What Is 2555 Form

What Is 2555 Form - Citizens and all resident aliens can use this test. Web april 2, 2022 form 2555 can make an expat’s life a lot easier! Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from. If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign income. Go to www.irs.gov/form2555 for instructions and the latest. Complete, edit or print tax forms instantly. Web irs form 2555 what is form 2555? The form consists of nine different sections: Web foreign earned income exclusion (form 2555) u.s. Citizens and all resident aliens can use this test.

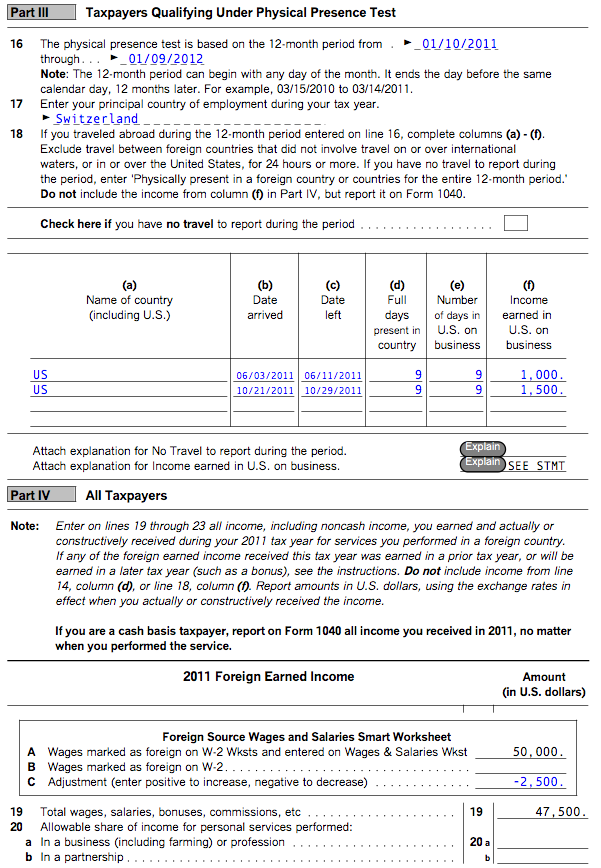

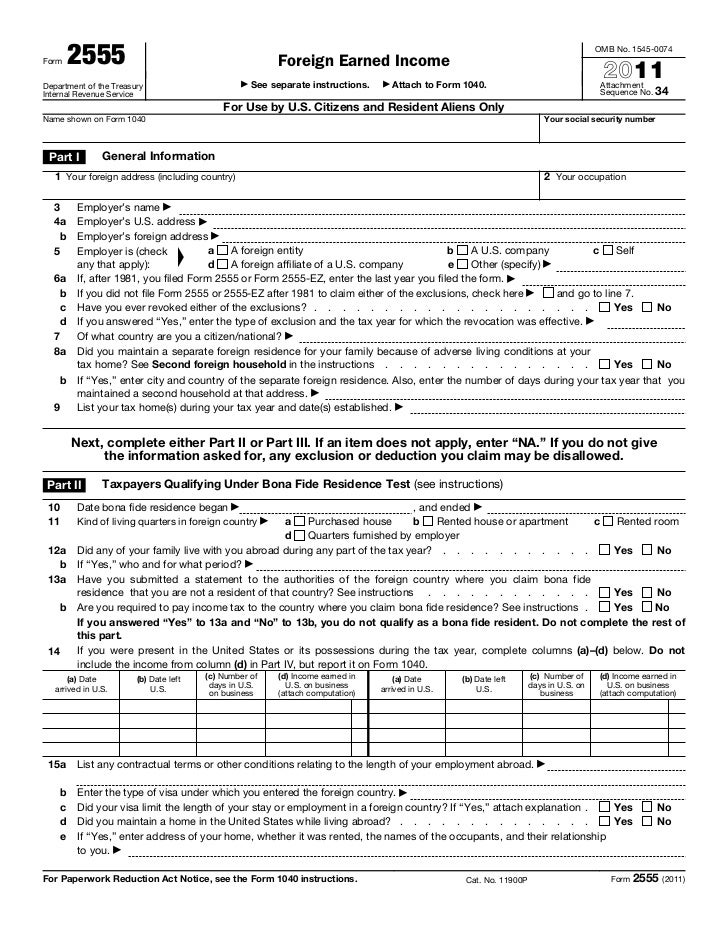

Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned. Web foreign earned income exclusion (form 2555) u.s. Include information about your employer and. It is used to claim the foreign earned income exclusion and/or the. Web part ii of form 2555 refers to the physical presence test and requires the taxpayer to provide the following information: If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign income. Web form 2555 (2021) 2 part iii taxpayers qualifying under physical presence test note: Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Web april 2, 2022 form 2555 can make an expat’s life a lot easier! Web irs form 2555 what is form 2555?

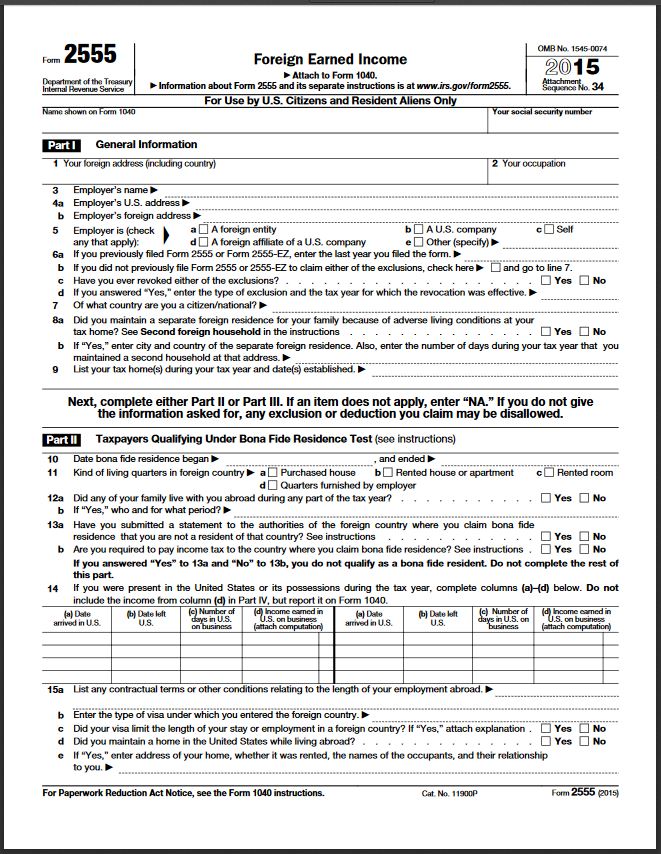

Ad access irs tax forms. Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from. Web april 2, 2022 form 2555 can make an expat’s life a lot easier! This form helps expats elect to use the foreign earned income exclusion (feie), one of the biggest. Web irs form 2555 what is form 2555? Complete, edit or print tax forms instantly. Citizens and all resident aliens can use this test. Include information about your employer and. Web form 2555 is the form you need to file to benefit from the feie. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned.

TurboTax for Expats

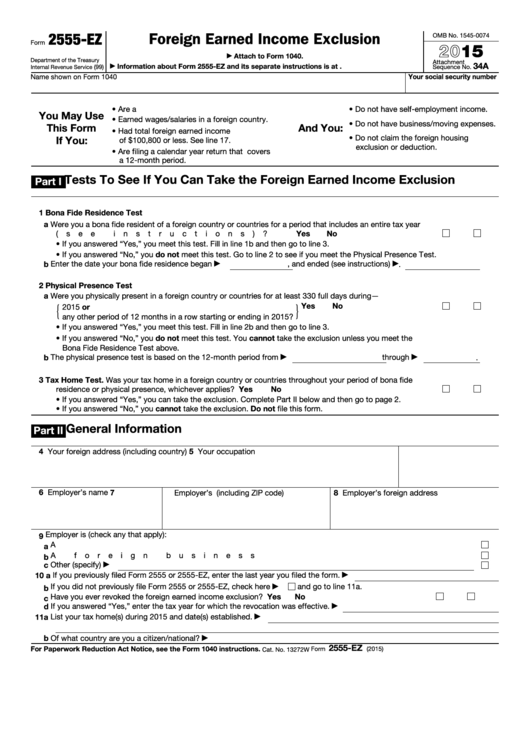

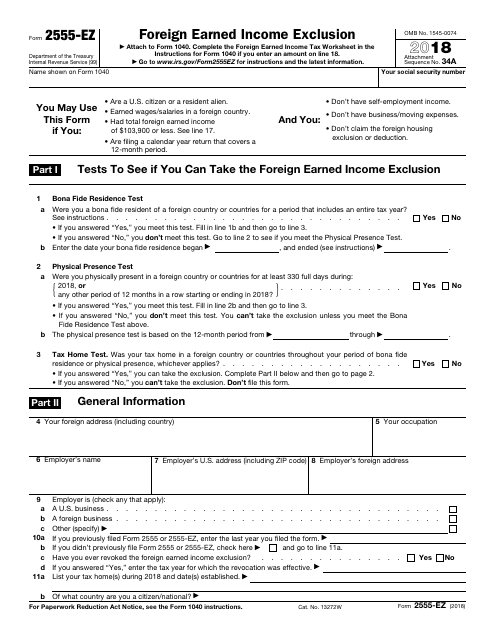

Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Complete, edit or print tax forms instantly. What this means for most expats is that they.

Foreign Earned Exclusion Form 2555 Verni Tax Law

Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. You cannot exclude or deduct more than the. Web april 2, 2022 form 2555 can make an expat’s life a lot easier! This form helps expats elect to use the foreign earned income exclusion (feie), one of the.

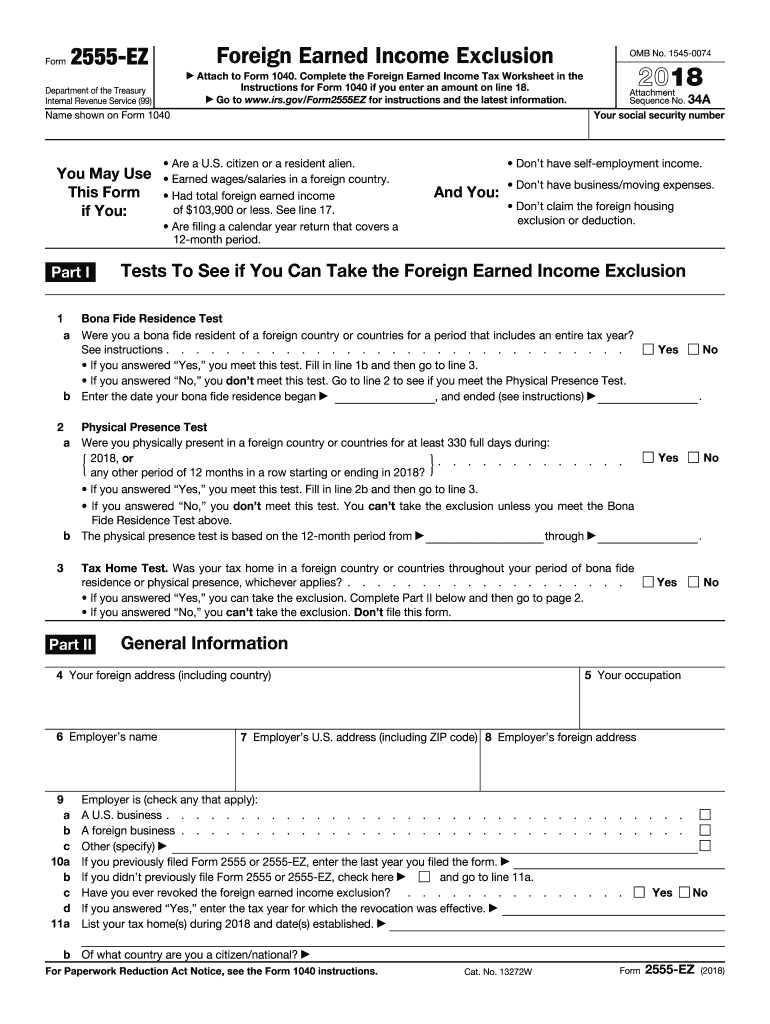

Fillable Form 2555Ez Foreign Earned Exclusion 2015

This form helps expats elect to use the foreign earned income exclusion (feie), one of the biggest. Web april 2, 2022 form 2555 can make an expat’s life a lot easier! Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. What this means for most expats is.

IRS Form 2555EZ Download Fillable PDF or Fill Online Foreign Earned

If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign income. Get ready for tax season deadlines by completing any required tax forms today. Include information about your employer and. Web timely filing the form 2555 is essential for claiming the foreign earned income exclusion one of the more common.

Form 2555 Ez 2020 Pdf Fill Out and Sign Printable PDF Template signNow

Web form 2555 (2021) 2 part iii taxpayers qualifying under physical presence test note: You cannot exclude or deduct more than the. Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate.

US Tax Abroad Expatriate Form 2555

Citizens and all resident aliens can use this test. What this means for most expats is that they can use the feie. You cannot exclude or deduct more than the. Web timely filing the form 2555 is essential for claiming the foreign earned income exclusion one of the more common misconceptions. Complete, edit or print tax forms instantly.

Ssurvivor Form 2555 Instructions 2019

Go to www.irs.gov/form2555 for instructions and the latest. What this means for most expats is that they can use the feie. The form consists of nine different sections: Complete, edit or print tax forms instantly. Citizens and all resident aliens can use this test.

Ssurvivor Form 2555 Ez Instructions 2019

It is used to claim the foreign earned income exclusion and/or the. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned. Web what is the foreign earned income exclusion (form 2555)? Web irs form 2555 what is form.

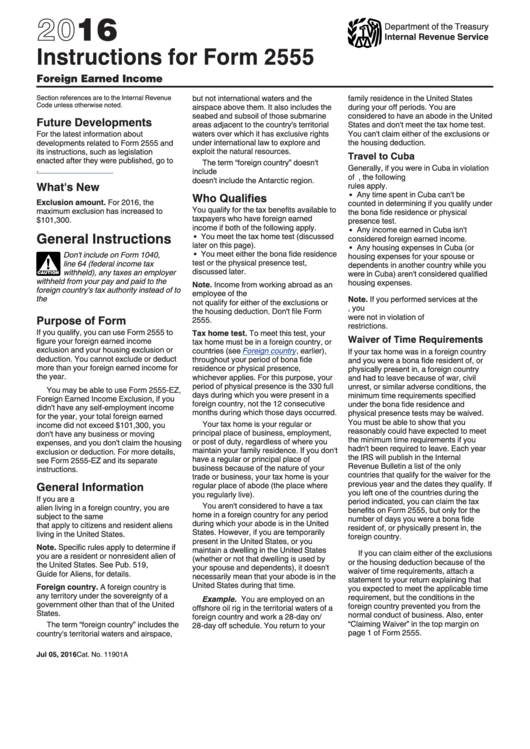

Instructions For Form 2555 2016 printable pdf download

If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign income. Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Web foreign earned income exclusion (form 2555) u.s. Include information about your employer and. Web form 2555.

US Tax Abroad Expatriate Form 2555

If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign income. Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from. Web what is the foreign earned income exclusion (form 2555)? Web form 2555 (foreign earned.

Web The Feie (Form 2555) Can Be Used To Exclude “Foreign Earned Income” From Being Subject To Us Tax.

Get ready for tax season deadlines by completing any required tax forms today. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign income. Web foreign earned income exclusion (form 2555) u.s.

Web Form 2555 Is The Form You Need To File To Benefit From The Feie.

Web form 2555 (2021) 2 part iii taxpayers qualifying under physical presence test note: What this means for most expats is that they can use the feie. You cannot exclude or deduct more than the. Include information about your employer and.

Create Legally Binding Electronic Signatures On Any Device.

Web part ii of form 2555 refers to the physical presence test and requires the taxpayer to provide the following information: Web what is the foreign earned income exclusion (form 2555)? Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. This form helps expats elect to use the foreign earned income exclusion (feie), one of the biggest.

Citizens And All Resident Aliens Can Use This Test.

The form consists of nine different sections: Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned. Web irs form 2555 what is form 2555?