and the $0 of amt ordinary income for the first sale.