Income And Expense Form

Income And Expense Form - Statutory tax exemptions (online july 1st through april 1.) must be downloaded, completed, signed and submitted to the board of assessors annually. Check out the best budget apps for 2023. Web this simple small business income statement template calculates your total revenue and expenses, including advising, equipment, and employee benefits, to determine your net income. Try an app that tracks and categorizes your spending. One must know which form to use for the right purpose. Web an expense report template helps you record and organize your expenses, making it easier to get reimbursed and keep accurate financial records. Web this daily expense report template is perfect for small business owners and employees to track expenditures. Effective tax rate is 25%. Superior court of california, county of. A has passive category foreign source taxable income before interest expense of $8,000.

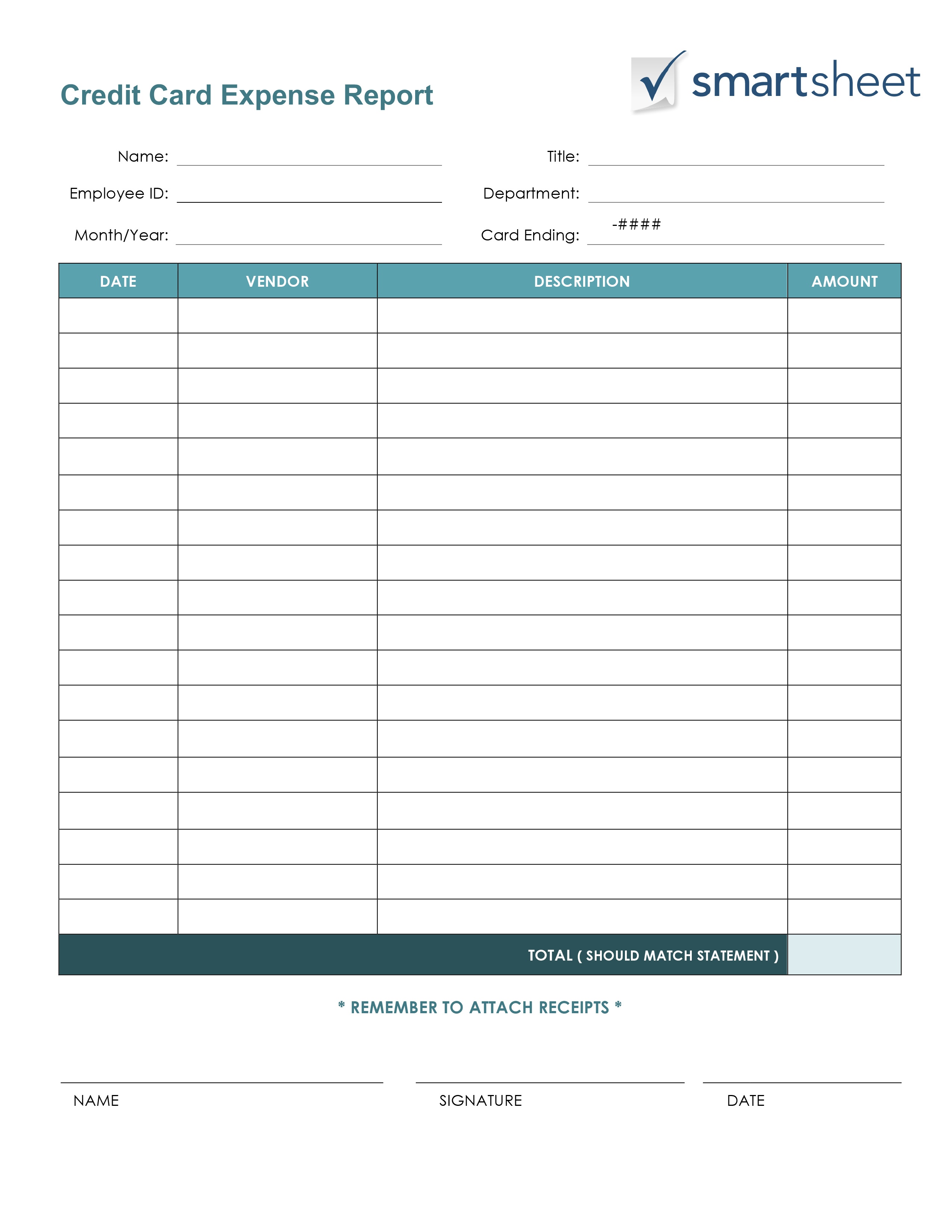

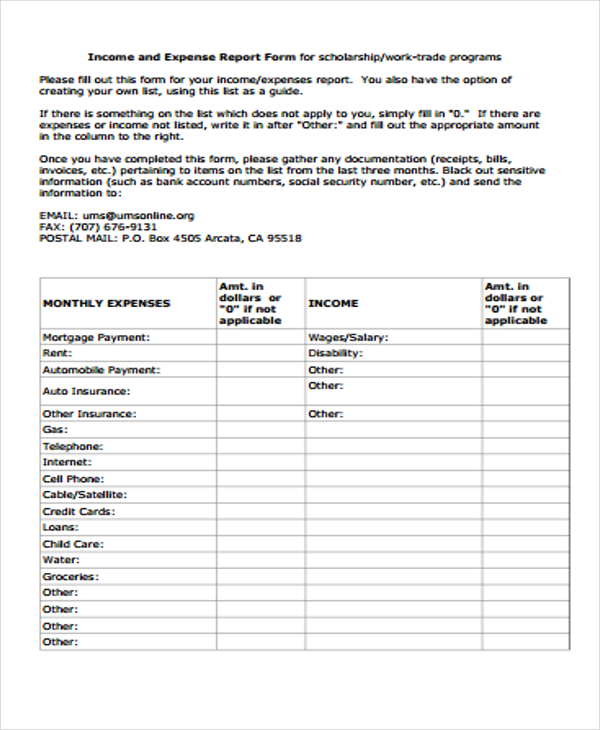

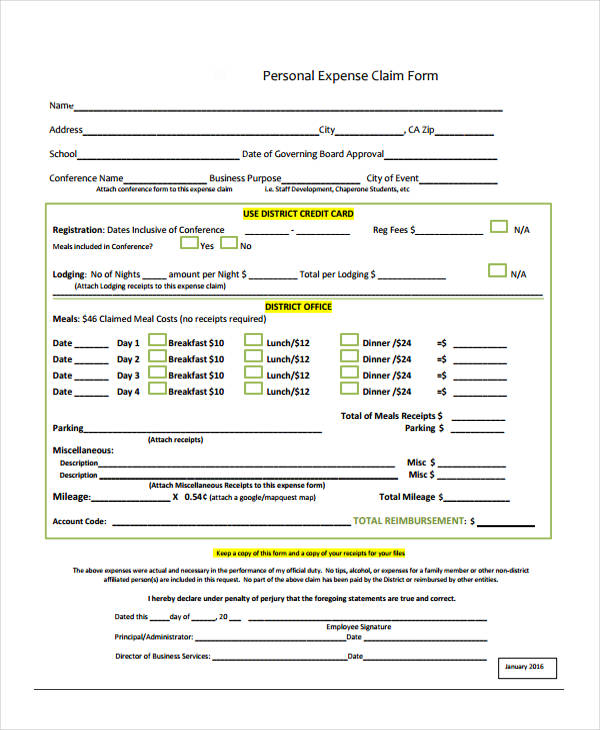

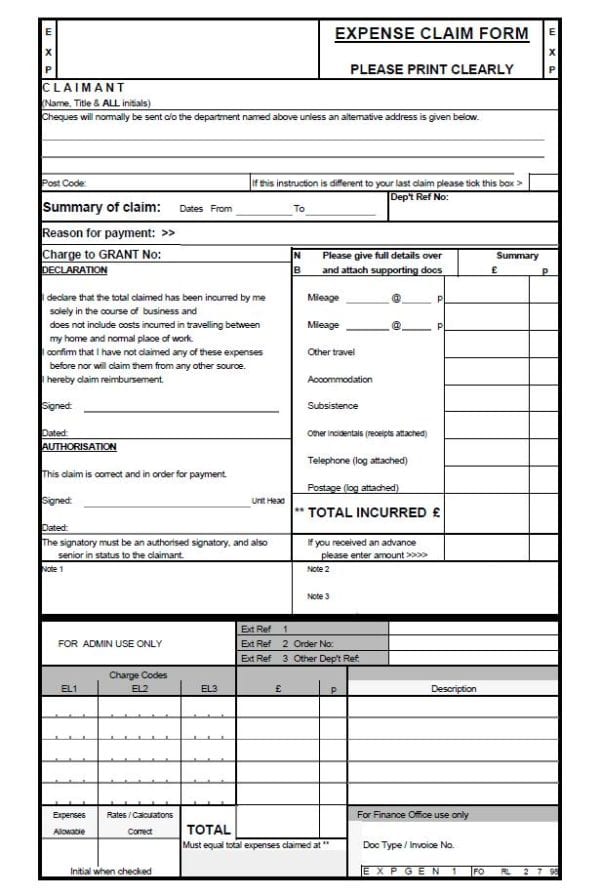

Web included on this page, you’ll find a simple printable expense report form, a business expense sheet, an employee expense report with mileage template, and a monthly expense report template. Superior court of california, county of. Apartment use property income form; Plus, find helpful tips on using these templates. Expense report templates are not only helpful for tracking business expenses but can also be useful in creating a personal budget. With this easy, clear format, you can organize your expenses to ensure that reimbursements are timely and accurate. Web income and expense declaration. Web of a’s assets, $10,000 generate foreign source income and $40,000 generate u.s. Commercial and industrial property income form; A has interest expense of $5,000 and domestic partnership does not have interest expense.

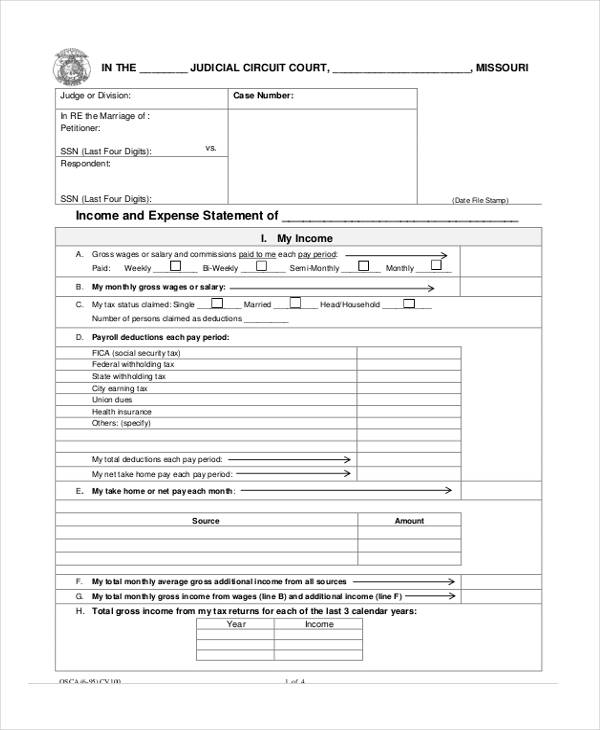

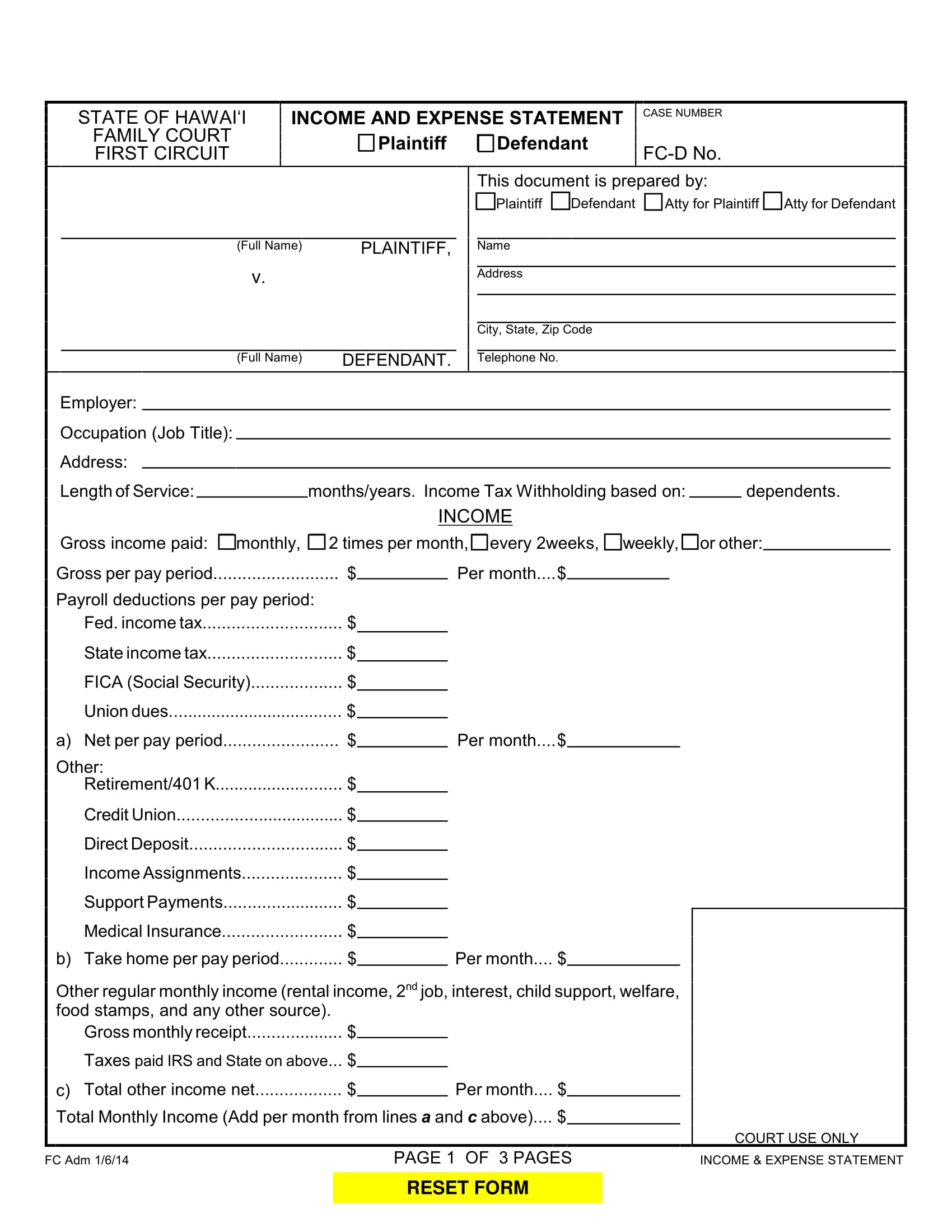

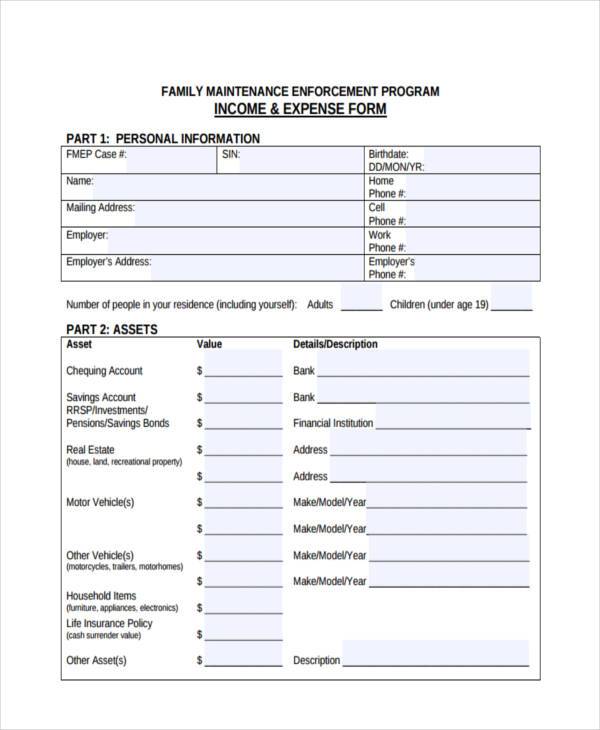

Check out the best budget apps for 2023. Expense report templates are not only helpful for tracking business expenses but can also be useful in creating a personal budget. Plus, find helpful tips on using these templates. Try an app that tracks and categorizes your spending. Statutory tax exemptions (online july 1st through april 1.) must be downloaded, completed, signed and submitted to the board of assessors annually. Many different people and businesses gain and incur different amounts of income and expenses. The court uses the information to make orders for support, attorneys fees, and other costs. Use this template to track and compare your finances over a. One must know which form to use for the right purpose. Effective tax rate is 25%.

Free Printable And Expense Form Free Printable

Many different people and businesses gain and incur different amounts of income and expenses. Web the different kinds of income and expense report forms. Try an app that tracks and categorizes your spending. Statutory tax exemptions (online july 1st through april 1.) must be downloaded, completed, signed and submitted to the board of assessors annually. The court uses the information.

FREE 10+ and Expense Forms in PDF MS Word

A has interest expense of $5,000 and domestic partnership does not have interest expense. Try an app that tracks and categorizes your spending. Plus, find helpful tips on using these templates. Effective tax rate is 25%. Commercial and industrial property income form;

FREE 30+ Statement Forms in PDF MS Word

A has interest expense of $5,000 and domestic partnership does not have interest expense. Expense report templates are not only helpful for tracking business expenses but can also be useful in creating a personal budget. Web this simple small business income statement template calculates your total revenue and expenses, including advising, equipment, and employee benefits, to determine your net income..

& Expense Form Bill Blau Real Estate Group Bill Blau Real

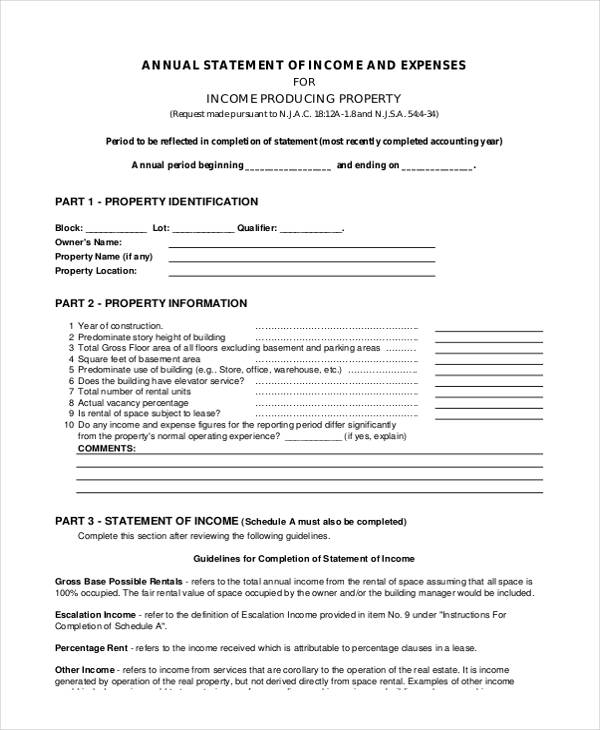

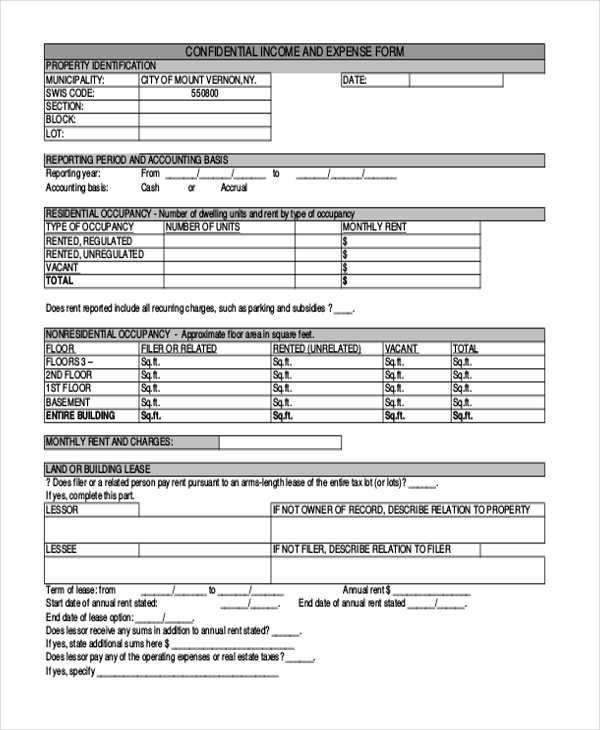

Statutory tax exemptions (online july 1st through april 1.) must be downloaded, completed, signed and submitted to the board of assessors annually. Many different people and businesses gain and incur different amounts of income and expenses. A has interest expense of $5,000 and domestic partnership does not have interest expense. Mixed use property income form; Commercial and industrial property income.

FREE 10+ and Expense Forms in PDF MS Word

Superior court of california, county of. Statutory tax exemptions (online july 1st through april 1.) must be downloaded, completed, signed and submitted to the board of assessors annually. Web this daily expense report template is perfect for small business owners and employees to track expenditures. Web included on this page, you’ll find a simple printable expense report form, a business.

FREE 8+ Sample Accounting Expense Forms in PDF MS Word MS Excel

A has passive category foreign source taxable income before interest expense of $8,000. Effective tax rate is 25%. Use this template to track and compare your finances over a. Plus, find helpful tips on using these templates. Statutory tax exemptions (online july 1st through april 1.) must be downloaded, completed, signed and submitted to the board of assessors annually.

FREE 10+ and Expense Forms in PDF MS Word

Web annual expenses for all property uses form; A has passive category foreign source taxable income before interest expense of $8,000. Effective tax rate is 25%. A has interest expense of $5,000 and domestic partnership does not have interest expense. Web this daily expense report template is perfect for small business owners and employees to track expenditures.

FREE 12+ Personal Expense Forms in PDF MS Word

Use this template to track and compare your finances over a. Plus, find helpful tips on using these templates. Many different people and businesses gain and incur different amounts of income and expenses. Commercial and industrial property income form; Web included on this page, you’ll find a simple printable expense report form, a business expense sheet, an employee expense report.

FREE 10+ Sample Personal Expense Forms in PDF MS Word

Statutory tax exemptions (online july 1st through april 1.) must be downloaded, completed, signed and submitted to the board of assessors annually. Check out the best budget apps for 2023. Web learn about the various monthly expenses you’ll want to track. With this easy, clear format, you can organize your expenses to ensure that reimbursements are timely and accurate. Apartment.

And Expense Statement Template Expense Spreadsheet

Apartment use property income form; With this easy, clear format, you can organize your expenses to ensure that reimbursements are timely and accurate. A has passive category foreign source taxable income before interest expense of $8,000. Mixed use property income form; Web income and expense declaration.

Check Out The Best Budget Apps For 2023.

Web annual expenses for all property uses form; Superior court of california, county of. Effective tax rate is 25%. Web learn about the various monthly expenses you’ll want to track.

Use This Template To Track And Compare Your Finances Over A.

Commercial and industrial property income form; January 1, 2019] income and expense declaration. Web the different kinds of income and expense report forms. Web this simple small business income statement template calculates your total revenue and expenses, including advising, equipment, and employee benefits, to determine your net income.

Many Different People And Businesses Gain And Incur Different Amounts Of Income And Expenses.

Mixed use property income form; Apartment use property income form; Try an app that tracks and categorizes your spending. Web this daily expense report template is perfect for small business owners and employees to track expenditures.

Expense Report Templates Are Not Only Helpful For Tracking Business Expenses But Can Also Be Useful In Creating A Personal Budget.

A has passive category foreign source taxable income before interest expense of $8,000. Web included on this page, you’ll find a simple printable expense report form, a business expense sheet, an employee expense report with mileage template, and a monthly expense report template. With this easy, clear format, you can organize your expenses to ensure that reimbursements are timely and accurate. Web of a’s assets, $10,000 generate foreign source income and $40,000 generate u.s.