What Is Ct-3 Form

What Is Ct-3 Form - Final federal date of determination nol capital loss determination carryback carryback. Web connecticut annual 2021reconciliation of withholding (rev. Ct3 form is issued by customs & excise officials to units under stpi and 100%. Web connecticut2020annualreconciliation of withholding (rev. Web ct 3 form 2020 use a ct 3 form 2020 template to make your document workflow more streamlined. For part 4, computation of tax on combined capital base, lines 1 and 6, and part 6, computation of combined business. Use fill to complete blank online new. A person with interests in relevant securities representing 1% or more. Show details we are not affiliated with any brand or entity on this form. Web 2 hours agoform 8.3.

Web 1 day agoform 8.3. What you need to know. Web connecticut annual 2021reconciliation of withholding (rev. A person with interests in relevant securities representing 1% or more. Public opening position disclosure/dealing disclosure by a person with interests in relevant securities representing 1% or more rule 8.3 of the takeover code. Web 2022 ctw3 1222w 01 9999 connecticut annual reconciliation of withholding (rev. Fill out the requested boxes. Link to official form info: Web up to 10% cash back ucc forms: Final federal date of determination nol capital loss determination carryback carryback.

Web 1 day agoform 8.3. Web 2 hours agoform 8.3. Public opening position disclosure/dealing disclosure by. Use fill to complete blank online new. Web connecticut2020annualreconciliation of withholding (rev. Link to official form info: (b) owner or controller of interests and short. Rule 8.3 of the takeover. Web ct 3 form 2020 use a ct 3 form 2020 template to make your document workflow more streamlined. Web 2022 ctw3 1222w 01 9999 connecticut annual reconciliation of withholding (rev.

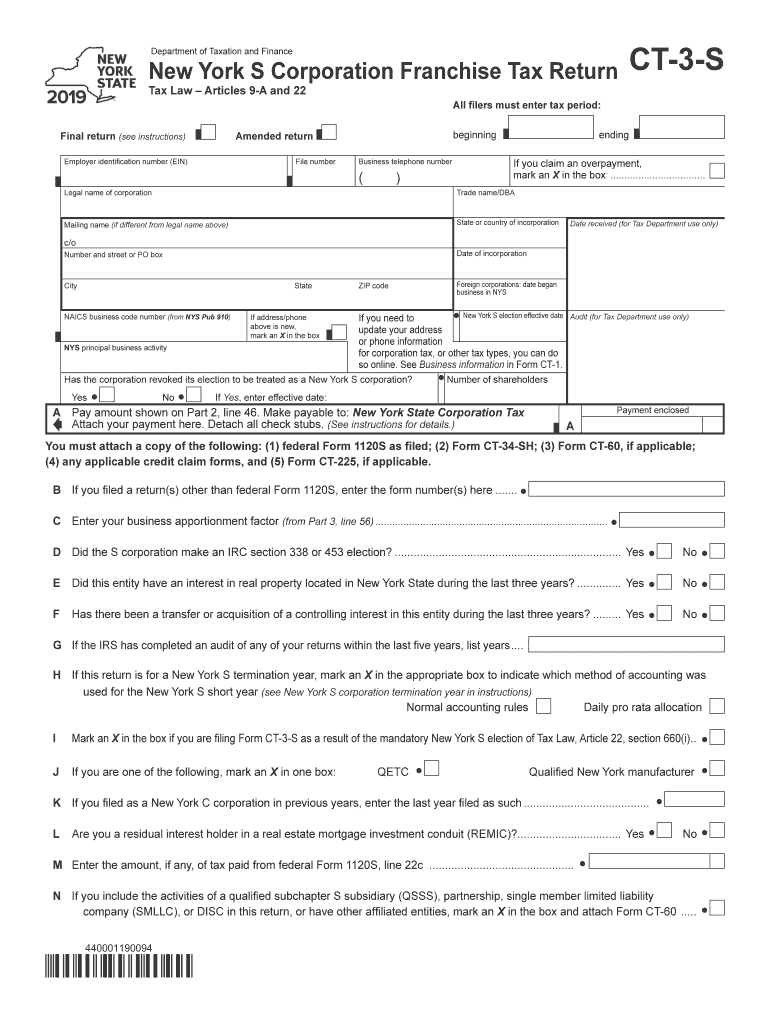

Ct 3 2019 Form Fill Out and Sign Printable PDF Template signNow

Web 2022 ctw3 1222w 01 9999 connecticut annual reconciliation of withholding (rev. Web up to 10% cash back ucc forms: Web connecticut annual 2021reconciliation of withholding (rev. What you need to know. Web corporate tax filing requirements.

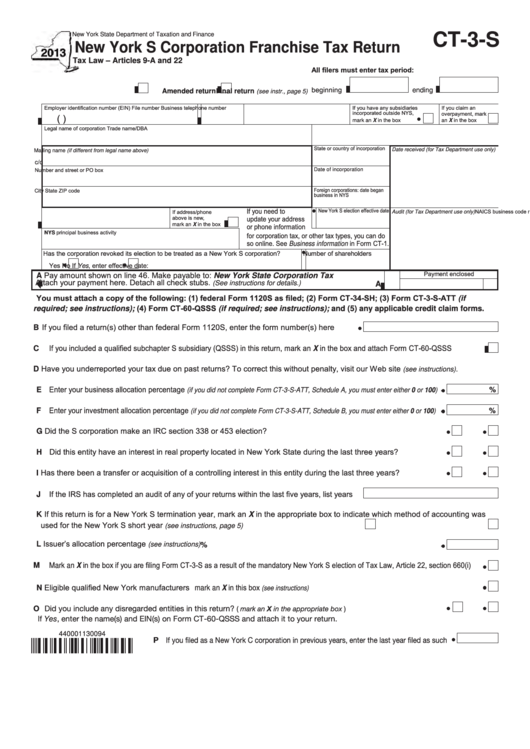

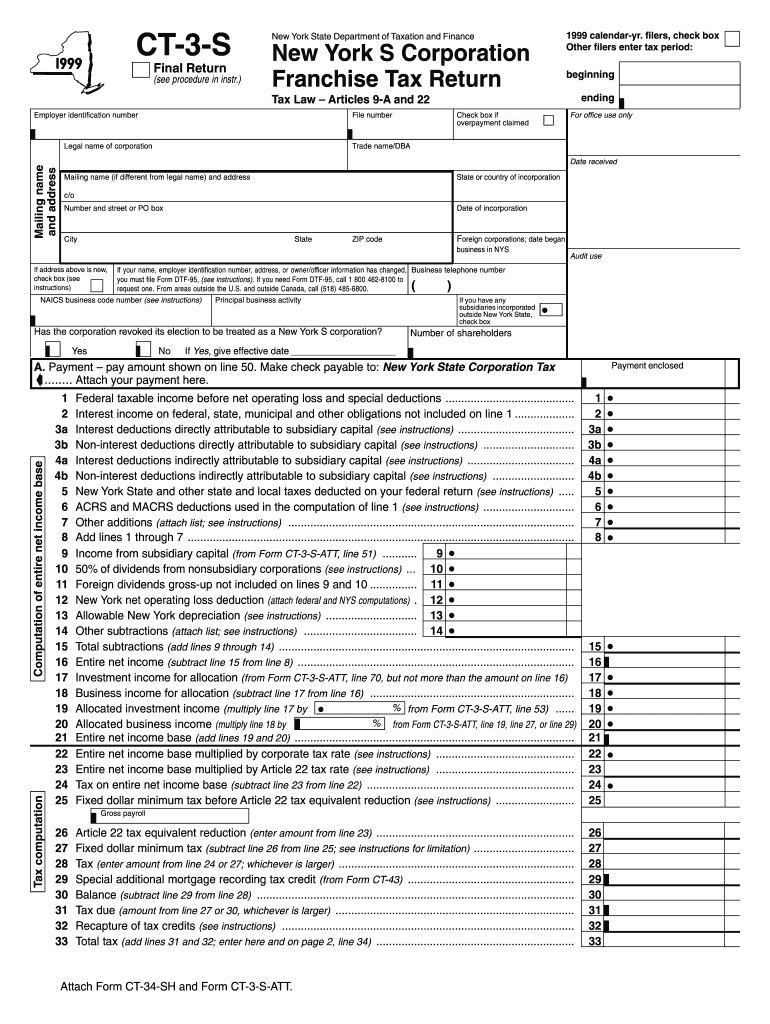

Form Ct3S New York S Corporation Franchise Tax Return 2013

Web connecticut annual 2021reconciliation of withholding (rev. Rule 8.3 of the takeover. Link to official form info: Use fill to complete blank online new. Ct3 form is issued by customs & excise officials to units under stpi and 100%.

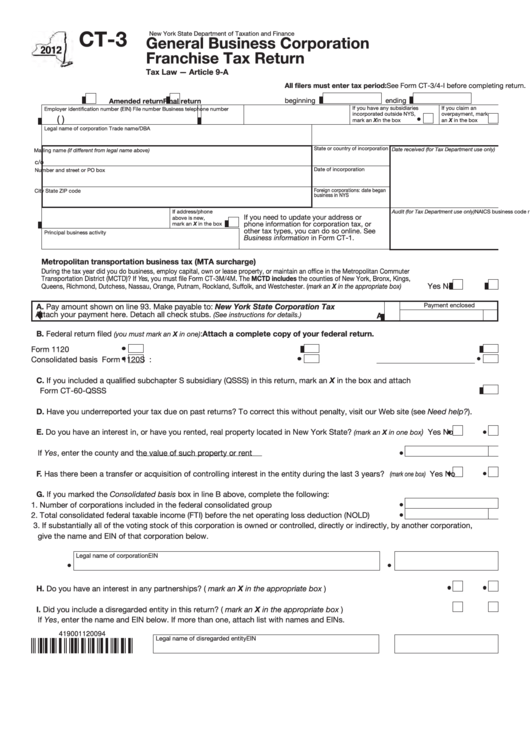

Form Ct3 General Business Corporation Franchise Tax Return New

Ct3 form is issued by customs & excise officials to units under stpi and 100%. Final federal date of determination nol capital loss determination carryback carryback. However, if your tier 1 employer taxes for. For part 4, computation of tax on combined capital base, lines 1 and 6, and part 6, computation of combined business. Link to official form info:

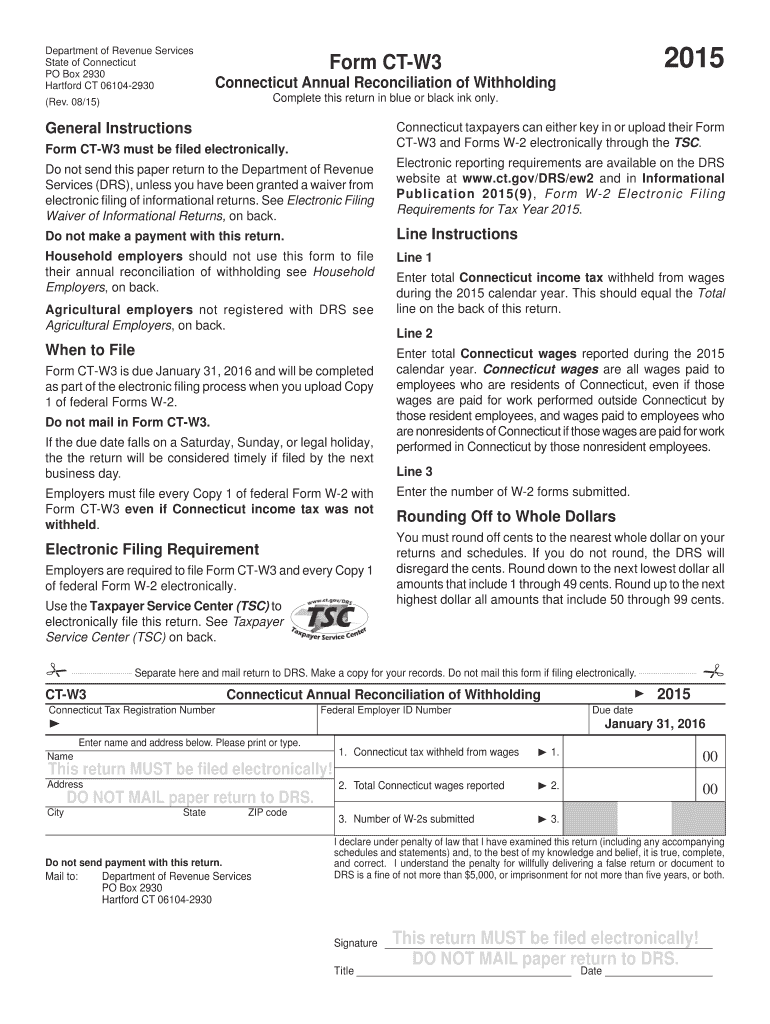

2+ Connecticut State Tax Withholding Forms Free Download

Use fill to complete blank online new. Web up to 10% cash back ucc forms: Find the what is a nys file number on form ct 3 s you require. Public opening position disclosure/dealing disclosure by. (1) federal form 1120s as filed;

2015 Form CT DRS CTW3 Fill Online, Printable, Fillable, Blank pdfFiller

Web up to 10% cash back ucc forms: Public opening position disclosure/dealing disclosure by. What you need to know. (b) owner or controller of interests and short. (1) federal form 1120s as filed;

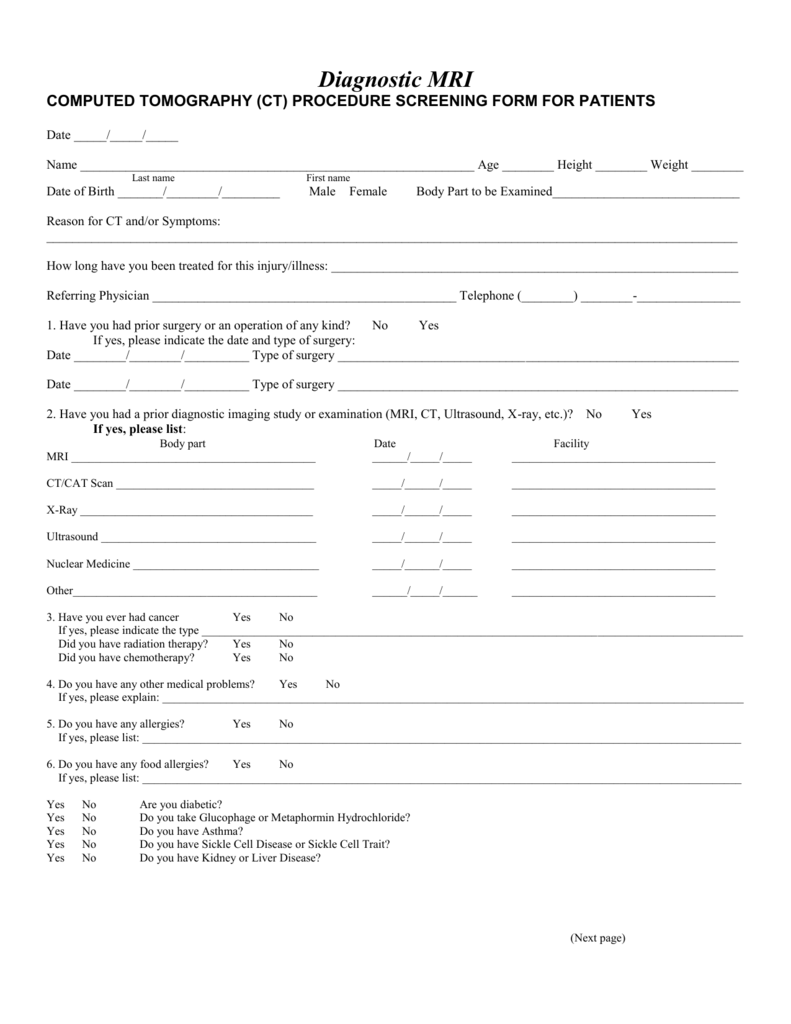

ct treatment form

Web up to 10% cash back ucc forms: (1) federal form 1120s as filed; Web corporate tax filing requirements. Web connecticut2020annualreconciliation of withholding (rev. Web rule 8.3 of the takeover code (the code) (a) full name of discloser:

1999 Form NY DTF CT3S Fill Online, Printable, Fillable, Blank pdfFiller

Link to official form info: For part 4, computation of tax on combined capital base, lines 1 and 6, and part 6, computation of combined business. The uniform commercial code (ucc) is a set of regulations adopted to make commerce. Show details we are not affiliated with any brand or entity on this form. What you need to know.

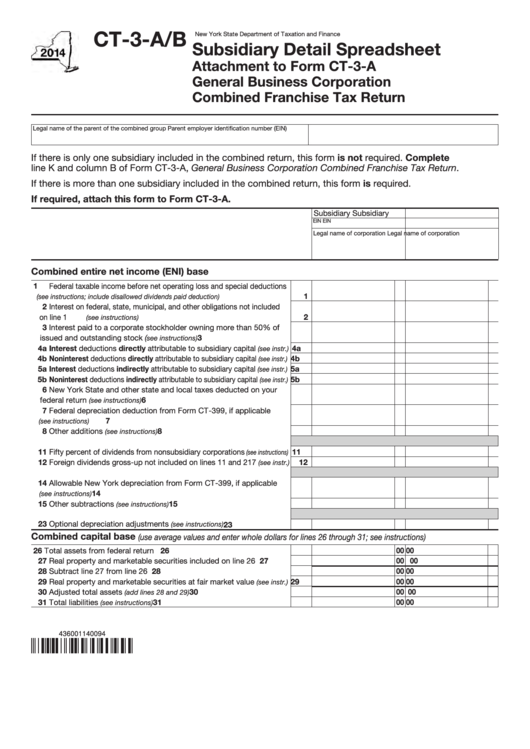

Form Ct3A/b Subsidiary Detail Spreadsheet Attachment To Form Ct3

Fill out the requested boxes. Use fill to complete blank online new. Web 2022 ctw3 1222w 01 9999 connecticut annual reconciliation of withholding (rev. Web corporate tax filing requirements. (b) owner or controller of interests and short.

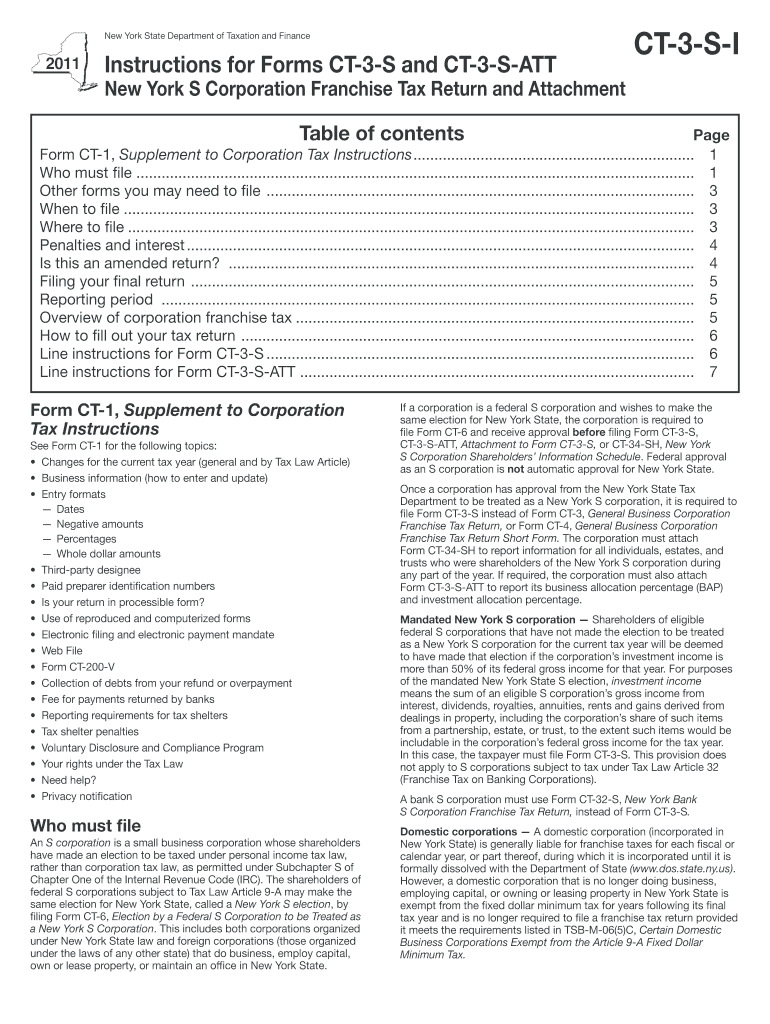

Ct 3 Instructions Form Fill Out and Sign Printable PDF Template signNow

A person with interests in relevant securities representing 1% or more. Web up to 10% cash back ucc forms: The uniform commercial code (ucc) is a set of regulations adopted to make commerce. Use fill to complete blank online new. (b) owner or controller of interests and short.

Using CTs with three phases Getting Started OpenEnergyMonitor Community

Use fill to complete blank online new. Public opening position disclosure/dealing disclosure by a person with interests in relevant securities representing 1% or more rule 8.3 of the takeover code. Web connecticut annual 2021reconciliation of withholding (rev. Fill out the requested boxes. (1) federal form 1120s as filed;

Public Opening Position Disclosure/Dealing Disclosure By.

Web 1 day agoform 8.3. Link to official form info: A person with interests in relevant securities representing 1% or more. (b) owner or controller of interests and short.

Find The What Is A Nys File Number On Form Ct 3 S You Require.

Web ct 3 form 2020 use a ct 3 form 2020 template to make your document workflow more streamlined. Ct3 form is issued by customs & excise officials to units under stpi and 100%. What you need to know. Web connecticut2020annualreconciliation of withholding (rev.

Use Fill To Complete Blank Online New.

Rule 8.3 of the takeover. Web up to 10% cash back ucc forms: Web 2022 ctw3 1222w 01 9999 connecticut annual reconciliation of withholding (rev. Web corporate tax filing requirements.

Web 2 Hours Agoform 8.3.

Web connecticut annual 2021reconciliation of withholding (rev. Public opening position disclosure/dealing disclosure by a person with interests in relevant securities representing 1% or more rule 8.3 of the takeover code. For part 4, computation of tax on combined capital base, lines 1 and 6, and part 6, computation of combined business. Fill out the requested boxes.